Employers expanded their payrolls by 96,000 last month as the nation's unemployment rate declined to 8.1%, according to this morning's report from the Bureau of Labor Statistics. The jobs number is weaker than was expected, and the tick down in unemployment was not due to stronger job growth, but to fewer folks in the labor force looking for work.

All told, it's not a strong report. The economy is consistently adding jobs-this is month 30 of private sector job growth. But job growth is not fast enough to provide workers the earnings opportunities they need, and the pace of growth has slowed in recent months.

The two questions answered by today's report are 1) would last month's stronger-than-expected payroll number survive the monthly revision?; and 2) did it signal a more lasting improvement in the lagging trend in payrolls earlier this year?

On the first point, July's revised payroll gain went down from 163,000 to 141,000, about the trend so far this year (job growth this year so far has averaged 139,000/month). On the second point, the 96,000 payroll gain in August is closer to the lower trend that's prevailed this year relative to last year's average monthly gains of around 150,000.

A few details but more to come shortly:

- Factory employment: It fell slightly in August, down 15,000, the first decline in that sector since September of last year. Slowing growth in Europe and China are likely hurting exports and playing a role here.

- Average weekly hours and wages: Persistently high unemployment continues to dampen wage growth. Both average weekly and hourly earnings fell slightly in nominal terms last month. Over the past year, weekly earnings are up by about 2%, which is faster than the pace of recent inflation. However, upward pressure on food and energy prices could change that.

- Underemployment: This broader measure of folks "underutilized" in the job market--there's an antiseptic way of putting it -- incorporates not just the unemployed, but the 8 million people unable to find jobs with the desired hours of work, i.e., involuntary part-timers. That rate stood at 14.7% last month, compared to 16.2% a year ago.

I'll let others speak to the horse-race-who-does-this-help part of the equation that always looms large with job reports this close to an election. But I will say this:

After two weeks of lofty speeches about vision, family, who gets it and who doesn't, there's nothing like a monthly jobs report to bring you back to the reality of the economic moment.

It's a tough reality in that far too many Americans remain un- and underemployed but it's also a reality in which things are improving. Not fast enough... and today's report suggests even slower improvement than earlier in the recovery. But anyone who says they're getting worse, as Rep. Paul Ryan did earlier this week, is simply misrepresenting the facts.

Furthermore, a weak report like this is a potent reminder that the president proposed the American Jobs Act -- a set of measures to offset the weak labor demand that has been so hard to shake in this economy-over a year ago. I viewed that proposal as an insurance policy against precisely this type of slowing in the job market. But Congressional Republicans blocked the measure and refused to purchase that insurance.

*By the way, while many of America's institutions are underperforming these days, the BLS just keeps quietly and efficiently doing great work, keeping the nation informed with high quality data on job markets, productivity, prices, and much more.

_________________________

Update (11:22AM EST, 9/7/2012):

I've been reflecting over the disappointing August jobs numbers (no surprise there, I guess). I made this point above:

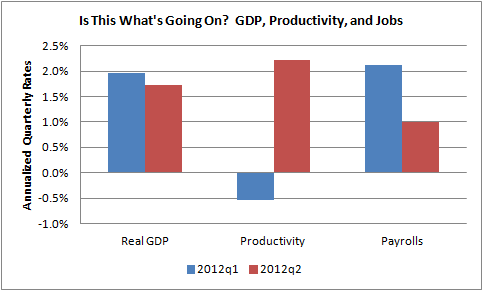

Over the past five months, when job growth has been slower, average monthly gains were 87,000; over the prior five months, they were 211,000, a notable deceleration. In fact, the more recent pace is consistent with trend, or slightly below trend, growth in GDP we've seen in recent quarters.

In this regard, it's that earlier, accelerated trend that's more suspicious. Why were we generating job growth numbers that most economists would associate with considerably higher GDP growth than was actually occurring?

Seasonal factors explain part of the difference. The unseasonably warm winter meant the BLS probably over-adjusted upwards in the winter and visa versa in the spring and summer. But productivity trends may also be in play.

Basically, if output is pretty constant and payrolls are moving up and down more than you'd expect, it could be that weaker productivity explains the payroll uptick and stronger productivity explains the downtick. To no small extent, this is, as President Clinton would say, arithmetic, because output growth -- hours growth=productivity growth. But it's worth a look.

Though I really, seriously wouldn't make too big a deal out of these quarterly numbers, which tend to be jumpy, they do tell that story, with pretty stable GDP growth at trend, and shifting productivity growth negatively correlated with the movements in payrolls.

This post originally appeared at Jared Bernstein's On The Economy blog.