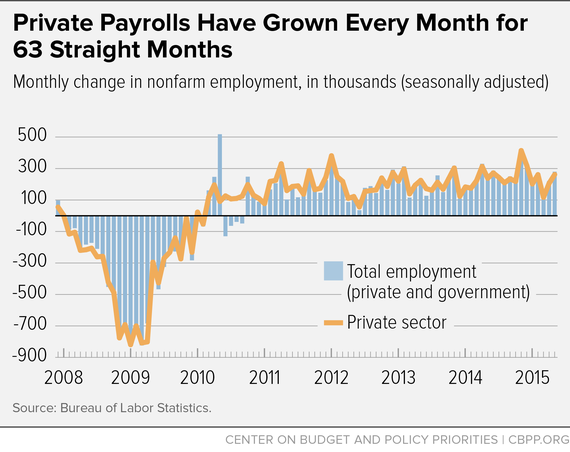

Today's strong jobs report shows continued solid growth in payroll employment (see chart), and many other labor market indicators have recovered substantially since the Great Recession. Nevertheless, the Federal Reserve should not rush to raise interest rates. By testing whether it can push unemployment lower -- rather than play it safe to avoid any risk of inflation -- the Fed could bring more workers back into the labor force, help more long-term unemployed find work, and begin to generate solid wage gains for most workers.

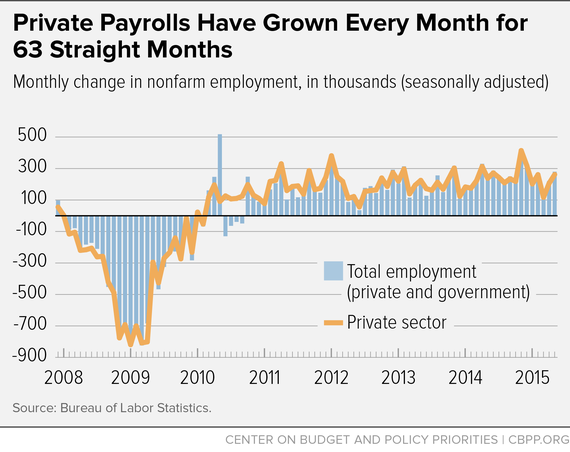

Payroll job growth has been among the best-performing labor market indicators during the recovery. Private-sector firms began expanding their payrolls in March 2010, and private payroll employment has grown every month since. Overall (private plus government) payroll job growth was distorted by the hiring and subsequent letting go of temporary workers for the 2010 Census, but total payrolls have expanded every month starting in October 2010. The dark cloud in this picture is government employment, which is still nearly half a million jobs lower than at the December 2007 start of the recession, dominated by a net loss of 361,000 local government jobs.

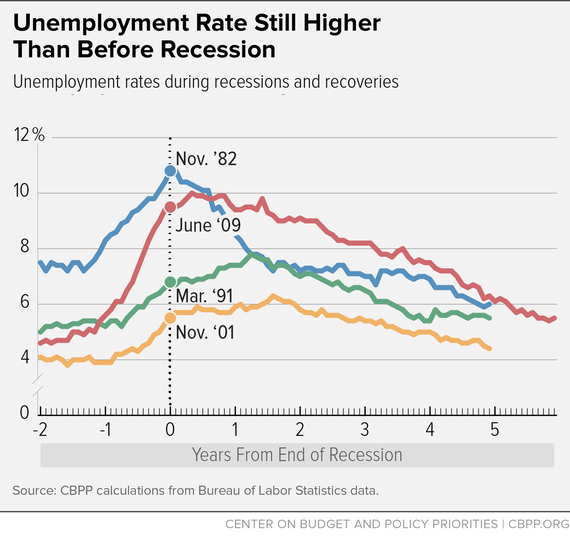

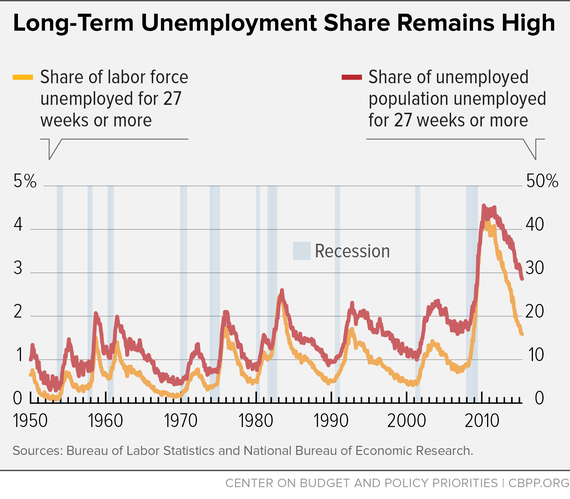

To be sure, unemployment has fallen substantially -- from 10 percent in October 2009 to 5.5 percent in May -- though it took much too long to get there. Moreover, many people dropped out of the labor force along the way or never entered it due to poor job prospects, and a historically high share of the unemployed have been looking for work for at least half a year. We need overall unemployment to fall further in order to bring more people back into the labor force and reduce long-term unemployment.

