Public economic discussion is dominated by the disclosure of trouble, panic, calm and the return of optimism. Within a few weeks, reality creeps back into focus. Reality brings further disclosure of trouble. The cycle repeats. Month after month of reassurances ring hallow. Further elaborate pronouncements and Federal Reserve credit action do less to increase confidence and sentiment. Housing firms, home owners, residential mortgage backed securities (RMBS), and financial earnings keep falling. Write-offs keep rising.

Into this fray strides Treasury Secretary Henry Paulson. He is armed with a plan to help those "with the financial wherewithal to own a home." We will set aside why there are hundreds of thousands of folks who own homes but don't have the financial wherewithal to own a home. Sub-prime borrowers fall into four groups, as defined by Secretary Paulson and the Treasury team. A coalition of the mortgage willing is being assembled.

There are those who can afford their adjusted interest rate; these homeowners need no assistance. There are also a substantial number of homeowners who haven't been making payments at the starter rate on their subprime loan and may not have the financial wherewithal to sustain home ownership; some of these homeowners will become renters again. A third category of homeowners might choose to refinance their mortgage - putting them in a sustainable mortgage while keeping investors whole. This is the first, best option. Servicers should move quickly to assist those who can refinance. And the fourth category is those with steady incomes and relatively clean payment histories who could afford the lower introductory mortgage rate but cannot afford the higher adjusted rate. We are focusing on this group, determining who they are and what steps may appropriately assist them. (emphasis added)

-- Treasury Secretary Paulson, 12/3/2007

In response, a Hope Now national alliance has been launched. Hope Now "is an alliance between counselors, servicers, investors, and other mortgage market participants." (pdf) Help will be directed to those who have made payments and can afford intro teaser rates but will likely default when these rates move up. The proposal is built around helping these folks refinance in order to lock in affordable rates.

There are issues aplenty. Mortgages were made under a dizzying array of conditions, contracts and stipulations. In addition, mortgages were made and sold so that the originators no longer own, but rather only service many mortgages. You can find the best and broadest description of the types and kinds of adjustable rate mortgages on the market here. Here you will see that there is no standard contract, ownership structure, or reset date.

The complexity of the market will be a significant impediment to solution. The law will be an issue; changing the terms of a bundled and sold mortgage may constitute tortious interference. I am sure you will be hearing plenty about this. Whatever is attempted will have to grind its way through the court system. There will be impacts on the quality, credit rating and price of the securities made out of bundled mortgages. Most adjustable rate mortgages have either 6 month or 1 year reset agreements. This means the mortgage rate was designed to reset between 27 and 54 times over the next three decades, once every 6 months or year for the life of the mortgage. Replacing this with a fixed rate would constitute massive contractual change. It would also mean a serious revaluation of any security made up of such loans. Credit ratings on securities that hold these loans would have to be redone.

There are 4 main issues with the plan as it stands now.

1. The assumption behind the plan

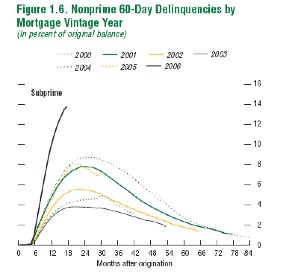

The assumption is that resetting rates causes delinquency and default. I am not sure this is correct. Research suggests that falling house prices and loans to folks without the income to pay are the leading issues. Delinquency research published in the September 2007 IMF Global Financial Stability Report (pdf) suggests trouble starts before interest rates reset upward. The chart (Figure 1.6) below makes this clear. The below data suggest that as we move forward in time, more folks are defaulting faster and faster. These defaults are not predominantly the result of resets. We know this because a rising portion of people are missing payments before rates change.

This group is offered nothing by the plan. What is the problem here? Home price and market condition, income variation and fraud are behind these default rates. Housing and mortgage fraud seems to have surged as the market topped out in late 2006. House prices are now falling nationally and will continue to do so through 2008. Employment growth is likely to slow with economic growth across 2008. If peak market mortgage fraud, falling house prices and income issues are driving defaults, the Hope Now alliance offers little solution. The assumption on which the Treasury plan rests may not be adequately grounded. The problems with this assumption will become increasingly clear as house prices continue to fall, incomes are pressured and further fraud comes to light.

