"A Daring Trade Has Wall Street Seething," is a simplified case study into the pitfalls of credit default swaps. Nobody, including The Wall Street Journal's reporters, could figure out exactly what was going on. The transaction, illustrated by Journal below, involved sophisticated players who ostensibly knew what they were doing.

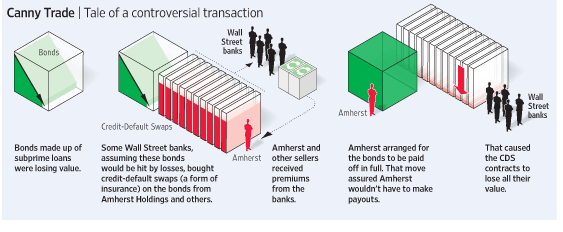

In this particular deal, a group of large banks held mortgage securities that they thought were worthless, so they decided to cut their losses, in order to recover 10 - 20 cents on the dollar. They bought credit insurance, aka credit default swaps, with a huge upfront premium, equal to 80 - 90 percent of the bonds' face amount. The banks expected that the bonds would default, at which point Amherst would pay out 100 percent of the bonds' face value. The banks did, in fact, receive a 100 percent payout on the bonds, but not from Amherst.

Instead, "Amherst arranged for the bonds to be paid off in full. That move assured Amherst wouldn't have to make payouts." But where did the $27 million, used to pay down the bonds, come from? Nobody who knows is talking, though the Journal found some people who have a pretty good guess:

In April, a servicer called Aurora Loan Services at the behest of Amherst purchased the remaining loans and paid off the bonds. Although Amherst won't provide specifics and won't comment on its arrangement with Aurora, it doesn't deny that it took this approach.

Why would Aurora pay face value for bonds that were trading at a deep discount? It makes no sense unless it had a side deal with Amherst. The Journal writes:

Since the mortgage securities were valued at just $3 million or so in the market, well below the $27 million they were redeemed for, traders believe Amherst entered into an uneconomic transaction to profit from its swap positions.

That's the way it usually works, with derivatives and with insurance. Amherst purportedly made a profit on one side of the deal (credit default swap fees), a loss on the other side of the deal (redeeming the bonds at par), and presumably netted out some small difference. If the markets were transparent and efficient, the net result would have been the same as if Amherst simply purchased the bonds outright at 10 - 20 cents on the dollar.

But the deal caused an uproar.

'It's all-out warfare' between the banks and Amherst, said a senior banker at one firm that lost money...When the bonds got paid off, the swaps became worthless, meaning the banks effectively forfeited what they had paid for the insurance. J.P. Morgan lost millions, while RBS and BofA suffered minimal losses, said people familiar with the matter.

The mischaracterization of those "losses" is the key element of the story that the Journal glossed over. Everyone "forfeits" his insurance premium if he has no need to file a claim. (If you aren't dead yet, you forfeited the premiums on your term life insurance.) The large banks are fully aware of how these instruments work. Yet they saw the Amherst deal as a dangerous precedent.

Firms that suffered losses as well as some that didn't have brought the trade to the attention of two financial industry groups, the Securities Industry and Financial Markets Association, and the American Securitization Forum, which are considering their concerns, say people familiar with the trade groups' thinking.

...

Many credit-default swap contracts that were written on subprime mortgage securities over the past three years remain outstanding, and holders could lose out if more bonds are made whole. Deutsche Bank has sent a list, reviewed by The Wall Street Journal, to its clients of more than two dozen other mortgage pools that could see similar moves.

The story illustrates the systemic pitfalls of credit default swaps, which are unlike all other types of swaps. If you enter into an interest rate swap (e.g. fixed rates for floating), or a currency swap (e.g. Euros for dollars) or an energy swap (e.g. oil for natural gas), you are effectively exchanging the price of one freely traded commodity for another. Over the life of the swap, both counterparties pay out at an agreed-upon price, and the referenced commodities should continue trading on the open markets.

A credit default swap is entirely different. One side is willing to make a bet that a company -- or in Amherst's case, a group of subprime homeowners -- will not go bankrupt, and the other side will make an upfront payment to insulate itself from that bankruptcy risk. After closing, the only time that one party pays out is when there is a payment default. If you look to the substance of the transaction, rather its form, you see that credit default swaps are really insurance policies.

Credit default swaps are insurance without the normal restraints imposed traditional insurance. Normally, you are not supposed to insure an asset that you do not own. Also, you are not supposed to insure an asset for many times more than its market value.

That's not how it works with credit default swaps. "At one point, at least $130 million of bets had been made on the performance of around $27 million in securities, according to a person familiar with the matter," writes the Journal.

The implication is that Amherst collected insurance premiums for many times the value of the bonds, and used the proceeds to redeem the bonds at a small fraction of the cost incurred for paying out on the insured claims.

In other words, if you sell a credit default swap, you may have an incentive to prop up the creditworthiness of the company, or other entity, with which you have no direct business relationship. And if you buy a credit default swap, you have an incentive to promote that company's failure. George Soros raised this issue in today's Financial Times:

Consider the recent bankruptcy of AbitibiBowater and that of General Motors. In both cases, some bondholders owned CDS [i.e. credit default swaps] and stood to gain more by bankruptcy than by reorganization. It is like buying life insurance on someone else's life and owning a license to kill him. CDS are instruments of destruction that ought to be outlawed.

Why would someone take out insurance on an asset he doesn't own? There are a number of reasons. The market for credit default swaps is more active than the market for subprime securities, and some investors may have purchased these swaps as an imperfect hedge against similar mortgage bonds. (The primary benchmark for pricing subprime securities, the ABX index, is in fact a credit default swap on a reference list of securities.) Also, beginning in 2006, investment banks started issuing "synthetic CDOs," which are exotic securities that were no longer backed by bonds of mortgages, but by credit default swaps.

Clearly, people did not understand what they were getting themselves into. And the unintended consequences have not fully played out.