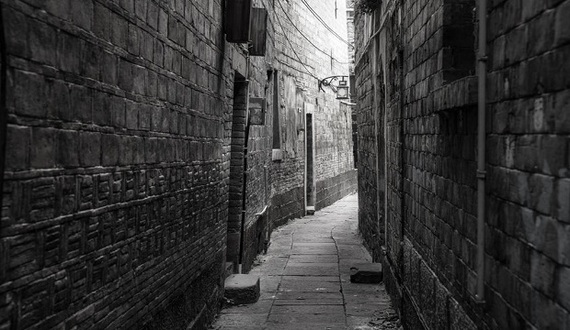

Many of us were told since childhood to avoid "dark alleys," but all too often we seem to forget this important advice when it matters most. The metaphor of a dark alley in the context of financial advisers is perfectly suited to describe a place in which you would never want to be. When in a dark alley, it's usually just you and the villain. Movies perpetuate the imagery of villains as shadowy figures lurking in places where they can't be seen, looking for prey.

In the financial services industry, the dark alley refers to a professional relationship between a client and an adviser, where trust serves as its foundation, but everything is conducted in a "silo" that's created by the adviser. Financial advisers often feel the need to create these silos due to the manner in which they receive compensation, which drives them to be very possessive and territorial when it comes to their clients. Further, clients' misplaced sense of trust tempts them to lower their guard, abandoning their normally astute sensibilities and caution. This provides advisers with the opportunity to inoculate their clients from any outside influence and intellectual germination, protecting their long-term professional survival.

The recent news about Tim Duncan, an NBA superstar who is suing his longtime financial adviser, seems to have gone viral. While Duncan stated his financial security was not affected by this debacle, there are countless other stories of investors who have lost their life savings to financial con artists. The list of victims with backgrounds as diverse as the general population, and many surprisingly educated and successful, is seemingly endless.

Victims are not without fault. In movies, viewers are appalled by the victim's ignorance and often murmur, "How stupid was that?" "Didn't he see that coming?" Or, "Why doesn't she just run away?" In real life, as in the movies, financial victims allow themselves to be victimized. Investors empower their financial advisers by placing trust almost unconditionally, without requiring accountability or transparency.

In the case of Bernie Madoff's victims, some even stated they sensed something was very wrong, but did not want to be proven correct and were living in denial. Of course, some clients never even knew he or she cohabited the proverbial dark alley with Madoff as he went about his business unchecked.

If you ask investors for the reason they do business with their financial adviser, a popular answer is, "...because I trust him/(her)." Trust, in its purest form, is virtuous and opens the door to many wonderful possibilities. However, trust also provides real life financial con artists the opportunity to exploit it, which makes it a double-edged sword. Ensure the sword is in its sheath when in a dark alley. But better yet, simply wait for daylight.

To learn more about Alexandria Capital, LLC, view their Paladin Registry profile.

Article originally posted on Paladin Registry.

About the Author: Augustine Hong is the CEO of Alexandria Capital, a diversified financial services company that offers wealth management, 401k plan and investment consulting services. They have offices in Washington DC, Northern Virginia, the Greater NY Metro Area and California. Augustine has more than 25 years of experience advising individuals, families, and businesses create and protect wealth. He continues to educate through his writing, coaching, and leading his team of committed financial professionals to advocate for their clients.