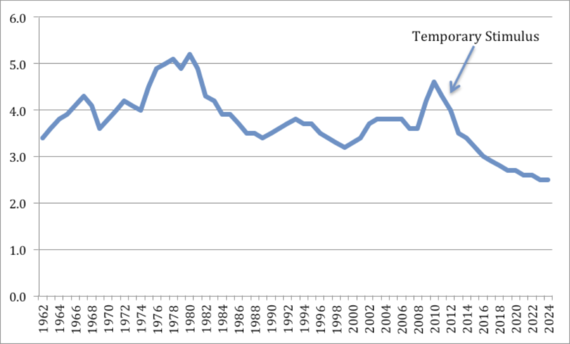

The new Congressional Budget Office outlook for 2014-2024 makes for grim reading. While the budget deficit is temporarily down to around 3 percent of GDP, this has been achieved by budget cuts that are gutting the capacity of the federal government to address our nation's economic, social, and environmental needs. And the situation gets worse in future years. The discretionary government programs fall to their lowest share of GDP in a half-century (Figure 1); the deficit and debt as a share of GDP begin to rise again; and health outlays continue to rise.

There is blame to go around on all sides. Yes, the Republicans have been intransigent in their opposition to higher revenues. But who was it that campaigned in 2008 to make the Bush-era tax cuts permanent for all but the top 2 percent of households? And who was it that signed the Fiscal Cliff agreement in January 2013 (after an election victory) to make the tax cuts permanent for all but the top 0.5 percent of households? That was President Obama.

The fact of the matter is that American politics is built on economic myths of both parties. The myth of the right is that tax cuts solve all problems, since we don't need government anyway, and even if we do, the tax cuts pay for themselves. The myth of the Keynesian left is that tax cuts and temporary spending increases (aka "stimulus") solve all problems since they stimulate aggregate demand. The ensuing debt doesn't matter and should be ignored.

This bipartisan fantasy of tax cutting and debt build-up has led us to a blind alley. The CBO projects revenues in 2024 (a decade from now) of just 18.4 percent of GDP. Yet Social Security, Medicare, and Medicaid alone will absorb 11.8 percent of GDP (up from 10.0 percent of GDP in 2013). Add in the other mandatory programs like food stamps and we will be at 13.9 percent of GDP. Add in 3.3 percentage points of GDP in interest on the public debt, and we're up to 17.2 percent of GDP. Add in the projected 2.7 percent of GDP for defense, and the sum is 19.9 percent of GDP.

The astute reader will see that there is no revenue left for civilian discretionary government, the part that builds bridges and roads; that helps educate our children; that protects the environment; that invests in science; that trains our workforce; that funds the justice system; that does the all the rest. So much for investing in our future: the future has been put on the chopping block, by bipartisan agreement.

The discretionary civilian budget -- the part that looks after your and your children's future other than social security, health, and emergency support -- is disappearing. What about America's future scientific and technological leadership? What about America's role in fighting climate change and in promoting clean energy through new R&D? Forget about it. It's a luxury that Washington can't afford (on our behalf).

How did we get here? We did it by one cynical maneuver at a time. The Democrats learned to play the Republican game. When Bush adopted unaffordable temporary tax cuts during 2001-3 (even his Treasury Secretary Paul O'Neill was aghast), Obama led the Democratic Party call to make them permanent for almost all Americans. The Dems kept their fig leaf of a progressive identity by proposing to roll back the Bush tax cuts at the very top. In fact, both parties more than compensate the top by sustaining other unconscionable tax breaks, such as the carried interest tax charade for hedge fund managers and the Caribbean tax dodges of IT giants including Amazon, Apple, and Google.

The Keynesians, led by Paul Krugman, propounded another myth: that the public debt doesn't matter, so we might as well spend more and tax less, as we were told with each "stimulus" package. The stimulus packages have come and gone while America's long-term, chronic problems remain, impervious to short-term Keynesian gimmicks. So too does the public debt left behind by the series of stimulus packages during 2009-2012.

The new CBO forecasts make clear that high debt service in future years will crowd out vital government spending. By 2024, when interest rates are back to normal levels, debt service will be larger than the entire civilian discretionary budget, and larger than the entire defense budget. The CBO is correct in its warning about the high debt-GDP levels:

Such large and growing federal debt could have serious negative consequences, including restraining economic growth in the long term, giving policymakers less flexibility to respond to unexpected challenges, and eventually increasing the risk of a fiscal crisis (in which investors would demand high interest rates to buy the government debt). (p.1)

What we should have done back in 2009 was to avoid the allure of a temporary stimulus, and focus on long-term policies. What we should have done in 2010 was to allow the Bush tax cuts to expire, and also end the absurd tax breaks enjoyed by the super-wealthy and the large multinational corporations, which are an abuse and affront to the rest of society. With those steps, we would now be able to pay for the future that our country desperately needs: well-educated children, well-trained workers, modern 21st century infrastructure, and cutting-edge technologies in energy, industry, transport, and construction to save the planet and lead the world in a new era of sustainable development.

Figure 1. Civilian Discretionary Spending as Percent of GDP, 1962-2024

Note: 2014-2024 Based on CBO Projections