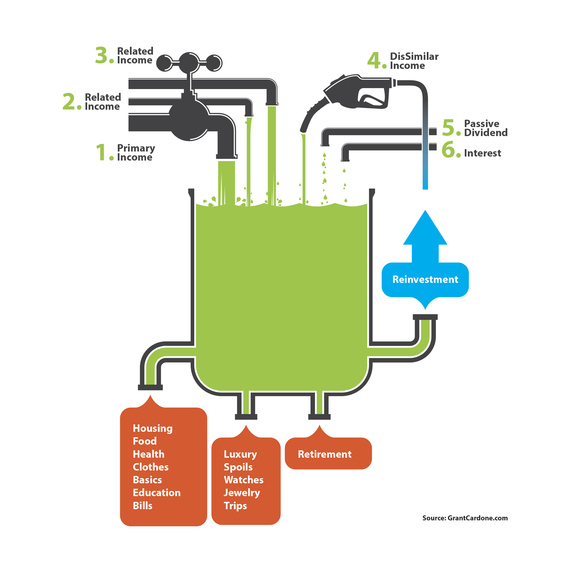

The most successful people use multiple flows of income to create financial freedom. Look at Warren Buffet. He doesn't have one investment or even one company. He depends on many. Building financial freedom, a successful business, or a great sales career, all require multiple flows of income and opportunities. Before you quit your job and join a multi-level marketing company there are a few things you need to know. I'll share what I've learned with hopes to clarify three key about creating multiple income flows.

First, never depend on one flow.

Second, never turn your back on the main flow you have.

Third, when moving to multiple flows go similar first.

The most common mistake made when creating multiple flows of income is walking away from the current one. The next most common mistake is moving to secondary flows of money or customers that are NOT similar to the first.

Never turn your back on the primary flows until the latter flows are so strong that nothing can possibly destroy or erode them. The same thing holds true when growing your customer base - never turn your back on your main customers.

When I was 25 years old, I was a successful automobile salesperson that wanted to increase my income flows. I got involved with a multi-level marketing company and failed at it because it required me to shift attention from my main job that was paying my bills. It's hard to show up for the multi-level meeting at 7pm when I had a customer that wanted to buy a car at the same time.

The solution was to move to similar products or flows similar to the main thing I was already doing. I started to learn about other products that I could add to a car purchase and/or sell to people who weren't interested in buying a new car but in enhancing their existing one.

Create multiple flows to ensure your success and when expanding, start with things that are similar.

When I was 35 years old, I had been in business for myself for about six years. At this point after a lot of hard work, my business was stable and growing but it still needed my full attention. I wanted to expand and always wanted to be in the real estate business however, I resisted moving into it at that time because it was unrelated to my first business. Rather than moving to the unrelated business, I looked at ways to add new business flows that were related to the stable primary business. For instance, I added a new division to the existing company and focused on making that strong. Then, I added an entire company in a new location run by a partner with similar ethic but who offered something different to our clientele. This third business soon started to run successfully and matched the first two businesses. Once I could depend on these primary flows, I started to pursue my dream of building a real estate company.

Keep in mind the real estate business was completely dissimilar to the other three businesses. Prior to creating the real estate business, I used the first three flows to handle all my basic living, food, health, clothes, schools and living expenses while focusing on the primary flows until they created overages. This allowed me to start savings, retirements, new endeavors, and indulge a bit all while setting up to capitalize on real estate ventures and create other passive, no effort incomes.

It has been 20 years now and the fourth company that focuses on multi family real estate has been involved in over $300 million in transactions. I still haven't abandoned the first businesses. Even my accountant says to me, "at this point, you should just focus on real estate." To me, flows of income are like childhood friends. You may no longer hang out with the kids you grew up with or conduct business with them, but it is still prudent not to ignore them. My original businesses allowed me to continue to expand in 2009-2010 when the world entered the Great Recession and real estate was frozen globally.

Multiple income flows is the way to achieve financial wealth and anyone can do it. Most people fail at this because they violate the sacred rules of creating multiple flows of income:

Never disregard the first flow when adding multiple flows of income.

Secondary and tertiary flows should be similar or an extension to the primary flow.

Do not move to dissimilar flows or business until the first flows are strong and stable.

Never disregard the first flow that made it all possible.

Most of the financial advice in this country focuses on saving and retirement when in reality, you cannot save your way to financial freedom. Creating financial freedom is literally impossible without creating multiple flows of income for an individual, family or even a company. It requires work, discipline, dedication and risk but, when done correctly it becomes possible for a person, family or business to spend and invest freely and live a life beyond just getting by.