2) The Proposed solution

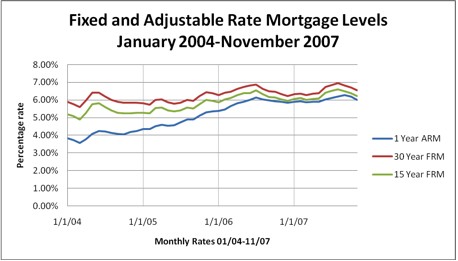

The long term solution offers folks fixed rate mortgages to remove the risk and uncertainty of upward adjusting rates. There is some question about how much this would help if market rates were used. You can reference the chart below, to see how little relief fixed rates offer; the data is from HSH Associates. I include this chart to illustrate that fixed and adjustable rates are converging. The spread, or difference between fixed rates and adjustable rates, does not look large enough to bring borrowers back from the edge. The spread is also falling, suggesting that the move to fixed rates offers less relief now than it offered in the past.

The only way to lower payments would be to offer longer term fixed mortgages at or near the low teaser rates. This is easier said than done. Such a plan involves drastically altering contracts. This will require the owners of the debt to suffer losses. Holders of this mortgage debt will see the credit quality, return and value of the debt they own fall. They will be recommitting to troubled lenders with falling collateral values at below market rates. This course of action will be taken by holders of mortgage debt that have just experienced significant losses? This is possible. It is doubtful that investors would select this course. Government co-ordination and possibly assistance and inducement will be required. Even with this support, success is far from assured. If rescue is to be so arranged, don't we need a little more debate as to who gets rescued?

3) Affectivity- Is this a favor to those who do get help?

The grand plan possesses few clearly defined elements. Is the plan really a favor to the distressed but "worthy"? All expect several rounds of interest rate cuts. We have already seen two rounds of cutting since August. If we are moving people from adjustable to fixed product, we will lock in the present market rates, less whatever special cost-reducing deals are negotiated by borrowers and officials. We could be "helping" people toward products that they can't afford and that will be increasingly less expensive over the next 18 months.

What do I mean? If rates are falling, they will be lower in the future. Adjustable rates are set to fall and fixed rates that are locked now will be above rates in the future. In addition, house prices will be falling. We might then be "helping" people stay in overvalued houses at new interest rates negotiated at peak interest rates. No less than Bill Gross of PIMCO is forecasting a Fed Funds rate at, or under, 3%. This is 1.5% less than the present Fed Funds Rate. Locking people who are struggling into rates now- ahead of massive downward rate pressures- may not be the gift of century. In fact, it may mean longer-term and greater future trouble, as these folks are pushed to lock in above market rates on housing valued well above present and future worth. If we are not reaching out to those in the worst position, and the market rates are already falling, what exactly is the main purpose and desired effect of this action?

4) General economic social benefit?

The most vulnerable bought at the peak of the market with no/low money down. If they did have equity, they borrowed it out. The target -- distressed but "worthy" group -- need credit terms eased. These people have little in the way of collateral. When one adjusts for modest home price declines, many borrowers owe more than their houses will be worth for the next several years. There are legitimate questions regarding how good it is for people's financial futures to struggle to pay off a house assessed at well above its real value.

Inflated home prices and costs are an enormous economic drag on people. A ten-year boom with five years of outrageous price growth takes time and pain to cure. Intervention to cushion the blow and redistribute pain makes sense. It requires broad social discussion and an honest accounting of what interests are helped and hurt by various plans. We need an honest accounting of where we are, where we are headed and who the public, should be intervening to help and punish. I don't doubt many earnest and intelligent folks are hard at work on the present plan. How we respond to this crisis is an important measure of our economy, policy and culture. I have many concerns about the assumption, solution, affectivity and benefit of this plan.