The role of asset bubbles as an unsustainable pillar of pre-2007 world economic growth has been widely recognized. Simultaneously, analysts worry that a secular stagnation, though momentarily offset by asset bubbles, may have been already at play in major advanced economies, leading to the ongoing sluggish and feeble recovery. Still, there is a core divergence among some "Keynesian" and "Schumpeterian" economists who have proposed such stagnation hypotheses; each camp points to different underlying factors for continued anemic levels of growth. "Keynesians" argue from the demand side, and believe that proactive fiscal policies are needed for a strong recovery, while "Schumpeterians" believe that the necessary force of creative destruction has continually been stymied by such policies.

Bubble-led growth had feet of clay

It has now been widely acknowledged that the long period of economic growth in advanced economies prior to the crisis was largely dependent on asset bubbles. Consider the case of the US:

"(...) the liquidity-generating machine inflated US asset values and fed the exuberant growth of US household spending. US consumers have accounted for more than one-third of the growth in global private consumption since 1990. Increasingly, their spending was made possible by the wealth effect generated by the rising prices of housing and household financial assets and stocks, whose values were in turn expected to more than outstrip those of household debt. It was this upswing in consumption by US households, and others as debt-based consumers-of-last-resort in the global economy that essentially made possible the extraordinary structural transformation and productivity increases experienced by some manufacturing exporters and commodity producers among developing economies." (Canuto, 2009)

A similar bubble-led growth process could be found inside the eurozone, starting with the downward convergence of both perceived risks and interest rates toward levels in Germany and France throughout the zone after the introduction of the new common currency. The eurozone countries under stress today were formerly able to sustain domestic absorption far above domestic production capacities over a long period, easily financing the difference through sudden domestic asset value appreciation. The underestimation of fiscal risks was another manifestation of such euphoria.

Asset-price dynamics has now been mainstreamed as an important subject to be addressed by policy makers, and macroprudential policies have become a component of the macroeconomic stabilization toolkit (Canuto, 2013a). However, enhancing the policy framework through improved financial regulation and articulated monetary and prudential policies, in order to ensure both financial and macroeconomic stability may not be enough if some underlying trend of stagnation is at play. If the pre-crisis growth trend was inextricably dependent on the overspending induced by the financial frenzy -- credit and house bubbles -- avoiding future asset price booms and busts might simply lead to stability around low growth rates.

Keynesians: It's aggregate demand, stupid!

Such a view underlies the possibility of a "secular stagnation" as discussed by economists like Krugman (2013) and Summers (2013):

"Manifestly unsustainable bubbles and loosening of credit standards during the middle of the past decade, along with very easy money, were sufficient to drive only moderate economic growth. (...) short-term interest rates are severely constrained by the zero lower bound: real rates may not be able to fall far enough to spur enough investment to lead to full employment." Summers (2013)

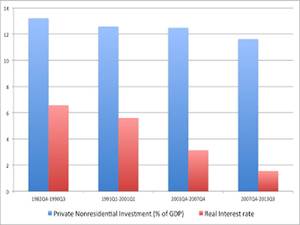

They and other -- "Keynesian" -- economists have suggested an array of possible causes for the US economy and others to display a propensity of aggregate demand shortfalls, in the sense that, as a result of structural conditions, aggregate spending would be enough to ensure full employment and use of potential output capacity only in the presence of negative real interest rates. Such an "investment drought" -- or, as a flipside, a "savings glut" as measured by levels of non-consumption expenditures required to sustain income at full employment -- could be seen as underlying the evolution depicted in Chart 1, obtained from Fatas (2013).

Chart 1

US - Private Nonresidential Investment and Real Interest Rates

Source: Fatas (2013)

Beyond the legacies of the crisis -- including higher risk aversion, increased savings by states and consumers, increased costs of financial intermediation and major debt overhangs -- several long-standing factors would have contributed to dampening investment. Among them, I single out two as the most significant:

First, rising income concentration -- rising shares of income accruing to capital and the very wealthy -- would be leading to overall under-consumption, only occasionally countervailed with unsustainable over-indebtedness by the poor. Second, technological evolution might also be contributing to an investment drought. Steep declines in the costs of durable goods -- especially those associated with information and communication technology and/or outsourcing -- means reduced spending on investment plans out of corporate savings. Furthermore, the trajectories of technological evolution currently unfolding would not carry as many high-return investment opportunities as past periods of innovation.

