It can be argued that people's online activities are a leading indicator of what they plan to do in the future.

- Before you buy a car, you search for the best deals online

- If you just lost your job, you tweet about it

- If you're visiting your local shopping mall, you "check in" with your mobile phone with apps like foursquare

- When you're reading financial media, you might be influenced by the bullish/bearish tone of the content

- And so on...

Of course, these databases of online data points are massive and unstructured, and it's difficult to extract insights out of the 2.5 quintillion bytes of data that the world generates every day.

This is the key problem that the "big data" industry is trying to solve.

Many believe that data is the oil of the 21st century, and that there are significant profits to be made by extracting value out of all this data.

Most companies are using this data to target ads more effectively, or to suggest songs/movies people might enjoy.

We believe that this data can also be used to develop superior investing strategies.

Can Facebook Data Be Used to Create Profitable Trading Strategies?

It takes a certain level of customer loyalty to press a company's "Like" button, and evaluating trends in the "Likes" of corporate Facebook pages can be an interesting indicator to track.

This is especially true in the case of pair trades -- if one company's "Likes" are growing faster than another, does that represent a long-term opportunity or not?

Case Study: Abercrombie & Fitch (ANF) vs. American Eagle (AEO)

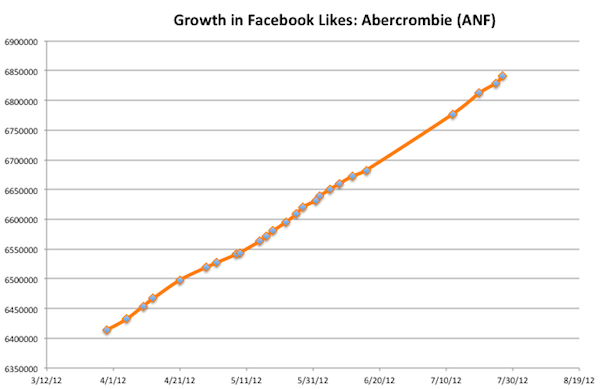

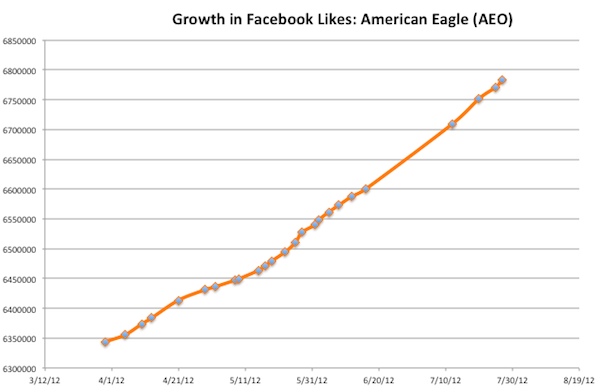

Contextuall has tracked the "Likes" on these two apparel retailers since the end of March.

Here is the trend in "Likes" for Abercrombie & Fitch:

..and the trend in "Likes" for American Eagle:

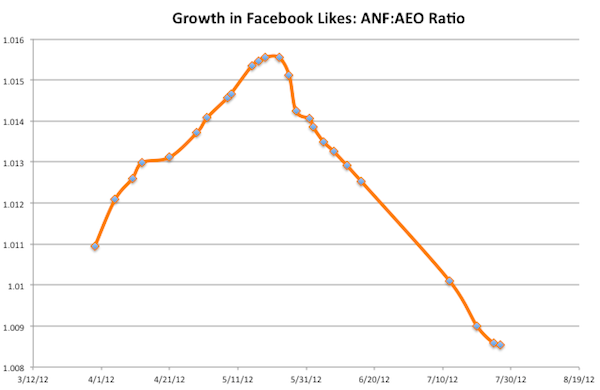

Contextuall also created a time series of the ratio ANF_Likes:AEO_Likes, i.e. measuring ANF "Likes" as a multiple of AEO "Likes".

It's quite incredible to see how American Eagle "Likes" accelerate relative to Abercrombie:

*Note: AEO is represented in the denominator in the ratio, hence an increase in its value will drag down the ratio.

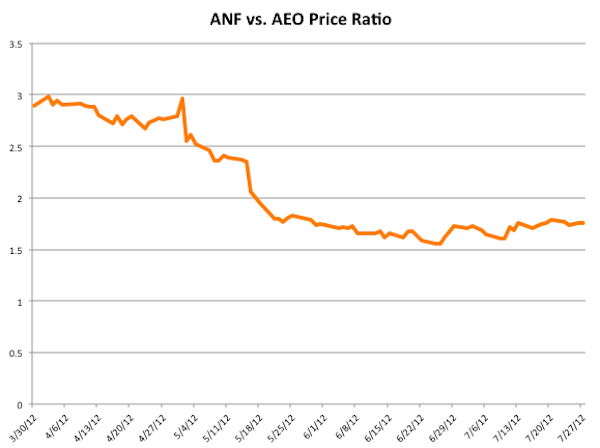

We also created a time series of the ratio ANF_Price:AEO_Price, which looks like this:

KEY TAKEAWAY: The chart is almost a mirror image of the Facebook "Likes" ratio graph above, indicating a strong historical correlation between Facebook mentions and stock performance in a pair trade strategy.

But Can This Data Be Used to Make Predictions?

To turn these data points into trading strategies, various machine learning and artificial intelligence algorithms can be used to transform unstructured data points into useful insights for portfolio managers and investors.

We've described two algorithmic models at this link. Both models used Facebook data to predict which stock will outperform over the next 10 trading sessions, and an out of sample test showed impressive accuracy.

That said, these samples are too small to come to any solid conclusions. Will continue to track these data points...

So what do you think? Is there value in analyzing social media data for trading strategies? Let us know in the comment section below.