I am an annoyed Time Warner Cable customer whose current Triple Play service, that had an $89.99 advertised priced, is now costing me $211.27. That is a 135% increase over the advertised price in just a few years, and it continues to climb. And somehow making this company larger through a merger with Charter helps because...?

In previous articles we called to block the proposed Time Warner Cable-Comcast and investigate how Time Warner shows 95%+ profit margins on 'Internet broadband' service, not to mention overcharging over $840.00 per household based on something called the "Social Contract" from 2001-2014. We even filed a complaint and petitioned the NY State Public Service Commission to investigate Time Warner Cable.

This merger -- larger is worse, not better.

The goal of this article is to learn from history. The roads to America's communications consolidation are drenched with great 'pre-merger' benefit statements, then comes the inevitable - 'we were just kidding' outcomes.

And it is a fact that neither the FCC nor any State has ever written enforceable conditions, much less even enforced those conditions that they imposed. These deals are always filled with caveats about what customers will get, and every merger -- and I mean every merger, showed that bigger - sucks, and that's a technical term.

And while there have been a bunch of articles claiming that this FCC is somehow different from past FCCs and that this FCC is for "competition, competition, competition"-- have they all moved to Colorado for a Rocky Mountain high?

The Book of Broken Promises was so named because no major promises are ever kept - and the book tracks commitments to upgrade America, as well as every major telecom merger, which also had additional commitments for advanced technology or to provide more competition. Rates never went down, competition never showed up, and, for the most part, most major broadband plans for fiber optics were killed off. (By 2010, America should have been the first, fully fiberized nation; we paid about $400 billion and counting. And it was the mergers and the consolidation of power that helped to not deliver and overcharge customers -- but that's another story.)

Let me use some highlights of telecom 'merger commitments' and the FCC's approvals based on 'Public Interest', to show just how poorly this will all turn out, if this merger is allowed to go forward.

The Formation of What is Now AT&T: Bigger is Always Worse.

In 1984, the original Ma Bell, "AT&T", was broken up as it had a monopoly over the telecom wires. Seven large regional holding companies, known as the 'Baby Bells', were created which gave each company specific state-based utilities that controlled local service (and the wires in these utilities) among other perks, such as the spectrum licenses for these territories.

See: Map of Bell Companies: Before and After.

At the time, there were also:

- Independent local phone companies, such as GTE, which had properties in 28 states, or SNET, which ruled Connecticut and Cincinnati Bell in Hamilton County, OH.

- Three major 'long distance' companies, AT&T, MCI and Sprint, which would also compete to offer local service.

Southwestern Bell Decided to Marry Its Siblings -- An Act Against Nature.

Starting in 1996, Southwestern Bell, which controlled five states including Texas, Arkansas, Missouri, Oklahoma and Kansas, would change its name first to "SBC", as it went after:

- Pacific Telesis, which controlled California and Nevada. California had plans to have 5.5 million households wired with fiber optics by the year 2000 -- and was to spend16 billion to do it. State laws were changed to fund this buildout via rate increases, and tax perks.

- Here is a page from the "Pacific Telesis 1994 Fact Sheet" outlining the plan and giving actual areas to be covered from L.A. to San Francisco.

- Outcome: After the merger, by 1997, the company shut everything down, even though the State had granted rate increases to upgrade the state utility networks, replacing the copper wires.

- SNET, which controlled Connecticut, came next. The reason given for this merger was that it would be the foothold for competition on the east coast.

- SNET had made commitments to have the entire state completed by 2007 with a fiber optic service and spend4.5 billion. SNET had actually started to roll out fiber in 1996,

- Outcome: After the merger, SBC would just stop what was being built -- and did not compete.

In 1996, another thing happened. The Telecommunications Act of 1996 passed and it was supposed to open up the local or 'Last Mile' phone wires, which are the state regulated utilities, to direct competition - i.e., you, the customer could choose your ISP, otherwise know as your broadband provider, your phone provider and even your cable provider.

So, around 1999, with fresh meat dangling from its mouth, SBC decided it would add Ameritech, which controlled five mid-west states-- Illinois, Ohio, Indiana, Michigan and Wisconsin to its expanding monopoly.

- Ameritech had gone into each state utility commission years before the merger with SBC and said - change the laws and give us more money and we will start to rewire the state -- as well upgrade the schools-- and like SNET, the company had started to roll out fiber optic infrastructure, though they didn't offer the services it had committed to.

- Merger Condition: Compete "Out-of-Region". Since 'competition' was in the air, SBC-Ameritech would be competing "out-of-region" in 30 cities - and it was in writing.

And there's a list of 30 cities that SBC-Ameritech was supposed to be attacking in the Verizon and CenturyLink territories.

FCC's Public Interest Statement -- Failed.

