Have a few blemishes on your credit report? You're not alone. According to a recent study from the Urban Institute, over one-third of Americans had debt in collections in 2013. The debts averaged $5,178 and include debt like medical bills, credit card balances, student loans, parking tickets and utility bills.

In a very real sense, the phenomenon is making the U.S. a debtor nation. The recently debuted documentary entitled Spent (by American Express) highlights some of the formidable challenges many Americans are facing. People all over the country have debt in collections. However, some areas have higher concentrations of debt than others according to the survey. Nevada residents have the highest rate of debt in collections, with 47 percent of residents with delinquent debt and an averaged owed of $7,198. Eleven of the twelve states where 40 percent of more of the residents have debt are in the South.

Once a debt goes into collections, it can remain on a person's credit report for up to seven years. And, even after a debt in collections is paid off, it can still reduce a credit score for a period of time. These delinquent debts can have a serious effect on people's credit, job prospects and more.

People with credit blemishes are often considered bad candidates for certain jobs. Bad credit can keep you, for instance, from getting a security clearance, which is necessary for certain companies that work with the federal government. Not only can delinquent debts keep someone from qualifying for a mortgage; they can cause apartment rental applications to be turned down, as well. When you have bad credit, you can pay more for everything from insurance to renting a car. The reduced opportunities and higher costs can keep people from the financial stability that would, in the future, reduce their chances of winding up in debt.

Tips for Consumers Facing Collections

The following tips can help consumers that are struggling with debt.

• Calls from debt collectors can be embarrassing and intimidating. But, as a consumer, you have rights and protections. If you are contacted by a debt collector, then always ask for communication about the debt in writing. This gives you time to research the debt and verify whether it is valid.

• If you have problems with credit card debt, consider switching to a prepaid debit card. Such cards do not charge interest and can be a great budgeting tool. BestPrepaidDebitCards.com reviews the best prepaid cards.

• Do not hesitate to report debt collectors who harass you. Actions that legally qualify as harassment include calling outside of approved hours, calling you at work after you have asked them to stop and seeking unjustified amounts. Both your state's Attorney General's office and the FTC can help.

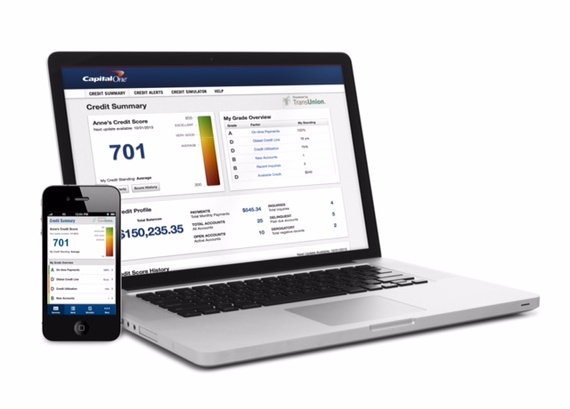

• Check your credit report. If you have been reported for debts that you do not owe, you can have those records removed so they do not negatively affect your credit score. Errors on credit reports are common.

Similarly, obtaining your credit score for free from a site like WisePiggy.com is a good idea. WisePiggy also gives you advice on how to increase your score.

• Know that you can negotiate debt payments. In some cases, debt collectors will be willing to accept a lower amount if you can pay off the debt all at once. You can also ask for a payment plan.

• It's a good idea to be proactive in dealing with your debt, especially debt that has gone to collections, and to know your rights. Consulting an attorney or reputable credit counseling agency can be helpful.

Curtis Arnold, a nationally recognized consumer advocate, is the founder of BestPrepaidDebitCards.com, which provides ratings of prepaid cards and secured credit cards.