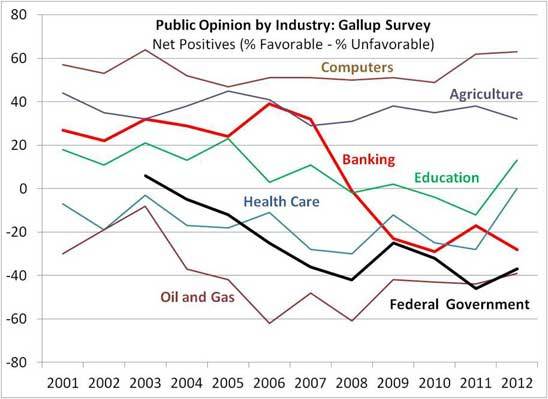

In the banking scandal du jour, HSBC managed to prove that our banks are not only too big to fail -- they're also too big to jail. Between the financial crisis, casino gambling, outsized bonuses, rate fixing and now money laundering, it's remarkable how much trust has been destroyed in such a short time. In the last six years, the public's opinion of the banking industry has dropped by over 60 points -- an almost unprecedented feat. Small wonder then that even the Wall Street Journal is beginning to call for the largest banks to be broken up.

But this banking crisis is just one symptom of a deeper problem. Along with increasing inequality, the hollowing out of the middle class and environmental degradation, there's an increasing sense that something's gone wrong, not just with a few individual companies, but with the system itself.

In order for us to thrive in the 21st century, capitalism needs to evolve. Rather than being bound by market fundamentalism, we need companies to be socially responsible. Rather than pursuing growth at any cost, we need companies to strive for sustainable success. As Simon Mainwaring puts it in his groundbreaking book and entertaining video, we need companies to shift from Me to We, and from just growing, to growing up. Along with government and non-profits, we need industry to become the third pillar for social change.

However, given all the urgent demands executives face, how can social responsibility ever become a real priority? From a practical perspective, how can companies actually focus on anything more than just next quarter's results? We're not just talking about a PR campaign or a new mission statement. We're talking about a new way of doing business. We're talking about deep change. As John Mackey, the CEO of Whole Foods puts it:

The whole corporate social responsibility ideal is trying to graft something onto the old profit maximization model. What we need is a transformation [in] the way we think about business, what it's based on. People want businesses to do good in the world. It's that simple.... We need a deeper, fundamental reform in the essence of business.

- Employee Engagement. Employee engagement is the top predictor of employee productivity. For example, Best Buy has found that every 0.1 percent increase in a store's level of employee engagement translates into more than100,000 of additional annual income. Companies that care recognize that employees don't just receive one paycheck each month -- they receive five. Their monetary paycheck determines whether they show up to work, but their four non-monetary paychecks -- particularly purpose and connection -- determine their level of engagement. If you want to have employees that care, they need to feel that they're part of a company that cares.

- Employee Recruitment and Retention. The global war for talent is based on the recognition that in a wide range of positions, an A-level employee (someone in the top 10%) is up to 10 times more productive than an average employee. And more and more, these top performers aren't just in it for the money. As Chip Conley explains, it's no longer enough for them to have a job or a career. They want their work to be their calling. They want their work to have meaning. If you want to attract and retain exceptional employees, create a company that cares.

- Marketing. In today's hyper-connected world, companies no longer control their brands. Consumers do. PR and advertising are rapidly being replaced by the internet and social media. And the rule #1 of social media is that it's not something you do -- it's a way to share who you are. The internet has created a level of transparency, communication and accountability that terrifies many marketing executives, because they're losing the ability to control what their customers think. Instead, the new paradigm of marketing involves four things: be a good corporate citizen, provide exceptional value, shift from interruption to invitation, and find ways to build authentic relationships.

- Sales and Customer Service. The top predictor of sales and customer service effectiveness -- by far -- is the level to which your employees genuinely care about your customers. Zappos, Nordstroms, Joie De Vivre Hotels, Whole Foods -- these are companies that have turned a culture of genuine care into an overwhelming competitive advantage. In contrast, look at the damage a single disgruntled employee did to Goldman Sachs, through his accusations about the company's culture. Genuine care is something that can't be mandated, controlled or hired -- it's something that has to be nurtured and developed from the inside-out.

- Leadership Development. Hundreds of academic studies have shown that leadership competency is the number one predictor of long term corporate success, yet if we did a survey of business leaders, what percentage do you think would rate themselves as "average" or "needs improvement"? As a leader, the more success you achieve, the more important it is to seek out your blind spots and patterns of self-deception, yet the harder it is to do so. In order to do the deep growth work that authentic leadership requires, leaders need to find something that's more important to them than just profits, success and protecting their egos. As the last six years have shown, people who aspire to be "masters of the universe" are much better at growing their bonuses than they are at growing great companies. In contrast, great leaders care more about growth and contribution than they do about short term profits and the trappings of success.

- Government Regulation. Ultimately, there are two ways an industry can earn society's trust: corporate culture and government regulation. The more people view an industry as being composed of "takers" instead of "makers," the less trust they'll extend and the more regulation they'll demand. Back when the banking industry was viewed in a positive light, many people supported de-regulation. Today, the argument is over how much new regulation and litigation is enough. This is an industry that's essential to our economy, and that includes many good people and companies, yet which has lost much of society's trust. Remarkably, we have yet to see the leaders in this industry even acknowledge this fact, let alone take responsibility for their industry's mistakes and explain how they're going to come together to address them.

The bottom line is that in order to create long term success in the 21st century, companies need to have employees that care, customers that care, leaders that care, and a government that cares. These needs, and the six initiatives they drive, are essential goals any executive can get behind. They're pragmatic reasons to create companies that care.

At the same time, creating a Company That Cares cannot be accomplished just from the outside-in. While effective leadership and cultural development are best driven and measured from the outside-in, they have to be developed simultaneously from the outside-in and the inside-out. It's not enough just to ask people to change what they do. Ultimately, it's also about helping them change who they are. It's about inviting them to bring their whole selves to work, and encouraging them to help others do the same.

What are your thoughts on this topic? Please add your ideas and experiences to the conversation below.