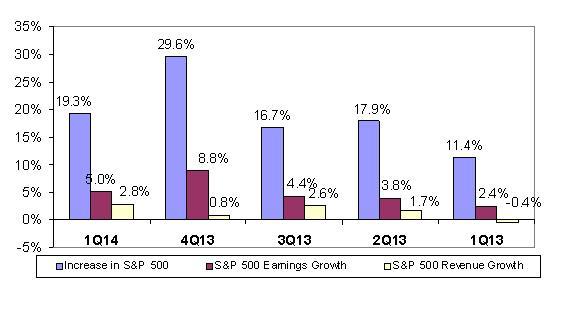

According to data obtained from Bloomberg, 92 percent of the companies in the S&P 500 have now reported their results for the first quarter of 2014. Based on the data, earnings grew 5 percent while revenue was up a more modest 2.8 percent. While these figures are by no means blockbuster, they are nonetheless firmly in positive territory and represent decent performance for a quarter in which GDP grew just 0.1 percent. In addition, earnings in the quarter fared much better than analysts' expectations as the average S&P 500 company beat its consensus estimate by about 6 percent.

The chart below shows index earnings and revenue growth over the past five quarters, along with the price performance of the index for each corresponding quarter. What can we glean from the data?

- The year-over-year increase in stock prices among S&P 500 companies continues to well outpace earnings and revenue growth

- Earnings continue to grow faster than revenue among S&P 500 companies; another way to interpret this is that margins continued to expand from already high levels

- Earnings have grown at an average pace of about 5 percent over the past five quarters, while revenue has grown at just 1.5 percent

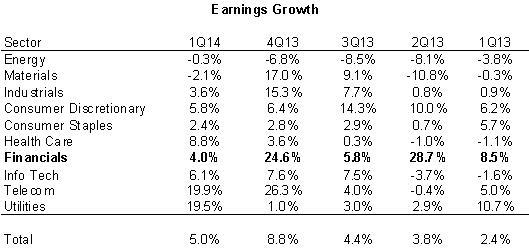

In the table below we show S&P 500 earnings growth by industry sector. What jumps out at us?

- The 5 percent aggregate earnings growth in the 1Q14, although less than the 8.8 percent in the 4Q13, was much less dependent on the Financials sector

- Earnings from health care companies (which comprise about 13 percent of the total index) and Technology companies (which comprise about 19%) were most responsible for the aggregate growth in index earnings

- The two smallest sectors by weighting (Utilities and Telecom, which together comprise just 5.5 percent of the index) were responsible for over 1 percent of the 5 percent aggregate earnings growth

- The Energy sector's drag on aggregate earnings growth was much lower than in the past four quarters

So what's our conclusion? Well, it's not too different from our conclusion last quarter. While the overall quality and composition of earnings in the 1Q may have improved somewhat (less dependence on financials, for example), index earnings growth remains highly dependent on margin expansion. When we performed this same analysis following the 4Q13 earnings season, we said that "the widespread optimism about a dramatic acceleration in economic growth and earnings growth is likely unwarranted. Unless and until we start to see more respectable top-line growth, we will hold back our optimism." We stand by those sentiments. We remain skeptical of continued margin expansion, and we cannot identify the source of an acceleration in top line growth. The consumer, or more specifically the middle class, remains financially strapped and cautious. Despite some evidence of an improving job market, we learned earlier this week that retail sales increased just 0.1 percent for the first month of the second quarter (April). Perhaps more ominously, the housing market is clearly showing signs of fatigue following a rate-induced bounce off the bottom. Data like these five years into our economic "recovery" (and following unprecedented fiscal and monetary stimulus) continue to argue for a defensive posture, especially given that much of the fiscal and monetary stimulus will be going away.