We're entering year two of the housing recovery, and things so far have gone very well. But the next few years will not look like the last one.

I'm not alone in noticing what looks like another Fed-induced housing bubble emerging in some markets. Zillow recently asked more than 100 experts if current monetary policy risked inflating a new bubble. Almost all respondents (96 percent) said they saw at least some risk.

This bubble comes from two current housing market distortions: high negative equity and low mortgage rates. Negative equity contributes to constrained housing supply- - 43.6 percent of Americans with a mortgage lacked sufficient equity in the first quarter to realistically sell. Low mortgage rates drive high demand. When high demand runs into limited inventory, the result is strong home value appreciation.

High appreciation rates aren't worrisome everywhere. Home values in Phoenix are 21 percent higher than last year, but 40 percent below their peak. Homes there are 37 percent more affordable than their pre-bubble, 1985-1999 average, and will remain affordable even when mortgage rates are back to 6 percent (still a relatively low rate, historically).

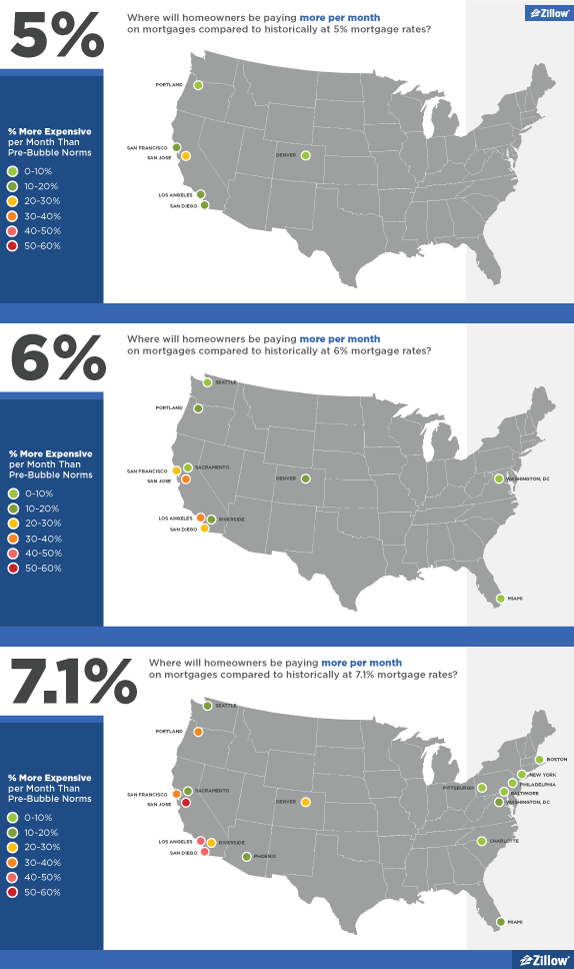

Not so in a market like San Jose, which has also seen annual appreciation of roughly 21 percent, but is only 6 percent below peak. Homeowners there historically spent 35 percent of monthly incomes on mortgages. Today, thanks to very low rates, they're spending 30 percent, making homes 16 percent more affordable than historically. But they will be 36 percent less affordable than historical averages when rates hit 6 percent, assuming home values continue to appreciate through early 2014 at even half their current pace.

Eleven major markets, including much of Southern California, Denver, and Washington, D.C., will show similar patterns at 6 percent mortgage rates if home values keep climbing.

The Federal Reserve has been performing a monetary magic show aimed at keeping mortgage rates low, spending $85 billion per month filling its balance sheet with treasury bonds and mortgage-backed securities. But the show is drawing to a close and rates are rising, and the effect on housing demand will be undeniable as homebuyers must spend more on mortgages. Home value appreciation will slow while incomes catch up or, in some areas, will have to fall.

Consumers in these emerging bubble markets must plan for slower appreciation over the next few years, and possibly localized depreciation. I am concerned about homebuyers intending to sell in five years or less, assuming substantially higher prices. Yes, future buyers will be paying more for homes. But they'll likely be paying the difference in financing costs, not necessarily higher base prices.

Fed policymakers will also have to make a kind of Sophie's Choice. They can more slowly withdraw the support aimed at the broader economy, risking another housing bubble; or remove all stimulus, potentially jeopardizing the broader recovery, but avoiding a bubble.

The real peril of global warming isn't necessarily rising temperatures, but volatile weather. Similarly, the real housing correction is not just the recently ended, years-long decline in home values. Instead, it may entail a longer period of price volatility, with current robust appreciation a small and unsustainable part.

Enjoy the current market. But prepare for Act Two.