How we pay for health care is a divisive political topic. At its core, the debate is based on how economists define the delivery of health care. Is it a public good like police protection or is it a market good like buying a car? How you answer that question likely depends on your political leanings and while I am an economist, this is not my research area so the answer to the philosophical debate is above my pay grade. But like everyone else, I have a decision to make soon; what health care plan is right for me.

My first post-college employer answered the question for me. Everyone got the same plan which was comprehensive and free, at least to me. But over the years, that deal changed and I was asked to bear more and more of the cost of my health care. To lessen the sting I was offered the option of setting aside money in a tax-free Flexible Spending Account (FSA). Money in my FSA could be used to pay the deductibles and co-pays. Since this would be tax-free I wanted to maximize the use of it but there was a catch. The unused amount at the end of the year was forfeited. In other words, it was "use it or lose it." Every year was a guessing game about how often I would go to the doctor or be admitted to the hospital. But in 2004 a new option was available, the Health Savings Account (HSA). Money set aside was tax-free but would roll over to subsequent years if not used. That's a much better deal but it also comes with a catch. You must use a high deductible plan and in 2004 my employer did not offer one that met the IRS guidelines. Now they do and most employers do as well so this is one of the choices facing most of us when the time comes to choose a health care plan. But should you choose that option? Few people at my college do and I think many of them are making a mistake. The high deductible plan may be the best bet for a lot of people.

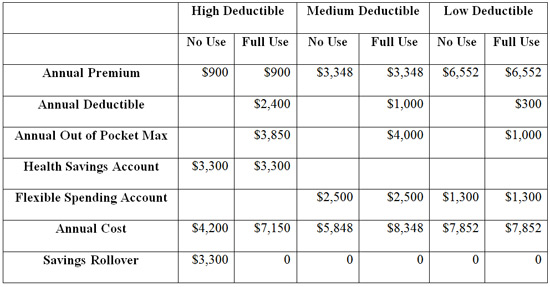

To illustrate I will use the options my wife has at her employer, the local school district. A few years ago most districts in our state made a radical shift in the health care benefit. Every employee was given a fixed amount from the district to pay for health insurance. The rest of the premium is paid by the employee no matter if you are single, married or has children. The employer contribution is almost enough to pay for the employee only premium of the cheapest plan, which has the high deductible. All the incremental cost for lower deductible plans or to include other family members falls on the employee. She has three options, a high deductible plan that qualifies for a HSA, a medium and a low deductible plan neither of which qualify for an HSA but she could set up a FSA to cover out-of-pocket costs. The following table lists the employee annual premium, deductible and out-of-pocket annual limit for the three options she has. I've also assumed that she will take full advantage of the HSA ($3,300 annual max in 2014) or FSA ($2,500 annual max) or in the case of the low deductible plan, enough set aside in the FSA to cover the deductible and out-of-pocket costs. The table shows the cost if she never goes to the doctor (No Use) and if she maxes out her costs (Full Use)

Clearly, the best option for my wife, and I suspect other district employees, is to take the high deductible plan and fully fund the Health Savings Account. The premium alone on the low deductible plan is higher than the premium on the high deductible plan plus the annual funding of the HSA. The premium alone on the middle option is $852 less but would only be beneficial if she chose that option and never used it. My wife is healthy and has only small medical expenses. But it would be foolish to assume she will never need medical care year in and year out. Unused contributions to the HSA can build up over time and when she does have a medical expense the money is there. In fact, if there is money left over in the HSA when she retires, it can be used for expenses not paid by Medicare.

We have both used the high deductible/HSA option for three years now. In that time, I have had one medical event that reached the out-of-pocket limit and she has had none. My guess is that on average, one of us will have a similar event every five years or so. We plan to retire in about 10 years and if our health care use continues in this pattern we will have about $50,000 in a tax-free account that can ease out-of-pocket health care costs as we age. This may not be a good option for everyone, but for us, and I suspect for many others, it is a choice worth considering.