In the approval of the merger, in 1999 the FCC writes that this was going to bring competition. ("LECs", are "Local Exchange Carriers", the incumbent companies that control the wires.) And it goes on and on about why they would 'compete if larger'

"This will ensure that residential consumers and business customers outside of SBC/Ameritech's territory benefit from facilities-based competitive service by a major incumbent LEC. This condition effectively requires SBC and Ameritech to redeem their promise that their merger will form the basis for a new, powerful, truly nationwide multi-purpose competitive telecommunications carrier. We also anticipate that this condition will stimulate competitive entry into the SBC/Ameritech region by the affected incumbent LECs."

The FCC's brain-dead merger conditions, however, had fine print that it required three--that's right -- only three customers in each territory/city to claim it had 'fulfilled' its obligation.

The Telecom Act Giveth; The FCC Helped to Kill Competition.

By 2000, AT&T and MCI, the long distance companies, were the largest 'competitors' and were competing and offering local, long distance and Internet service.

We need to thank former FCC Chairman Michael Powell, who helped to close the 'Open Networks' based on SBC's deception. SBC told the FCC that it would be bringing fiber-to-the-home in 2004, and this is immortalized in Powell's reason to remove 'unbundling', i.e.; the laws and regulation that let Competitive Local Exchange Carriers (CLEC) rent the incumbent LEC last mile networks to offer their own competing services.

Powell gave his reason for closing the networks due to 'commitments' for 100 Mbps, fiber-optic based infrastructure to deliver 'Triple Play' services by SBC (now AT&T), October 2004

"By removing unbundling obligations for fiber-based technologies, today's decision holds great promise for consumers, the telecommunications sector and the American economy. The networks we are considering in this item offer speeds of up to 100 Mbps and exist largely where no provider has undertaken the expense and risk of pulling fiber all the way to a home.

"SBC has committed to serve 300,000 households with a FTTH (fiber to the home) network while BellSouth has deployed a deep fiber network to approximately 1 million homes. Other carriers are taking similar actions."'

Again, the FCC just said - do whatever you want, no one will check; Powell is currently the head of the National Cable Telecommunications Association {NCTA), which represents the largest cable companies including Charter and Time Warner Cable.

And having closed the networks, this put the long distance providers, AT&T and MCI, up for sale since their access to provided competing services to the last mile of homes and business premises was blocked. So, of course, SBC buys AT&T, renames itself AT&T, while Verizon buys MCI.

With only a few Bell companies left, AT&T merges with BellSouth -- yeah, the same BellSouth that also claimed it would be upgrading 1 million homes in its service area - and didn't.

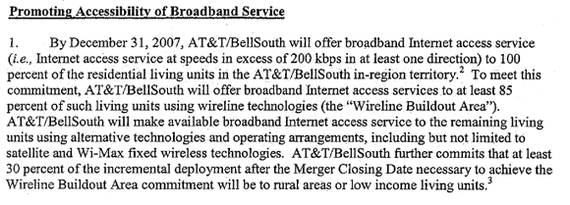

AT&T's merger condition claimed it would have broadband infrastructure and services to 100% of their now 22 state territory by the end of 2007-- It's in the damn merger commitment letter, which I've previously quoted.

FCC's Failed Oversight: AT&T BellSouth Commitment:

In 2015, we even filed a complaint to investigate this merger as in every document since this time, AT&T has claimed that it didn't complete about 25% with broadband and that it needed money from the government to do the work.

And the slap in the Public's face? AT&T currently gets nearly a $1/2 billion dollars from the FCC's Connect America Fund (CAF) annually.

Ars Technica writes.

"AT&T grudgingly accepts $428 million in annual government funding.

AT&T objected to 10 Mbps requirement, but will expand "broadband" in 18 states.

AT&T complained that the speed requirement should have been lower; low enough that the AT&T-BellSouth merger commitment would have been met had AT&T actually done the work.

Instead, AT&T not only didn't fulfill the original commitment but figured out how to get $1/2 billion a year extra to pay for network upgrades. And so now we pay additional Universal Service Fund taxes to fund the CAF due to the FCC's failure to perform basic oversight of the mergers.

Summary: So, we have Southwestern Bell, (then-SBC), Pacific Telesis, BellSouth and Ameritech, four of the original Bell Companies, and SNET, an independent telco, and AT&T - merged where each was supposed to be competing with each other--one big happy family, now controlling 21 states (AT&T sold off SNET).

The Creation of Verizon -- The Same XXXXX. (Fill in the Blank).

