Paul Krugman has a piece up today about how Germany's large and persistent trade surpluses play an important, destructive role in the slump in the rest of the Euro area -- essentially, they import much-needed labor demand from the rest of the zone.

The implication is that there's some type of market manipulation going on behind these imbalancing acts. The typical culprit here is currency management, where you boost your exports through favorable exchange rates which you maintain by keeping your currency low relative to that of your competitors. But given the common currency in the Eurozone, that's clearly not the issue here.

Instead, it's a) "internal devaluation," something Paul and others have often documented, and b) enforced austerity. And note that if you're a periphery country, "b" keeps you from offsetting the negative effects of "a."

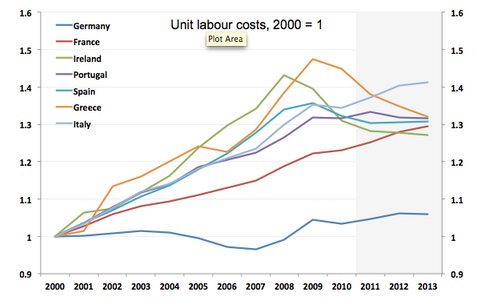

Under internal devaluation, since you can't keep relative prices down through the exchange rate, you do so by jamming down relative compensation, controlling for relative productivity differences, i.e., you hold down you unit labor costs. Here's a figure from Antonio Fatas showing just that.

Source: Fatas, see text.

How do the Germans keep labor costs low relative to productivity? In no small part, it is a national strategy, agreed to by labor, producers, and government. Paul and others object to the mercantile, "beggar-thy-neighbor" outcome, especially when coupled with the arch-austerity of a Schauble (Germany's finance minister). I share that view, though at the same time, I think one should separate the use of strategic industrial policy from the problems caused by German trade surpluses.

Here in the U.S., for example, we typically eschew industrial policy, by which I mean cooperation between the groups noted above to invest in manufacturing, increase production, market share, and net exports. The latter is particularly important in the U.S. case, since our trade performance has been a mirror image of Germany's. We've posted persistent trade deficits that have exported large amounts of labor demand for over a decade.

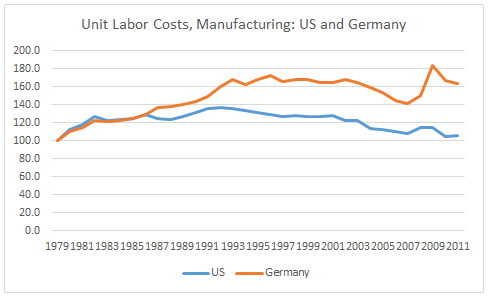

And here's the kicker: our unit labor costs in manufacturing are well below the Germans both in levels and trends. The latter is shown below. Our ULC's -- which should be an important determinant in trade flows -- have been essentially flat for years, up 5 percent since 1979 while German manufacturing ULC's are up 64 percent (see here for level comparisons, where U.S. hourly manufacturing compensation is 25 percent below that of Germany).

Source: BLS

In other words, based on "price," we should be much more internationally competitive. To be very clear, I'm not saying we should generate persistent imbalances going in the other direction. As I read Paul and others, the problem is not German industrial policy per se. It's such policy in the context of deep misunderstanding (or denial) of basic macro, which in this context is really a fancy work for international accounting.

I think these numbers and trends reveal the impact of the absence of coherent industrial policy here in the U.S. and I challenge Paul and others to think and talk about this. Why, given our internationally low manufacturing ULC's (at least among advanced economies), are we stuck with large, persistent trade deficits that rob us of jobs in much the same way the Eurozone periphery is hurt by the German trade surpluses?

This post originally appeared at Jared Bernstein's On The Economy blog.