The Wall Street Journal trolled the private-jet set this weekend, warning the wealthy of the "sticker shock" of soaring taxes. But fear not, rich people: Things aren't nearly as bad as they seem.

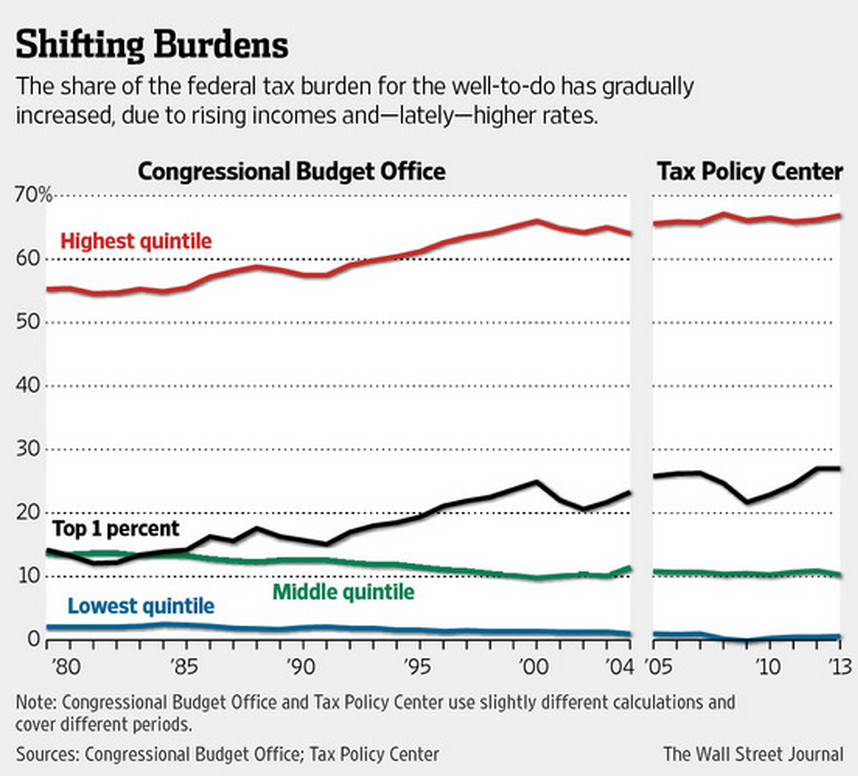

The gist of the WSJ story, entitled "Top Earners Feel the Bite of Tax Increases," was that it's a really tough time to be a rich person because high earners are shouldering an ever-bigger share of the overall federal tax burden. The paper had a scary chart to prove it:

It is true that the rich are paying a bigger share of federal tax revenue. And their income-tax rates have risen in recent years.

But it is also true, as the WSJ concedes, that the biggest earners also suck up a much bigger share of the nation's income. The 1 percent now account for about 17 percent of total income, according to the WSJ, citing the Tax Policy Center, a share that has doubled since the 1980s. In that light, it's less shocking that the 1 percent's share of the tax burden has nearly doubled in that time, too.

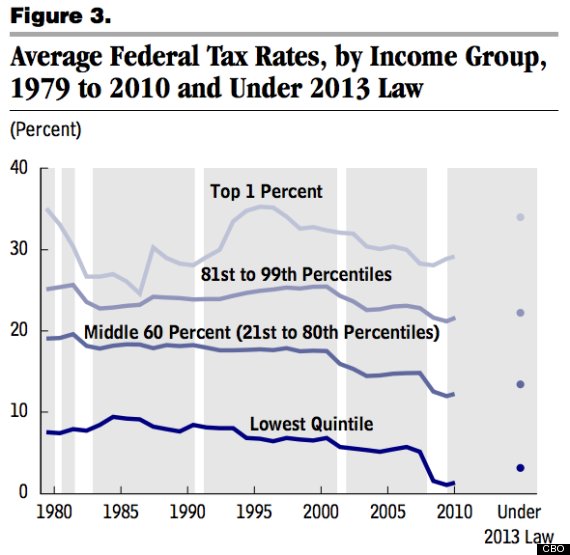

More importantly, tax rates on the wealthy aren't unprecedentedly high. As illustrated in this chart from the Congressional Budget Office, rich people don't have all that much to complain about:

As you can see from the dots on the right, which represent 2013 estimates, the average tax rate for the 1-percent is just about what it was in 1995, when the U.S. economy was doing pretty great. Back then, income was more evenly distributed. And no, job growth didn't suffer as a result of those higher tax rates on so-called "job creators."

So the next time you hear the argument that the rich are paying too much in taxes, kindly remind them that a minimal rise in tax rates is being eclipsed by income gains that only benefit the wealthiest of the wealthy.