When it comes to business loans, many small business owners say thanks but no thanks.

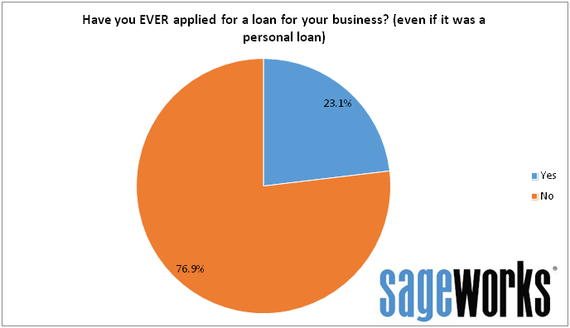

Actually, a recent survey by Sageworks, a financial information company, found that 3 out of 4 owners in businesses less than 10 years old said they have never applied for a loan (personal or business) for their companies.

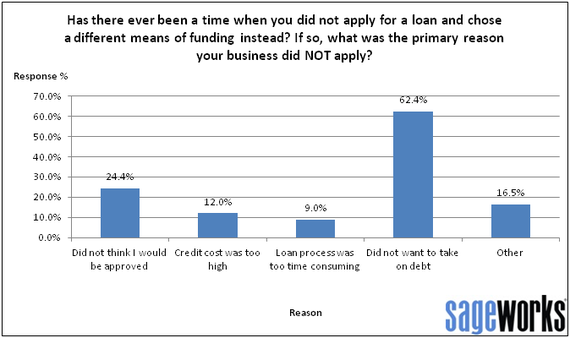

The top reason they didn't seek loans? More than 60 percent who chose alternative means of funding simply didn't want to take on the debt, and a quarter of respondents didn't think they'd get approved. Another 12 percent said the cost of credit was too high, and 9 percent said the loan process was too time-consuming.

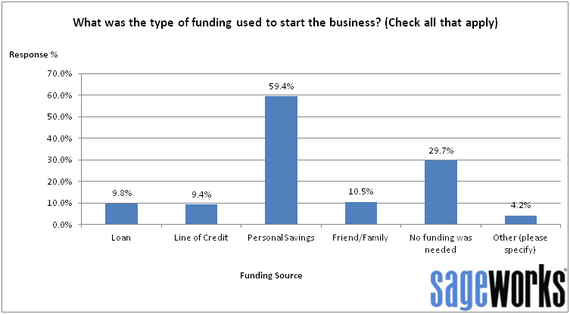

Among the 286 small business owners surveyed, almost 3 out of 5 (59 percent) said they used personal savings to start their businesses and 30 percent said no funding was needed. About 11 percent tapped friends and family for startup funding; 10 percent got a loan and 9 percent used a line of credit. The online survey was conducted April 23-25 and covered owners representing a wide range of industries.

Sageworks analyst Regan Camp said that in some ways, the large share of business owners trying to avoid taking on debt isn't surprising, given the way small business owners operate and the risks they face if the business fails.

"This is their livelihood on the line -- this is the family home, their transportation," he said, noting personal collateral is often a requirement for loans. "They've got more skin in the game than your traditional borrower, so that may be one reason they'll try to avoid becoming a 'slave to the lender.' "

As a result, many people begin putting aside money as they prepare to start a business. "It's something they're going into with a sink-or-swim mentality, and if they sink, they know that at least they have a floor on the possible loss," Camp said.

Reluctance to take on debt can be good in other ways, too, says Sageworks Chairman Brian Hamilton. "Taking on too much debt can be harmful to a business," according to Hamilton. "Management starts worrying about how to pay back the loans, rather than how to really scale the business."

Camp noted that the respondents who were pessimistic about being approved for a loan may reflect the fact that many of these businesses were operating during the financial crisis, when the reality was that many small business owners probably would not have been approved. "It's easier for a lending institution to look at somebody who has years of financials that support the stability of the company and the stability of its cash flow," he said.

The borrowing environment for small businesses has certainly improved in the last couple of years, with credit standards having eased and interest rates still low by historical standards, Camp said. And businesses are better able to demonstrate solid performance as profits and sales have improved with the economy.

Indeed, an earlier survey by Sageworks showed that more than two-thirds of banking and credit union professionals who work closely with their institution's lending portfolio expected their institution to either make more or significantly more commercial loans this year than in 2013.

Many companies now might be weighing the benefit of borrowing at low interest rates in order to grow their businesses vs. the benefit of funding operations and growth internally so that debt remains low, said Camp. "We've learned before that the opportunity for borrowing and obtaining that credit won't necessarily always be there, so now that it is there and it's at such a low interest rate, some businesses may be trying to decide whether to borrow now and put aside their reserves to fund future growth."

Previous research by the Ewing Marion Kauffman Foundation found that outside debt - namely bank loans -remains a key source of capital for U.S. businesses, especially as they mature. A long-term survey by the foundation found that outside debt represented a larger share of total capital as the companies aged.