Summers (2014) argues that "(...) our economy is held back by lack of demand rather than lack of supply. Increasing capacity to produce will not translate into increased output unless there is more demand for goods and services." He strongly recommends establishing "a commitment to raising the level of demand at any given level of interest rates through policies that restore a situation where reasonable growth and reasonable interest rates can coincide."

It follows from this view that the policy mix that has prevailed since the aftermath of the crisis has been inappropriate. Instead of relying single-handedly on ultra-loose monetary policy, public spending -- on infrastructure, energy and other sectors -- should be rescued from the retrenchment to which it has been submitted. As long as credible medium-to-long-term adjustment programs are announced, there would be scope for fiscal stimulus despite current public debt levels. By the same token, pro-active public policies to ignite private investment spending should also be implemented.

Schumpeterians: It's all about "creative destruction," folks!

On the other side of the debate, there are those "Schumpeterian" economists who have offered supply-side based hypotheses of a long-run stagnation trend supposedly already in course for some time. Like Joseph A. Schumpeter, they lay emphasis on growth as a process of "creative destruction" in which obsolete forms of resource allocation and wealth -- jobs, fixed-capital assets, technologies, and balance sheets -- are replaced by higher-value ones. Although accepting an eventual role of monetary policies in avoiding systemic financial meltdowns, they tend -- also like Schumpeter -- to be more skeptical of fiscal or other types of countercyclical stimulus if these are designed in ways that retard the process of creative destruction. As for the post-crisis policy mix, Schumpeterians believe that public policy which artificially props up aggregate demand cannot be a key component in the fight against stagnation. In other words, "If you are postulating a stagnation across the longer run, ultimately it will have to boil down to supply side deficiencies."(Cowen, 2013). The evolution of declining investments in tandem with lower interest rates shown in Chart 1 is seen as stemming from disadvantageous rates of return not related to the pace of aggregate demand expansion.

Technological evolution as a cause of stagnation has been put forth as a hypothesis by Gordon (2014). Nevertheless, his arguments focus on the limited ability of current technological trajectories to raise productivity, rather than their supposedly dampening effects on aggregate demand.

Cowen (2011) has in turn approached stagnation as an outcome of the exhaustion of a significant set of "low-hanging fruits" reaped in recent history, namely one-off supply-side opportunities associated with post-war reconstruction; trade opening; diffusion of new technologies in power, transport, and communications; and educational attainments, among others. Other recently-proposed causes for supply-side stagnation are associated with features of resource allocation, such as over-sizing of financial activities, as discussed by Canuto (2013b).

As Rajan proposed in 2012, such propositions about stagnation trends suggest that:

"(...) the advanced countries' pre-crisis GDP was unsustainable, bolstered by borrowing and unproductive make-work jobs. More borrowed growth - the Keynesian formula - may create the illusion of normalcy, and may be useful in the immediate aftermath of a deep crisis to calm a panic, but it is no solution to a fundamental growth problem. If this diagnosis is correct, advanced countries need to focus on reviving innovation and productivity growth over the medium term, and on realigning welfare promises with revenue capacity, while alleviating the pain of the truly destitute in the short run."

To be effective, a pair of scissors needs both blades

Keynesian and Schumpeterian hypotheses on stagnation trends are based on non-directly observable factors. Therefore, the struggle for hearts and minds of public opinion and policy makers will likely remain unsettled.

I, for one, lean in favor of the argument of insufficiency of aggregate demand throughout the ongoing recovery in advanced economies, as the behavior of the prices of goods and services seem to indicate (Chin, 2014). Nevertheless, one may acknowledge the possible negative effect on investment prospects caused by procrastination regarding "creative destruction." This is clearly the case with sluggish balance-sheet adjustments and a debt overhang in the Eurozone.

Let me offer two key takeaways. First, regardless of the size of public outlays, public action and spending should be both designed in ways that maximize the "bang for their buck" in terms of overcoming obstacles to the process of creative destruction. Take the case of Japan: the success of the third arrow of Abenomics, which focuses on structural reforms in the services sector, will be a condition for successful results in its fiscal and monetary arrows. Likewise, in the Eurozone, quicker action to restructure/consolidate "zombie" balance sheets and companies, in line with a more pro-active stance taken by monetary and financial authorities, should also hasten their path out of the current stagnation.

Second, regardless of whether advanced economies are indeed facing demand- or supply-side stagnation trends, the developing world's economic transformation remains as a powerful source of growth for the global economy as a whole (Canuto, 2011). However, for such growth to continue, developing countries themselves will also need to pursue their own country-specific agendas of structural reform and, therefore, of "creative destruction" (Canuto, 2013c).