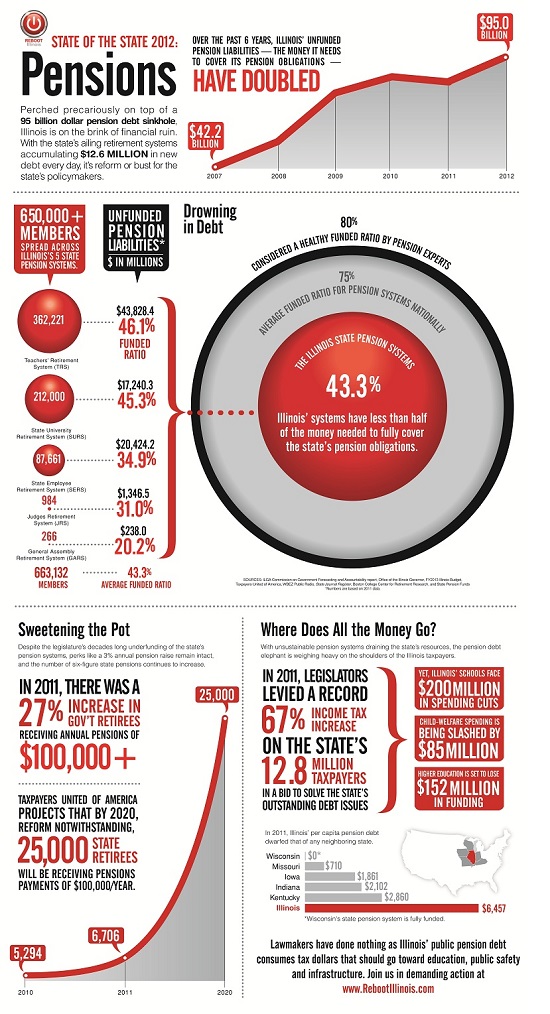

Remember last year, when lawmakers raised your income tax by 67 percent? Are you aware that all the extra money that year went into the state's troubled public pension systems? But even with its new, increased personal and corporate income tax rates, Illinois remains financially sandbagged by $95 billion in unfunded pension liabilities.

And the number is getting worse fast: Gov. Pat Quinn estimates that the pension liability grows by $12.6 million every day. We've heard about this issue for so long that it's become a jumble of doom-laden numbers all so large they are difficult to comprehend.

One thing that is simple in this issue: Schools, public safety, road, bridge and infrastructure construction will suffer as the state desperately cuts discretionary funding to shovel money into pensions. Without major changes - more money contributed by current employees, changes in how benefits are calculated or any number of other possibilities - Illinois soon will pay more toward its pensions than it does for education. Our lawmakers have known this for years, yet still have failed to take substantive action. This never will be an easy issue for them politically, and they've become accustomed to taking the easy way.