The number of active trial and permanent Home Affordable Modification Program (HAMP) modifications in the Chicago region is now at its lowest since regional data has been reported, new data show (see our previous analyses). There were 34,576 active modifications in the Chicago region in July 2010, compared to 36,208 in November 2009, the first month Treasury released data by metro area.

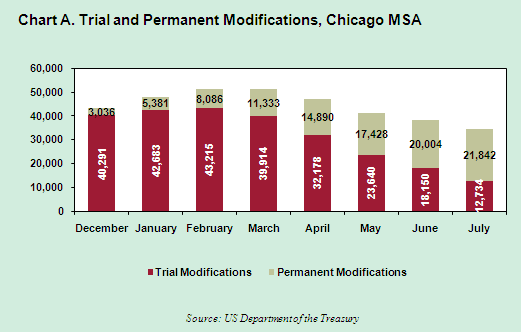

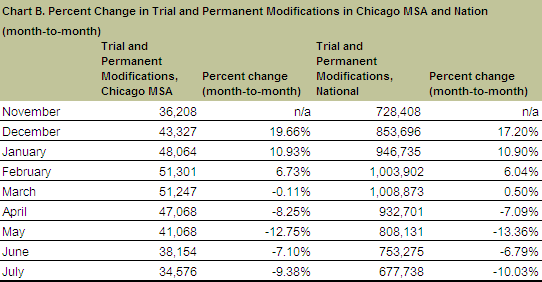

HAMP's momentum appears to be slowing, as permanent modification growth slows and the number of trial modifications decreases more sharply. Chicago region permanent loan modifications rose by 9 percent from June to July, compared to 15 percent growth from May to June and 17 percent growth from April to May (see charts A and B). Regional trial modifications fell by 30 percent from June to July, which is the third month in a row of month-over-month losses above 20 percent. Total modification activity in the Chicago region fell by 9 percent from June to July.

Similar trends can be seen nationally. Trial modifications also dropped by 30 percent from June to July, and permanent modifications grew by 8 percent--slightly less than the 9 percent growth in the Chicago region. Nationally, total modification activity fell by 10 percent from June to July.

As we noted in past months, the falling numbers of active modifications are likely due in part to the fact that many servicers did not require full income documentation before starting a trial modification; borrowers who do not qualify based on income are now being dropped from the program. Additionally, Treasury now requires that all servicers collect full income documentation before starting a trial modification, likely slowing the rate of new trial modifications.

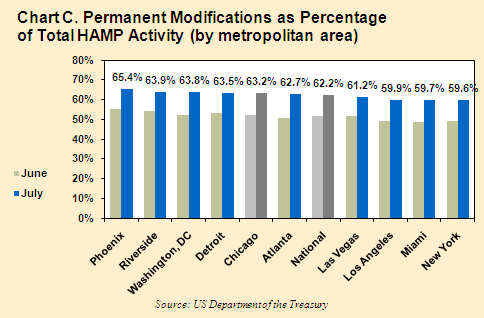

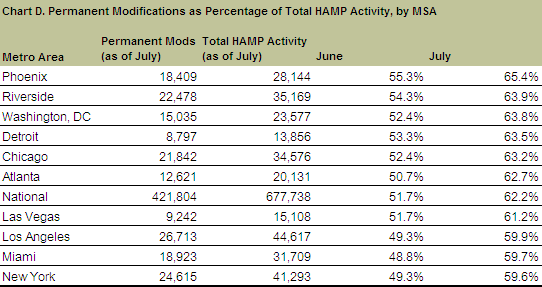

Compared to the 10 metropolitan areas with the highest HAMP activity, Chicago is fifth in terms of percentage of all active HAMP modifications that are permanent, with permanent modifications comprising 63.2 percent of all active modifications. This is higher than the national average of 62.2 percent of all active modifications being permanent (see charts C and D below).

However, within the context of continually decreasing numbers of active modifications, this ratio does not indicate how well metropolitan regions are performing in terms of converting trial to permanent modifications. For instance, more than 16,000 modifications in the Chicago region have been cancelled since the February peak of 51,301 active modifications. The ratio of permanent to all active trial modifications continues to increase by virtue of the decreasing number of all active modifications. Since Treasury does not currently release regional data on all modifications that have been started (including those that have been cancelled), we cannot accurately assess the Chicago region's conversion rate.

The Treasury data reports that 60 percent of borrowers with permanent modifications listed "loss of income" as their reason for hardship. Even after modification, 64 percent of the median permanent modification borrower's income goes to servicing debts, including mortgage, automobile, and credit card payments (this number was 80 percent before modification). The average HAMP borrower owes 50 percent more on their home than it is worth in the market. These figures are likely equally or more severe for those homeowners who were dropped from the program or did not qualify for HAMP in the first place.

It's clear that, while HAMP has helped thousands of homeowners save their home and achieve an affordable monthly payment, it is not enough to prevent the large number of foreclosures triggered by unemployment and underwater home values. Widespread principal reduction and assistance for unemployed homeowners will be crucial to making a dent in foreclosure crisis.