In September 2014, Japanese Prime Minister Shinzo Abe appointed five women to Japan's cabinet, reinforcing his earlier message that taking better advantage of female talent in the workplace is a key piece of his growth strategy for the country. In 2012, the World Economic Forum (WEF) introduced a quota system to help boost the participation of women in the group's annual meeting. At the time, just 17% of the participants at the meeting were female. It hasn't worked; in 2014, only 15% of the attendees at the annual WEF forum at Davos were women. Sad though that is, women are still better represented at WEF than in the executive suites of the world's businesses. As of September 2014, according to data gathered by Pax World Gender Analytics, less than 12% of the senior executives of the 2,446 companies in the MSCI All Country World Index were women, and within the 1,620 companies in the MSCI World Index , just over 12% of senior executives are women.

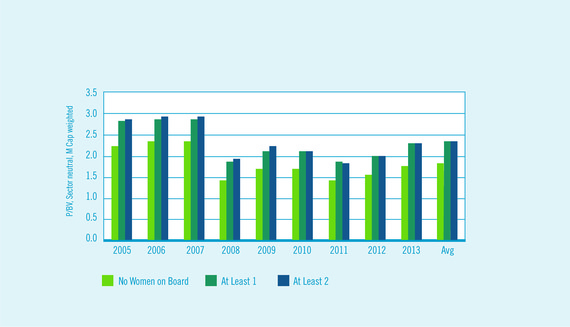

It is difficult to imagine -- impossible, actually -- that just 12% of the world's management talent is female when the evidence shows that companies with more female managers actually perform better. Credit Suisse reports that from 2005 to 2013, companies with women in senior management had higher price/book value ratios than companies with none, and companies with at least 2 women managers tended to outperform those with only one (figure 1). A 2001 study showed that over a 19-year period, firms in the Fortune 500 that had better records of promoting women to executive positions were more profitable than the relevant industry medians. In 2008, during the recent financial downturn, French companies with more women in management saw smaller share price declines than peers with fewer women executives. A 2005 study of 2500 Danish firms showed that those with more women in top management and board roles performed better than those with fewer women on four measures of financial performance, including measures of profitability and return on assets. A 2013 paper from the Harvard Business School found that multinational firms operating in Korea were able to gain competitive advantages over their Korean peers by more aggressively hiring women, who are often excluded from managerial ranks in Korea. In China, where women are also underrepresented in top management, firms with higher proportions of female managers outperformed the average in terms of both stock market performance (market/book ratio) and operational performance (return on assets.) In a global study, McKinsey found that companies with three or more women on senior management teams outperformed companies with no senior women leaders on nine dimensions of organizational performance and financial performance.

Source: Credit Suisse Research Institute, "The CS Gender 3000: Women in Senior Management," September 2014.

P/BV= Price/Book Value.

While little of the literature establishes causal links between greater female participation in top management and performance, there are reasons to think that these correlations are not simply coincidental. Most of the studies mentioned above do control for obvious other sources of correlation, such as firm size and industry. Moreover, there is considerable evidence that diversity itself is valuable in terms of the quality of decision-making. Diverse groups of decision makers often outperform groups composed of the best and brightest. Decision-making in diverse groups may be less comfortable, but diverse groups often appear to put forward more options and evaluate them more fairly than homogeneous groups do. In short, the argument for more gender-diverse executive teams is not that men or women are superior, but that they bring different perspectives to the table, and that diversity is valuable.

There are some specific roles where the differences between male and female perspectives may have particular value. Women are often thought to have a more conservative appetite for financial risk than men, though this is not invariably the case. That propensity can be useful in specific roles, particularly that of the CFO. A pair of studies both show that companies with female CFOs report financial information more conservatively than those with male CFOs, and that those differences can have value in financial markets. A recent study showed that companies with women CEOs tend to have lower leverage, less earnings volatility and higher survival rates. In contrast, Credit Suisse found no evidence for greater financial conservatism among companies headed by women, when conservatism was measured by leverage. The Credit Suisse study also found that companies with women CEOs have higher dividend payout ratios.

The current snapshot of female CEOs and CFOs is dispiriting, however. Among the constituents of the MSCI All Country World Index, just 1.6% of CEOs and 4.3% of CFOs are female. The percentages are slightly higher among developed markets; women make up 2.4% of CEOs and 5.8% of CFOs among the constituents of the MSCI World Index. The U.S. has the largest number of CEOs and CFOs, but in terms of proportion, the country with the greatest proportion of female CEOs is Belgium, and there are two countries in which 25% of CFOs are female (Denmark and Ireland); in all three cases, the high proportions may be an artifact of the fact that there are few Belgian, Irish or Danish companies in the Index. Among the countries that have at least 25 companies in the MSCI World Index, the highest proportions of female CEOs are in Taiwan, Mayalsia, Canada and Brazil. One country (France) has no female CEOs, and two countries (Japan and the Netherlands) have no female CFOs. The fact that women are less well represented in these two key roles is confirmed in Credit Suisse's recent study , which notes that women's management roles tend to be "skewed towards areas of less influence or offer less opportunity to move into the most senior positions in a company."

