In a surprisingly downbeat look at last month's job market, today's jobs report shows payrolls up only 142,000 in August, a downward revision to June's gain, flat weekly hours, and a slight tick down in the labor force. While one month does not a new trend make -- far from it, as these are noisy data -- the report is a unfortunate reminder that this recovery has been fraught with "head fakes," as favorable trends have fizzled.

Unemployment ticked down slightly, from 6.2 to 6.1 percent, but this was largely due to labor force exits, not jobseekers finding work.

Today's report will surely be a noted over at the Federal Reserve, as their data-driven mode of operations will likely take the August report as support for Chair Yellen's view that considerable slack remains in the job market.

Job creation weakened across many industries. The large service sector was up 112,000, down from an average of 186,000 over the prior two months. After adding an average of 25,000 jobs in June and July, factory payrolls come in at zero in August, with autos down 5,000. (The Bureau noted there could be a seasonal issue distorting these data as the pattern of layoffs for factory retooling changed in ways they may not have adequately adjusted for.)

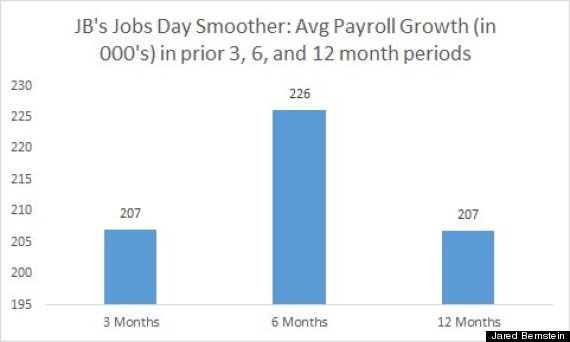

Given all this these monthly bips and bops, it makes sense to take an average of the monthly payroll results. Below is this month's version of JB's Jobs Day Smoother, wherein I show average monthly job growth over the past three, six, and twelve months -- a useful way of pulling recent trends out of the bouncy monthly data.

The underlying pace of payroll job growth over both the past three months -- 207,000 per month -- is the same as over the past year. This is a slight deceleration from the bump up in more recent payroll reports, as the monthly average over the past six months is 226,000.

The safest conclusion from this numbers is this: August's lousy report notwithstanding, we are solidly in the midst of a moderate jobs recovery. Payrolls are reliably growing at a pace slightly north of 200K per month. That's neither a breakneck nor a dismal rate of job growth, but it does mean that given the existing extent of remaining slack in the job market, full employment is still years, not months, away.

Turning to some other indicators worth watching in today's report, as noted, the rate of labor force participation ticked down a tenth to 62.8 percent. While that's a tick in the wrong direction, it's not much of one (the rate fell from 62.91 to 62.83 percent) and the fact remains that the labor force has been pretty stable for a year now, wiggling within a 40 basis point range from 62.8 to 63.2 percent since last August, a very positive development.

Finally, let's talk about wages. Average hourly wages were up 2.1 percent over the past year, showing no sign at all of wage acceleration -- this series has been stuck at 2 percent, nominal, for years now. Since that's about the rate of inflation, it means real hourly wages have been flat. Combine that with the finding of flat weekly hours, and you get a sense of the difficulty facing working families who depend on their paychecks as opposed to their stock portfolios.

These facts, themselves a function of the considerable slack remaining in the labor market, should seriously quiet calls for the Federal Reserve to raise rates pre-emptively.

What's really needed -- pretty desperately, I'd say -- is a benchmark against which to compare nominal wage growth, i.e., some sensible standard by which we can gauge the potential for wage-push inflation. Otherwise, we're too exposed to the sharp talons of inflation hawks who will label any wage acceleration inflationary.

As Dean Baker and I stress, and EPI economists makes the same case here, one standard benchmark is the rate of productivity growth:

...for workers to get their fair share of the economy's growth, real wages should keep pace with productivity growth. Productivity growth has been weak recently, most economists put the underlying trend at close to 1.5 percent. This means that wage growth at a 3.5 percent annual rate (2 percent inflation plus 1.5 percent productivity growth) would be consistent with the Fed's inflation target.

But there's even more room for non-inflationary wage growth than that. In recent years we've seen a large shift within national income from wages to profits. Wage growth paid for by a shift back toward to a more normal split between wages and profits does not put pressure on prices.

So the persistent trend in average nominal hourly wages of about 2 percent per year has a lot of room to grow.

All told, a disappointing report, one that's clearly off the trend of the improved reports we've been seeing in recent months. That's shouldn't be enough to wave us off of our priors that the economy and the job market continue to improve at a moderate rate. But it's enough to remind us we're not at all out of the woods yet.

Source: BLS, my analysis

This post originally appeared at Jared Bernstein's On The Economy blog.