Credit card reform requires banks by July to get permission before providing "overdraft protection," which hits customers with fees of $30 or more to cover any debit card transactions that exceed the balance in a checking account. Consumer advocates have long maintained that consumers ought to be allowed to decide whether they want to pay more than $30 for a cup of coffee, no matter the indignity of being declined at the register.

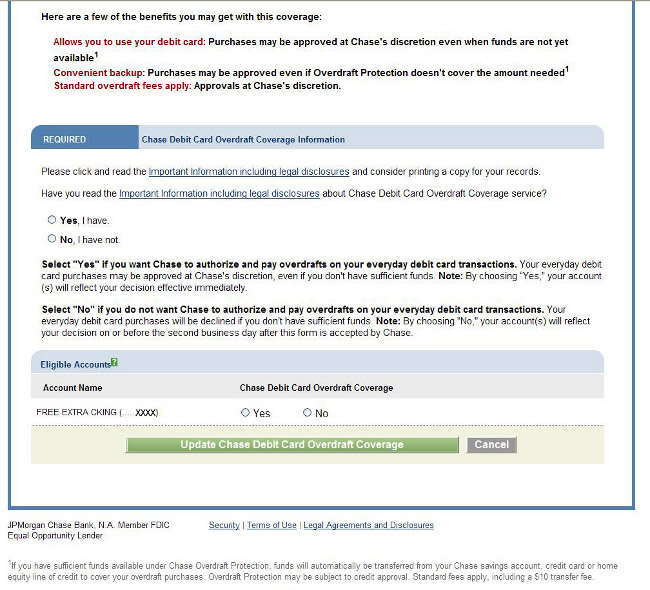

JPMorgan Chase is playing by the new rule already, but it's not clear the bank is making much of an effort. The online consumer advocacy powerhouse Consumerist posted a screenshot of Chase's "opt-in" page for overdraft protection and posed this question: "Is Chase's Overdraft Fee 'Opt-In' Purposefully Confusing?" Have a look:

The screen describes some of the benefits of overdraft protection. At the top, bright red letters indicate that signing up for overdraft protection "Allows you to use your debit card" -- surely nobody would assume that means you couldn't use your card without opting in. And, as Consumerist's tipster complained, there are two yes/no questions to answer. The first is whether you have read "important legal disclosures." The second is the important one -- if you don't want overdraft protection, disregard that bit to the left that says "FREE EXTRA CKING" and click the "no" button.

"I wouldn't be surprised if Chase had hired confusion consultants to write this," wrote Ed Mierzwinski, a lobbyist for the U.S. Public Interest Research Group, in an email to HuffPost.

Chase seemed confused by Mierzwinski's confusion.

"It is unfortunate that Mr. Mierzwinski found the overdraft option screen unclear," wrote a spokeswoman. "The goal of our overdraft coverage material is to educate our customers about the topic and their options, so they can make an informed choice. As a Chase customer, Mr. Mierzwinski can always call a telephone banker 24 hours a day or visit one of our 5,100 branches to get clarification on the subject."

Mierzwinski told HuffPost that he is not, in fact, a Chase customer. ("I am just a consumer advocate.") He said the confusing screen illustrates the need for a Consumer Financial Protection Agency.

"One reason Chase CEO Jamie Dimon is telling Congress 'No CFPA' is because he knows a CFPA would crack down on this sort of purposely unintelligible gobblygook designed to trick consumers into paying fees," Mierzwinski wrote. "Chase is chasing fee income that smells so bad even Bank of America is running the other way."

Compare Chase's opt-in screen to the Federal Reserve's "model form" for banks (PDF).