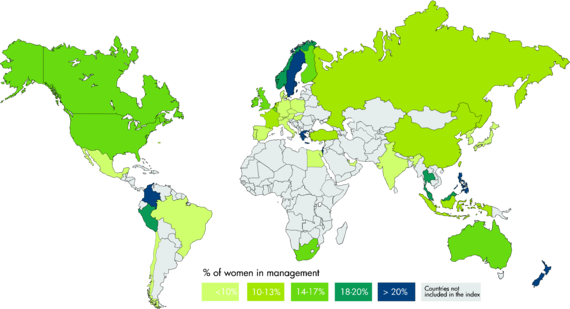

So, where is the gender diversity in executive suites? Analysis of the gender diversity of senior executives in the companies in the MSCI World Index shows that the proportion of women senior executives varies widely by countries, with a high of 27% in New Zealand to a low of 1% in Japan (Figure 2). The range is similar for emerging market companies included in the MSCI All Country World Index. It is noteworthy that executive diversity is generally below average in Europe (which has higher board diversity than any other region), and mixed in the Asia-Pacific region, with Japan's low balanced by the above-average percentages in New Zealand and Australia among developed countries. In the developing world, there are several East Asian countries with relatively high proportions of women executives, though Korea's picture is much like that of Japan.

Source: Pax World Gender Analytics, September 2014.

Caution is appropriate in interpreting these figures; in some cases there are very few companies, and a single company can bias country averages. Countries with ten or fewer companies in the index include New Zealand, Greece, Israel, Norway, Ireland, Portugal and Austria among developed nations, and Russia, the Czech Republic, Qatar, the United Arab Emirates, Egypt and Hungary among developing nations.

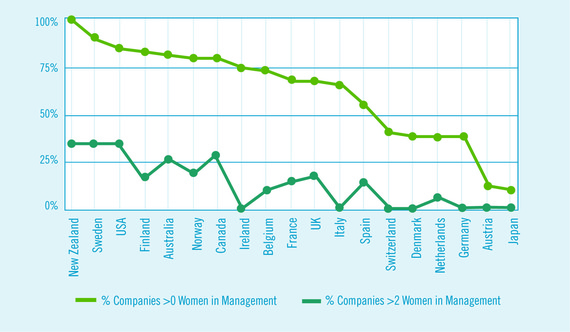

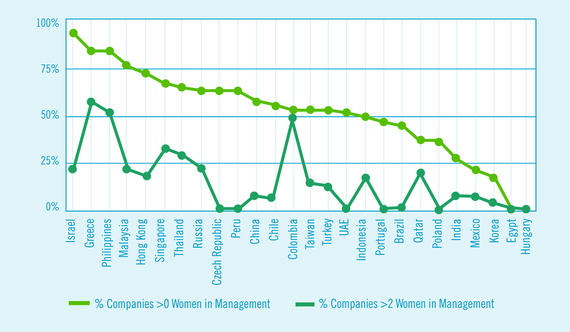

Critical mass is also a consideration. The journey from complete male dominance to the embrace of diversity often starts with one person, but a single woman in management should not be the long-term aspiration. Literature defining critical mass often settles on three women or 30% women, and there are only three countries where at least one-third of companies have at least three women executives: New Zealand, Sweden and the U.S. When we look at executive diversity from this standpoint, we find many fewer companies with at least three women in management, though in some countries there is commendable progress (Figures 3 and 4).

Source: Pax World Gender Analytics, September 2014.

Figure 4: Companies with >0 and >2 Women in Senior Management, MSCI All Country

World Index, 2014

Source: Pax World Gender Analytics, September 2014.