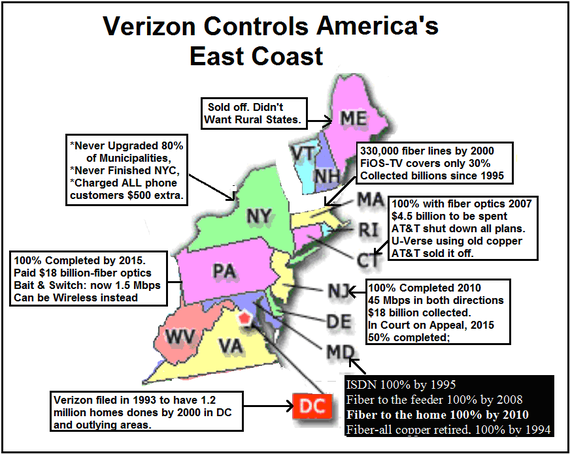

Verizon is the creation of two 'Baby Bells', Bell Atlantic and NYNEX, that merged around 1996 to become Bell Atlantic, and then merged with the largest independent incumbent phone company, GTE.

Bell Atlantic and NYNEX controlled the East Coast of America from Maine to Virginia. And to help get the merger through Bell Atlantic claimed it would be spending $11 billion to have 12 million households wired with fiber optics - by 2000-- starting in 1997.

"The company plans to add digital video broadcast capabilities to this "fiber-to-the-curb" switched broadband network by the third quarter of 1997, and broadband Internet access, data communications and interactive multimedia capabilities in late 1997 or early 1998."The fiber-to-the-curb architecture that Bell Atlantic will build is the next step in the company's ongoing, aggressive network modernization program. Bell Atlantic plans to begin its network upgrade in Philadelphia and southeastern Pennsylvania later this year. The company plans to expand this Full Service Network deployment to other key markets over the next three years. Ultimately, Bell Atlantic expects to serve most of the 12 million homes and small businesses across the mid-Atlantic region with switched broadband networks." (By 2000)

After the merger, the company never built anything and rolled out DSL, over the old copper wires. However, both NYNEX and Bell Atlantic went state to state to pitch a fully fiber optic future in the 1990's and asked for and received billions per state to build out a fabulous fiber optic future - starting in 1996; Verizon's FiOS service wasn't introduced until 2006 and then only in limited municipalities in the service area of the states they serve.

Add GTE

And the merger with GTE was to bring out-of-region competition, just like the AT&T-Ameritech deal. GTE's had 26 million access lines in 28 states as of December 31, 1999.

According to the FCC, the reason they agreed to this merger was:

"The merger conditions are designed to accomplish the following five public interest goals:

1.Promote advanced services deployment;

2.Enhance the openness of the merged company's in-region local telecommunications markets;

3.Foster out-of-region local competition;

4.Improve residential phone service; and,

5.Provide for enforcement of the merger."

None of these items happened in a meaningful way.

Another FCC Failed 'Benefit' Statement?

"The Applicants, however, have proposed conditions that will alter the public interest balance. These conditions are designed to mitigate the potential public interest harms of the Applicants' transaction, enhance competition in the local exchange and exchange access markets in which Bell Atlantic or GTE is the incumbent local exchange carrier (incumbent LEC), and strengthen the merged firm's incentives to expand competition outside of its territories. We believe that the voluntary merger conditions proposed by the Applicants and adopted in this Order will not only substantially mitigate the potential public interest harms of the merger, but also provide public interest benefits that extend beyond those resulting from the proposed transaction. Accordingly, we conclude that approval of the applications to transfer control of Commission licenses and lines from GTE to Bell Atlantic serves the public interest, convenience, and necessity and, therefore, satisfies sections 214 and 310(d) of the Communications Act given these significant and enforceable conditions."

Stop laughing (or crying).

I note that the current sale of Verizon's Florida, Texas and California service areas were formerly GTE properties. These were supposed to be spring-boards to compete out-of-region as Bell Atlantic was the East Coast of America from Maine through Virginia. (Except part of CT)

And this is what happened when one company takes control of lots of states - they all get harmed.

And this Time Warner Cable Et Al. Merger?

Please refrain from laughing at this presentation:

Application: Public Benefit, Time Warner Cable et al

"An Engine for New Investment and Jobs. The Transaction will lower the per-customer fixed costs of investments, facilitating the deployment of new technology and advanced infrastructure. In addition, substantial synergies will reduce the merged company's costs, providing additional resources to invest productively. "

Or - the always popular "increased scale" argument:

Or as Broadcasting and Cable, the trade publication, wrote in its summary article, which could also be renamed 'Promise them Cake':

"Among the key benefits Charter tells the FCC the deal will produce are: faster speeds, affordable (and unlimited) broadband, faster rollouts of new technology, nondiscriminatory interconnection, and more investment in customer care.""Among its commitments are a $2.5 billion investment in commercial broadband and returning call center jobs to the U.S.

"According to a summary of the public interest statement filed with the FCC, Charter is volunteering the following specific, legally enforceable commitments."

NOTE: Likely Results:

- Time Warner Cable spent4.4 billion on CapX in 2015 - so this additional investment is hand waiving.

- Voluntary commitments--just like the AT&T-BellSouth commitments - will be forgotten 13 days after the signing on the merger.

- Everything in the above was created by a comedy writer for Comedy Central.

Maybe the state AGs should investigate these companies' business practices as the 'public interest' benefit?