Friday's January unemployment report should close the books once and for all on the debate whether austerity cutbacks in government spending (and debt) such as happened in Europe, or pro-active government policies by the U.S. Federal Reserve has been the prime instigator of growth during recoveries from depressions, large or small.

A total of 257,000 payroll jobs were created in December, and with revisions to the past 2 months more than 1 million jobs were created just over the past 3 months. Though the unemployment rate calculated from the separate Household report declined from 5.6 to 5.7 percent, it was because an additional 700,000 new and older folks entered the workforce, surely a sign of rising job availability.

This means what can only be called the U.S. Bernanke-Yellen recovery from the Great Recession is finally reaching its growth potential, thanks to the Fed's efforts to keep both short and long term interest rates as low as possible with the massive buying of U.S. Treasury and mortgage-backed securities, called Quantitative Easing, among other measures. The U.S. has the best growth rate in the developed world, thanks to the actions of Fed Chairmen Bernanke and Yellen.

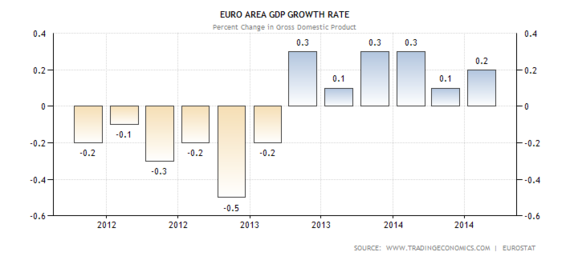

Whereas the Eurozone is declining into negative growth for the third time since 2008, in what Paul Krugman is now calling Europe's Second Great Depression, as Greece has elected a government that is rebelling against German-inspired austerity measures.

"... Germany is demanding that Greece keep trying to pay its debts in full by imposing incredibly harsh austerity," said Krugman in his most recent recent NYTimes Oped. "The implied threat if Greece refuses is that the central bank will cut off the support it gives to Greek banks, which is what Wednesday's move sounded like but wasn't. And that would wreak havoc with Greece's already terrible economy...Beyond that, chaos in Greece could fuel the sinister political forces that have been gaining influence as Europe's Second Great Depression goes on and on."

The European Central Bank has begun its own tepid version of QE, but excluded Greek sovereign debt from ECB purchases, which will only make Greece's situation more dire by increasing its borrowing costs.

It wasn't long ago that the U.S. might have suffered the same fate. Congressional conservatives had demanded that the U.S. pay down its debts rather than spend more to create jobs, opposition that shut down government and led to a downgrade of U.S. sovereign debt,

But first Ben Bernanke, a student of Japan's two decade deflationary spiral, and now Fed Chair Janet Yellen have held firm in their resolutions to stimulate growth until Main Street experiences a sustainable recovery.

This is something that Germany, instigator of the eurozone's austerity policies, has to learn if it wants to bring Europe out of its Second Great Depression; by supporting policies that will unite Europe into a greater union, rather than cause its disintegration.

Harlan Green © 2015