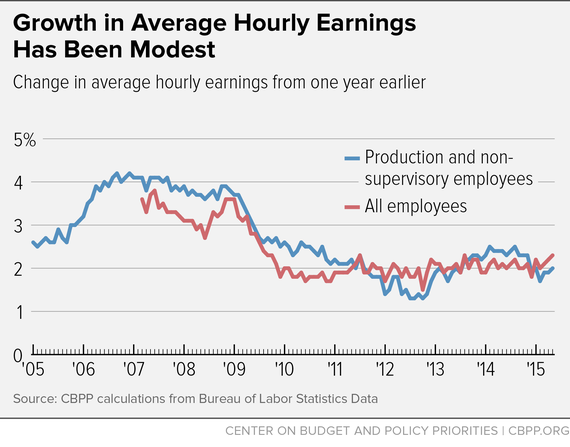

Meanwhile, wage gains during the recovery have been modest while profits have soared. We need tighter labor markets with more plentiful job opportunities and hence more competition for workers to redress that imbalance.

Throughout the long labor market recovery, inflation has remained low, and the Fed has taken a number of steps to keep interest rates low and enable the labor market to improve. Inflation is still low, and there's still room for further labor market improvements -- if the Fed remains cautious about raising interest rates.

About the May Jobs Report

Employers reported strong payroll job growth in May. In the separate household survey, the unemployment rate edged up to 5.5 percent, but this was due to strong growth in labor force participation, not weaker demand for labor.

- Private and government payrolls combined rose by 280,000 jobs in May, and job growth in the previous two months was revised up by 32,000. Private employers added 262,000 jobs in May, while overall government employment rose by 18,000. Federal government employment rose by 3,000, state government was unchanged, and local government rose by 15,000, two thirds of that in education.