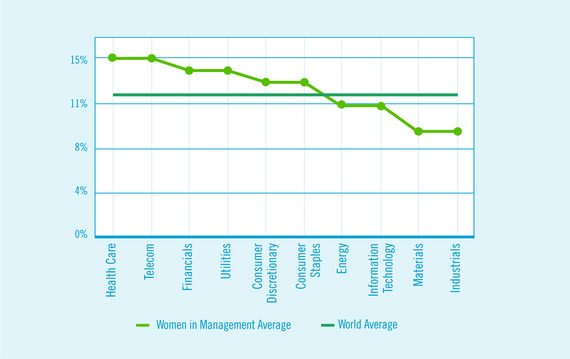

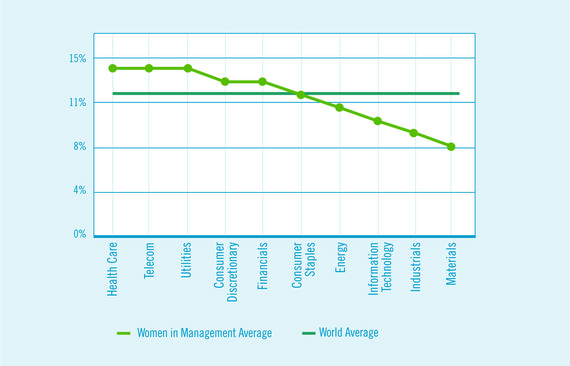

Sectoral distribution of gender-diverse management committees is also uneven, though the differences among sectors are much less dramatic than they are among countries (Figures 5 and 6). It is perhaps not surprising that women are better represented among the executives of companies in the consumer discretionary sector, where the majority of consumers are often female. However, it is noteworthy that the health care, telecommunications, financials and utilities sectors also have higher proportions of women managers. The laggards are materials and industrials. The distributions and ranks are fairly similar among developed and emerging markets companies.

Source: Pax World Gender Analytics, September 2014.

Source: Pax World Gender Analytics, September 2014.

There is no reason to believe that managerial talent is unevenly distributed by gender, and there is considerable evidence that diversity can add value to companies, both operationally and financially. The snapshot offered here is probably better than one that would have been taken a decade or more ago, but it is still clear that additional progress is needed if companies are to take full advantage of the range of talent available to them.

You should consider a fund's investment objectives, risks, and charges and expenses carefully before investing. For this and other important information, please obtain a fund prospectus by calling 800.767.1729 or visiting www.paxworld.com. Please read it carefully before investing. An investment in the Pax World Funds involves risk, including loss of principal.

Copyright © 2014 Pax World Management LLC. All rights reserved. Distributor: ALPS Distributors Inc.: Member FINRA.

ALPS is not affiliated with World Economic Forum (WEF), Credit Suisse, McKinsey, MSCI, Morningstar Associates, Pax World Management LLC.

PAX004640 (10/2015)

Citations

[1] The MSCI All Country World (ACWI) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 46 country indexes comprising 23 developed and 23 emerging market country indexes. The developed market country indexes included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The emerging market country indexes included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. One cannot invest directly in an index.

2 The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of the following 23 developed market country indexes: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. One cannot invest directly in an index.

3 Roy D. Adler, Ph.D., Pepperdine University, "Women in the Executive Suite Correlate to High Profits", 2001.

4 Nina Smith, Valdemar Smith, and Mette Verner, "Do Women in Top Management Affect Firm Performance?A Panel Study of 2500 Danish Firms," August 2005.

5 Jordan Siegel, Lynn Pyun, and B.Y. Cheon, "Multinational Firms, Labor Market Discrimination, and the Capture of Competitive Advantage by Exploiting the Social Divide," February 10, 2014.

6 Georges Desvaux, Sandrine Devillard-Hoellinger, and Mary C. Meaney, "A business case for women," The McKinsey Quarterly, September 2008.

7 See, for example, Scott E. Page, The Difference: How the Power of Diversity Creates Better Groups, Firms, Schools and Societies (Princeton and Oxford: Princeton University Press, 2007), and Lu Hong and Scott E. Page, "Groups of diverse problem solvers can outperform groups of high-ability problem solvers," Proceedings of the National Academy of Sciences, November 16, 2004.

8 KelloggInsight, "Better Decisions Through Diversity," http://insight.kellogg.northwestern.edu/article/better_decisions_through_diversity, Oct 1, 2010.

9 Alison L. Booth and Patrick J. Nolen, "Gender Differences in Risk Behaviour: Does Nurture Matter?" Discussion Paper No. 4026, Institute for the Study of Labor, February 2009.

10 Bill Francis, Iftekhar Hasan, Jong Chool Park and Qiang Wu, "Gender differences in financial reporting decision-making: Evidence from accounting conservatism," Bank of Finland Research Discussion papers 1, 2014, and Gopal V. Krishnan and Linda M. Parsons, "Getting to the Bottom Line: An Exploration of Gender and Earnings Quality," Journal of Business Ethics (2008), 78:65-76.

11 Joseph T. Halford and Hung-Chia Hsu, University of Wisconsin, Milwaukee, "Beauty is Wealth: CEO Appearance and Shareholder Value," November 20, 2013.

12 Credit Suisse Research Institute, "The CS Gender 3000: Women in Senior Management," September 2014.