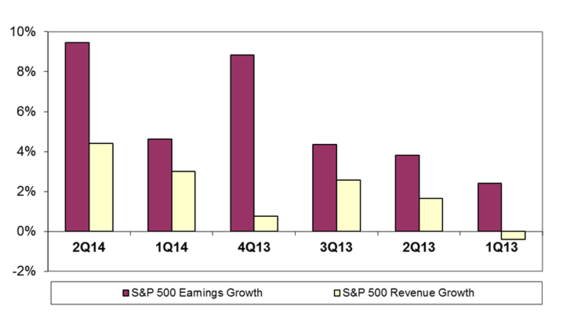

Second-quarter earnings season is nearly in the books, so we decided to provide an early progress report. According to data obtained from Bloomberg, 95 percent of the companies in the S&P 500 have reported their 2Q results. Based on the preliminary data, earnings grew 9.5 percent on 4.4 percent revenue growth in the quarter. These are the best growth rates in several quarters. Moreover, they appear to compare favorably to the 4Q13 when roughly 9 percent earnings growth was juiced by ~25 percent growth within the Financials sector. As we've noted in the past, bank earnings have benefited enormously from the outsized release of loan loss reserves over the past few years. Earnings growth within the Financials was much less of a factor in the 2Q.

Source: Bloomberg

So what drove the earnings strength in the 2Q, and is it sustainable?

The first thing to note about the aggregate S&P 500 earnings is that earnings growth continues to far outpace revenue growth. In fact, earnings grew at nearly twice the pace of revenue during the 2Q. The way to interpret this trend is that profit margins continue to expand further into record territory. As we've discussed numerous times in past Market Commentaries, corporate profit margins are running about 50 percent ahead of historical long-term averages. This trend may or may not continue if/when the recovery gains steam and a reduction in idle capacity leads to higher wages and other costs. Some degree of mean reversion is a safe expectation.

Aside from continued high margins, earnings growth is also benefiting from a huge amount of stock buybacks by the companies themselves. Faced with continued weak organic growth opportunities, corporate boards are authorizing buybacks of record magnitude. These buybacks lower the share count, which has contributed to higher earnings-per-share. Other companies are opting to use their cash (and high stock prices) to execute acquisitions. In fact, a surge in M&A activity probably explains a good portion of the recent gains in stock prices. These trends can certainly go on for a while, but they are unlikely to be a sustainable, long-term source of earnings and stock price appreciation.

Another factor adding to 2Q earnings and revenue growth was a big increase in inventories, which contributed about half of the 4.0 percent growth rate in 2Q GDP. Second-quarter inventories, and economic activity in general, undoubtedly benefited from some pent-up demand resulting from the harsh winter weather in much of the country during the 1Q. While hard to quantify, some demand was undoubtedly pushed out from the 1Q to the 2Q. These gains are unlikely to repeat going forward.

And finally, companies within the Health Care sector reported a 15.7 percent increase in earnings in the 2Q as a result of greater spending related to the Affordable Care Act. While higher spending helped corporate earnings and 2Q GDP growth, the longer-term effects on consumer spending and corporate profits (outside the Health Care sector) are unknown at this point. It stands to reason that corporate margins will suffer if companies are required to spend more on health care for their employees.

So what are the causes for optimism with regard to future earnings power? Well, the most notable are probably the recent sharp decreases in interest rates and gas prices. These are two very important factors that influence consumer spending and the housing market. In fact, we finally got some good news on the housing front with this week's better-than-expected housing starts and building permits. Until now, the housing news had been steadily worsening this year. But with the Fed remaining fully engaged and sluggish growth outside the US, we can probably expect to continue to benefit from lower interest rates and energy prices for a while.

On balance, we remain cautious (surprise, surprise). Despite the pent-up demand from the 1Q, retail sales remain very sluggish. Both Wal-Mart and Target, which are reasonable barometers for consumer spending (which represents 70 percent of GDP), reported flat same-store sales growth for the 2Q. Taking a more recent data point, July Retail Sales grew just 0.1 percent excluding auto and gas -- well below the consensus estimate of 0.4 percent. At the same time, numerous developments outside the US suggest that exports may be pressured in the months to come. Europe is on the brink of recession, the Middle East is a mess, Russian imports will obviously suffer from the situation in Ukraine, Japan remains weak, China's growth is slowing and there are warning signs from Latin American (Argentinian default). For all these reasons, those expecting continued robust growth in GDP and corporate earnings may want to temper their expectations. Risk is increasing.

Peace,

Michael