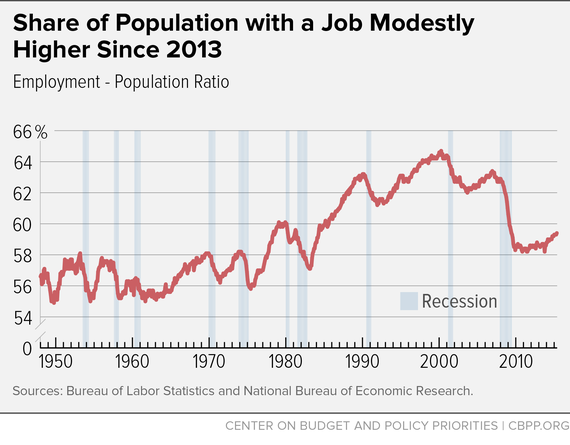

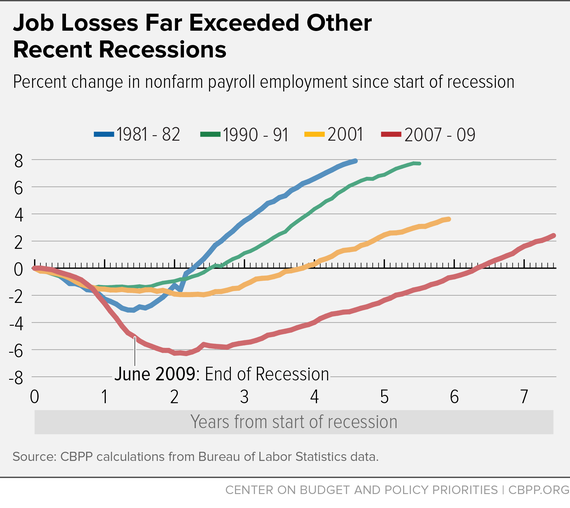

This is the 63rd straight month of private-sector job creation, with payrolls growing by 12.6 million jobs (a pace of 199,000 jobs a month) since February 2010; total nonfarm employment (private plus government jobs) has grown by 12 million jobs over the same period, or 191,000 a month. Total government jobs fell by 535,000 over this period, dominated by a loss of 337,000 local government jobs. Employment remains below where it was at the start of the recession in December 2007 for all three levels of government: federal (lower by 18,000), state (lower by 56,000), and local (lower by 361,000). The job losses incurred in the Great Recession have been erased. There are now 3.8 million more jobs on private payrolls and 3.3 million more jobs on total payrolls than at the start of the recession in December 2007. Because the working-age population has grown since then, the number of jobs remains short of what is needed to restore full employment. Continued growth at the average pace of 255,000 a month achieved over the past 12 months would close the gap in a reasonable period of time. Average hourly earnings on private nonfarm payrolls rose by 8 cents in May to $24.96. Over the last 12 months they have risen by 2.3 percent. For production and non-supervisory workers, average hourly earnings rose by 6 cents to $20.97 -- 2 percent higher than a year earlier. The unemployment rate edged up to 5.5 percent in May -- 0.5 percentage points higher than it was at the start of the recession -- and 8.7 million people were unemployed. The unemployment rate was 4.7 percent for whites (0.3 percentage points higher than at the start of the recession), 10.2 percent for African Americans (1.2 percentage points higher than at the start of the recession), and 6.7 percent for Hispanics or Latinos (0.4 percentage points higher than at the start of the recession). The recession drove many people out of the labor force, and the ongoing lack of job opportunities kept many potential jobseekers on the sidelines and not counted in the official unemployment rate. May's numbers were much more encouraging. The labor force grew by 397,000 people, and much of that reflected an increase of 272,000 in the number of people with a job. Not everyone found a job immediately, however, and unemployment rose by 125,000, nudging up the unemployment rate to 5.5 percent. (The data on household employment and unemployment come from a different survey than those on payroll employment and show considerably more month-to-month variability.) The labor force participation rate (the share of the population aged 16 and over in the labor force) edged up to 62.9 percent in May, 3.1 percentage points lower than at the start of the recession. The labor force participation rate has stayed in the narrow range of 62.7 to 62.9 percent since April 2014. Prior to recent years, the labor force participation rate hasn't been this low since the 1970s. The share of the population with a job plummeted in the recession from 62.7 percent in December 2007 to levels last seen in the mid-1980s and has remained below 60 percent since early 2009. This number rose modestly in 2014 and edged up to 59.4 percent in May, after being stuck at 59.3 percent since January. The Labor Department's most comprehensive alternative unemployment rate measure -- which includes people who want to work but are discouraged from looking (those marginally attached to the labor force) and people working part time because they can't find full-time jobs -- was 10.8 percent in May. That's well down from its all-time high of 17.1 percent in April 2010 (in data that go back to 1994) but still 2 percentage points higher than at the start of the recession. By that measure, about 17 million people are unemployed or underemployed. Long-term unemployment remains a concern. Almost three in 10 (28.6 percent) of the 8.7 million people who are unemployed -- 2.5 million people -- have been looking for work for 27 weeks or longer. These long-term unemployed represent 1.6 percent of the labor force. Long-term unemployment reached much higher levels and has persisted much longer in the Great Recession and subsequent jobs slump than in any previous period in data that go back to the late 1940s. The worst previous episode was in the early 1980s, when the long-term unemployment share peaked at 26 percent (compared with 45.5 percent this time) and the long-term unemployment rate peaked at 2.6 percent (compared with 4.4 percent this time). Moreover, in the earlier episode, a year after peaking at 2.6 percent, the long-term unemployment rate had dropped to 1.4 percent. It has not fallen that low yet in the recovery from the Great Recession. The original statement can be viewed here.

Support HuffPost

Our 2024 Coverage Needs You

Your Loyalty Means The World To Us

At HuffPost, we believe that everyone needs high-quality journalism, but we understand that not everyone can afford to pay for expensive news subscriptions. That is why we are committed to providing deeply reported, carefully fact-checked news that is freely accessible to everyone.

Whether you come to HuffPost for updates on the 2024 presidential race, hard-hitting investigations into critical issues facing our country today, or trending stories that make you laugh, we appreciate you. The truth is, news costs money to produce, and we are proud that we have never put our stories behind an expensive paywall.

Would you join us to help keep our stories free for all? Your contribution of as little as $2 will go a long way.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

As Americans head to the polls in 2024, the very future of our country is at stake. At HuffPost, we believe that a free press is critical to creating well-informed voters. That's why our journalism is free for everyone, even though other newsrooms retreat behind expensive paywalls.

Our journalists will continue to cover the twists and turns during this historic presidential election. With your help, we'll bring you hard-hitting investigations, well-researched analysis and timely takes you can't find elsewhere. Reporting in this current political climate is a responsibility we do not take lightly, and we thank you for your support.

Contribute as little as $2 to keep our news free for all.

Can't afford to donate? Support HuffPost by creating a free account and log in while you read.

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. Would you consider becoming a regular HuffPost contributor?

Dear HuffPost Reader

Thank you for your past contribution to HuffPost. We are sincerely grateful for readers like you who help us ensure that we can keep our journalism free for everyone.

The stakes are high this year, and our 2024 coverage could use continued support. If circumstances have changed since you last contributed, we hope you’ll consider contributing to HuffPost once more.

Already contributed? Log in to hide these messages.