College is worth it. That's the straightforward conclusion of a recent study from the Brookings Institution's Hamilton Project. "A college degree -- in any major -- is important for advancing one's earnings potential," the study's authors write. Median earnings are higher no matter what you study, and the advantage you have over high school graduates lasts throughout your career. The difference isn't minor, either: Over a lifetime, the Hamilton study notes, "the typical bachelor's degree graduate worker earns $1.19 million, which is twice what the typical high school graduate earns."

College, as The Washington Post's Dylan Matthews detailed in 2012, is a great investment. And despite growing anxiety about Americans' rising student-loan bill, using debt to partially finance one's education makes it an even better investment.

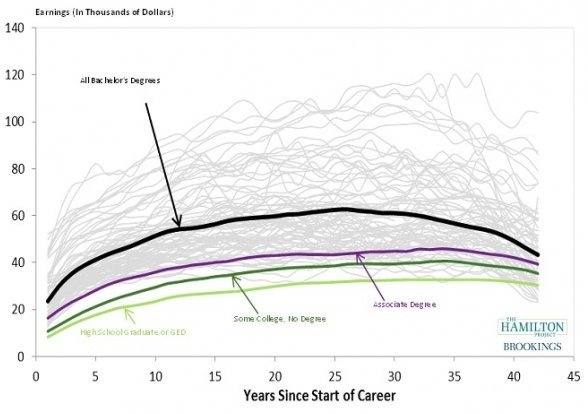

Here's a chart clearly showing the boost you get from a college degree:

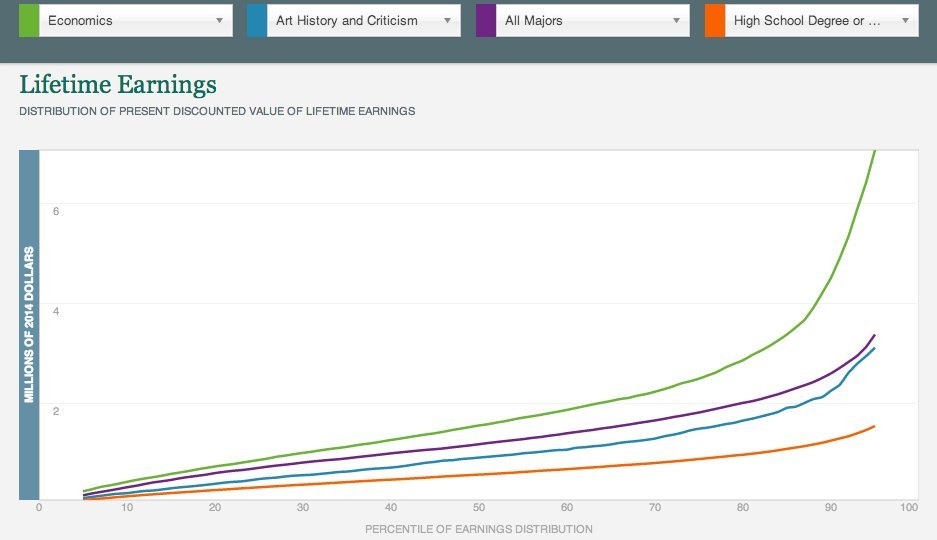

The message is stark: Go to college, major in something you like so that you'll graduate (yes, art history is worth it), and you will typically make more money. Hamilton even has a fantastic interactive graph that lets you see how much more money you can expect to earn based on your major:

Granted, gaining that advantage in lifetime earnings does cost something, and the cost of college is rising -- a trend that no student is happy about. Those rising costs are at least partially a result of the abundance of loan options available to students. Those same loans, however, let Americans borrow their way toward a higher lifetime income.

College debt, which is increasingly synonymous with a college education, has many potential downsides: It depresses the housing market, crowds out other spending, and leaves graduates vulnerable to default, marred credit ratings and all kinds of nasty practices.

There are real reasons to worry that student debt is too easy to acquire right now. There are other ways of financing college that would make it an even better deal for Americans, like the government using its excellent credit to borrow more money to fund more federally backed loans -- or, even better, grants. Increased funding for state schools also wouldn't hurt. Student-loan burdens from for-profit colleges tend to be very high, and come with shady collection methods and a degree of dubious long-term value.

Still, education is a fantastic way to invest in your own earning potential, and debt is a great way to invest in things that yield predictable returns. Investors famously love leverage. It boosts returns, because borrowing money from someone else is a cheaper way to buy something than putting up cash yourself, and because the tax code loves leverage too: The interest companies pay on debt is tax-deductible.

In a limited way, student loans give Americans access to the magic of leverage, with the bonus of tax deductions. Ordinary Americans can get access to loans to buy all sorts of things that fall in value and usefulness shortly after they're bought: cars, clothes, electronics, furniture, appliances. Even homes, which you can take out a mortgage to buy, can rise in value, but their price is volatile, and the thing itself is immobile and requires money to maintain.

A college degree has none of these drawbacks. It's the only type of loan Americans can use to directly invest in their long-term personal economic well-being.

There are lots of bad reasons to go into debt. A college degree is a good reason to borrow money.