While chatting with a colleague today about the new CBO long-term budget outlook, we agreed there wasn't much new there, but then he said something that stuck with me:

"Of course, it shows that we can afford the entitlements."

To hear everyone from the Washington Post editorial page to Bowles/Simpson to all the Republicans and many of the Democrats, there's an entitlement crunch, crisis, death spiral, or whatever... waiting for us out there in the future if we fail to muster the steely-eyed courage to face it. And "face it" invariably means cutting benefits, privatizing, voucherizing, raising the retirement age, means testing... basically, fixing them by breaking them.

This morning's Washington Post has a case in point: "New estimates the Congressional Budget Office (CBO) released Tuesday underscore that Medicare must change, a lot." A few lines in: "...a death spiral of ever-higher interest payments."

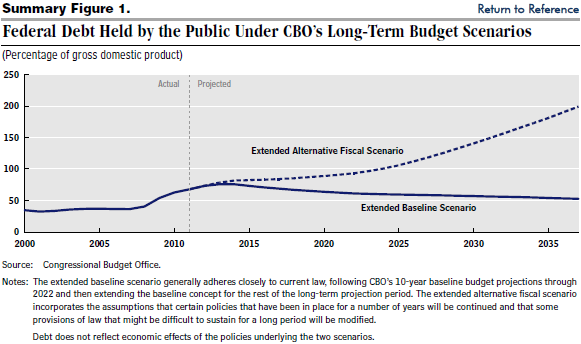

Well, look at this chart, one I'm sure will be showing up all over the place. It shows the debt as a share of GDP projected well into the future under two different scenarios. Under the explosive scenario -- the one on which all the scolds will focus -- debt swamps the economy, reaching 200% by 2037.

But look at the other line. Under that scenario, which in fact happens to be current law (meaning all the Bush tax cuts expire, for example), debt stabilizes as a share of the economy in a few years and then starts down a slow glide path. And Medicare, Medicaid, and Social Security as we know them today are all in that bottom line.

Under that scenario taxes go up and spending is restrained compared to the alternative baseline. Some of the assumptions -- like we allow Medicare payments to doctors to fall sharply or all the tax cuts permanently expire next January -- are wholly unrealistic. But there are unrealistic assumptions under the other scenario too (the federal gov't is not going to be spending 36% of GDP by 2037 (the historical average is about 21%)).

But generally speaking, and with some tweaks, there's no reason why something like that bottom line's baseline couldn't prevail. The Bush tax cuts would all have to eventually sunset, and we'd need to continue-and ramp up-what looks like early progress on slowing the growth of health care spending.

But aside from dysfunctional politics feeding a largely misleading public debate, we could do this. If we, as a nation, decide that we want to achieve fiscal sustainability and preserve the entitlement programs, along with government's other critical functions, it is well within our means to do so.

So sayeth the CBO.

(H/t: JH)

This post originally appeared at Jared Bernstein's On The Economy blog.