Parents are more likely to support a student's cell phone bill than their pursuit of a college degree, a new survey released Wednesday by Citigroup and Seventeen magazine found.

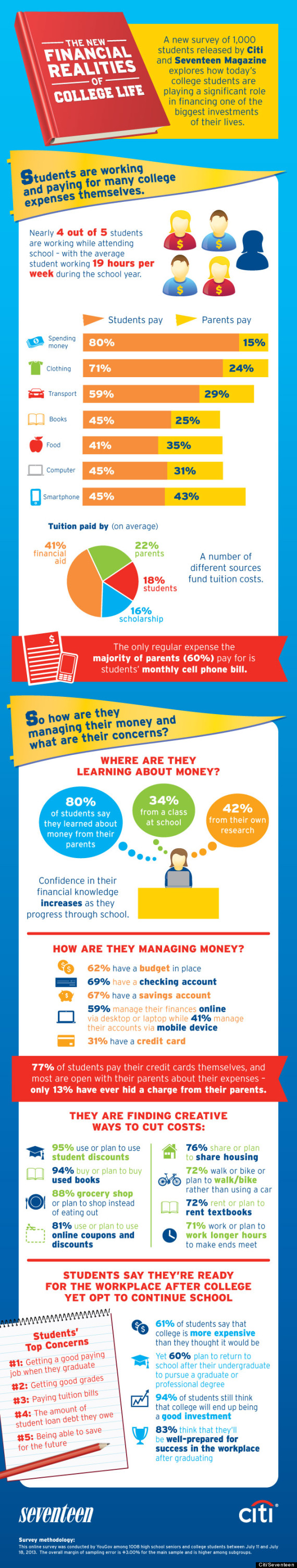

Nearly 4 out of 5 college students are working part-time while studying for their degrees, averaging 19 hours a week, according to the survey, but just 18 percent pay their way through school.

Forty-one percent rely on financial aid while 16 percent said scholarships get them through college. Another 22 percent said their parents cover the bill. Students are also slightly more likely than parents to fund their housing in school, 31 percent of students compared to 30 percent of parents footing the bill.

The survey found that the only expense parents are more likely to cover is students' monthly cell phone bills, which 60 percent of students said their parents paid for, compared to 35 percent of students paying on their own.

The survey was conducted by YouGov among 1,008 high school seniors and college students in July, with a sampling error of ±3.00 percent. Citi sold most of its portfolio of student loans to Discover in 2011.

Two-thirds of students have checking and savings accounts, but just 1 in 5 will have a credit card when they start college, according to the survey, and 62 percent plan to maintain a budget.

The Citi/Seventeen survey backs up a Sallie Mae-Ipsos finding that fewer parents are chipping in to pay for college, dropping their contribution to education costs by 35 percent from 2010 to 2012.

"Kids used to rely on the bank of mom and dad," Linda Descano, a managing director at Citi, told the Wall Street Journal. "So many families are trying to work themselves out of the financial impact of the Great Recession."

Sixty-one percent of students said in the Citi survey that college costs more than they expected. Part of the reason could be that room and board and other fees often is larger than the cost of in-state tuition at public colleges, where a majority of students get their degrees.

Students identified in the survey a number of ways they plan to scrimp in college, including 7 in 10 planning to avoid using a car, rent textbooks or work longer hours. Ninety-five percent said they'd take advantage of student discounts, 94 percent plan to purchase used books and 88 percent said they will buy groceries instead of dining out.

Despite the large cost of a higher education, 94 percent of respondents believe college is a good investment.