The facts are these: the underlying characteristics of the labor market remain troublesome; middle-class incomes are not growing; the divide between the haves and have-nots has seldom been wider; housing is slowing from an affordability-induced bounce; exports are weakening due to slower growth in emerging markets and continued problems in Europe and Japan; the consumer is still carrying too much debt; aging baby boomers are ill-prepared for retirement; governments of all stripes are attempting to introduce austerity to reverse massive increases in debt; and the economy has become addicted to ultra-low interest rates.

These facts stand in stark contrast to the narrative that mosts economists are pitching. The consensus opinion now seems to be that spring will bring stronger (3%+) and more sustainable economic growth this year. It seems like this has been the consensus opinion every year for the past four or five years. I'm not sure what these economists are smoking, but I want some of it.

As widely expected, the Federal Reserve elected to continue lowering the pace of its asset purchases today. The Fed will now buy just $45 billion in Treasuries and Mortgage-Backed Securities (MBS) each month, which is down $10 billion from the prior pace. While no surprise to anyone, the decision comes on the same day we receive news that GDP grew just 0.1 percent in the 1Q. This pace is well below the 2.6 percent pace in the fourth quarter of 2013 and significantly below the consensus expectation of 1.2 percent, leading some to question whether the Fed is justified in further reducing its asset-purchase program. The second-guessing is compounded by the news of further disinflationary pressures contained within today's economic releases (GDP deflator and Employment Cost Index both came in below expectations).

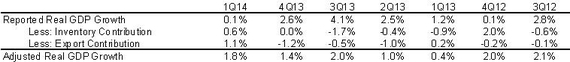

Most economists, including the Fed, seem inclined to chalk up the 1Q economic sluggishness to three factors: horrible weather, a reduction in inventory builds relative to the 4Q13, and lower exports. Upon taking a closer look at the data, this thesis seems to hold water. Lower inventory builds subtracted about 0.6 percent from GDP growth while lower exports subtracted 1.1 percent. Adding back these two headwinds results in an adjusted growth rate of 1.8 percent for the 1Q, which is roughly the average we saw over the previous two quarters.

As for the weather, the effects were most likely to be seen within the "Gross Private Investment" component of the GDP, which fell 6.1 percent on annualized basis from the 4Q13 (the reduction in inventory builds accounted for a little over half of the drag from Gross Private Investment). It makes sense that investment would slow during periods of cold and snowy weather. Construction activity decreases, and the normal course of everyday commerce is interrupted. However, it should also be noted that some of the negative, non-recurring effects of the frigid weather on investment may have been offset by weather-related increases in consumer spending on utilities (such as gas to heat homes). Another offset to the weather-related drag was an increase in Obamacare-related health care expenditures.

So now that we've determined that 1Q growth remained roughly in line with the 2 percent pace since the recovery began, what's the outlook from here? Well, if we examine recent economic indicators, we do find evidence that some of the weather-induced weakness in the 1Q may have passed. Recent indicators for manufacturing and the labor market have indeed started to show some improvement. Moreover, increases in consumer confidence, no doubt related to an improving labor market, may portend a greater willingness to spend in the months to come.

But the housing market is a different story. Following 2-3 years of strong price appreciation and increased sales activity, new home sales and mortgage originations have recently fallen off a cliff. We find it odd that so many people are surprised by the sudden reversal in housing activity. Housing affordability has plunged in recent months as prices have spiked, middle-class incomes have continued to stagnate, and mortgage rates have risen by over 1 percent. While a 1 percent increase may not seem like a lot, that 1 percent increase represents nearly a 30 percent increase from the lows of about 3.3 percent to 3.4 percent in late 2012 and early 2013. The fact that mortgage rates "are still low compared to historical averages" has absolutely no relevance in today's housing market.

So what does all this new information say about the state of the economy? From my vantage point, it appears as though the economy continues to chug along at a sluggish pace -- that is, right above the proverbial "Mendoza line" of about 2 percent. This is what we expected, and this is what we continue to expect for a couple more years. Recovery from a financial crisis and debt bubble is a multi-year process. Attempting to accelerate the process at all costs is fraught with risk. What is most troubling to us is just how much fiscal and monetary stimulus has been required to produce an average growth rate of 2 percent since the recovery began about five years ago.

To boil things down, there are really only two roads we can follow in an environment of such as this. The economy will either muddle along at a sub-par rate of about 2 percent until balance is restored, or we go down the path of running up debt in an effort to produce higher growth rates in the near term. We've tried the latter approach repeatedly in over the past 15 years to no avail. Maybe it's time to try a new approach.