Tonight, the president gives his State of the Union address, followed by the Republican response from Rep. Paul Ryan. There'll be a lot of talk about the economy: jobs, taxes, deficits, and the state of American business. If you find that your mind's getting lost in vagaries and theories, here are 10 "reality checks" to bring you back to earth, benchmarks that provide context for tonight's speeches:

1. The federal government isn't a runaway fiscal monster.

You'll probably hear Rep. Ryan say that the United States government is relentlessly devouring everything in its past, consuming an ever-greater portion of our national prosperity. The president may even echo this notion, in a milder way. But it ain't so:

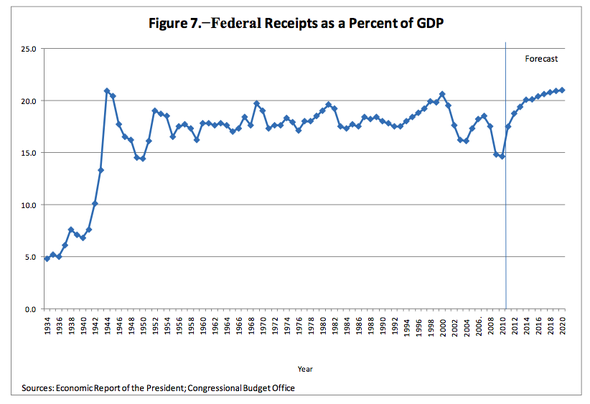

As the Joint Committee on Taxation documented, federal taxes have been stable as a percentage of our GDP for a long time. Even a projected uptick in this figure leaves us pretty much where we've been all along. It's a needed corrective to the reckless tax giveaways of the last decade -- and some of that revenue increase is needed because of the crisis caused by banking deregulation.

2. Main Street and Wall Street aren't "in this together."

Let's hope there's no more presidential talk about how "Wall Street and Main Street rise and fall together." That was never less true than it is today, and the numbers prove it: The GDP is up 4 percent -- but the stock market's up 24 percent. Barry Ritholtz thinks that's due to Federal Reserve policy, and that sounds right. If you can get cheap low- or no-interest loans, it's pretty hard not to make out pretty well in the stock market.

If that's true -- and we have no way of knowing, since your Federal Reserve operates in secrecy -- the bankers once again have the taxpayers to thank for their extraordinary success. And, as Ritholtz explains, that could include several trillions in wealth that was artificially created by the publicly created Fed.

The stock market's grown at six times the rate of the real economy. The financial sector has become untethered from physical reality. Stop looking for the intersection where Main Street meets Wall Street. They're not even in the same town anymore.

3. The bankers who created this crisis are doing great.

They bankers are rolling in cash, thanks to the United States taxpayers who saved them. 2010 is still on track to be the banks' second-best year ever, topped only by 2009. They've come out of their self-created crisis more profitable than ever, and they'll be giving out about $16 billion in bonuses this year (not counting stock options).

Bankers will receive as much as $144 billion in total 2010 income. Meanwhile, politicians will say we can't help the victims of bank recklessness because we're paying too much interest on the national debt. That interest cost us $160 billion last year. Which gives me an idea...

4. Taxes for the wealthy are historically low.

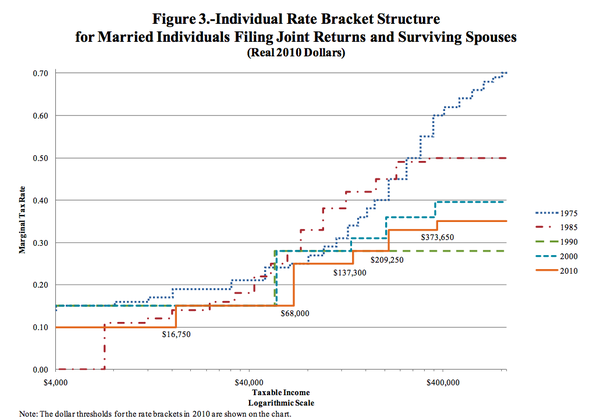

You'll probably hear some talk about the oppressive tax burden we're imposing on our wealthy neighbors. Forget about it. When it comes to taxes, this country's rich people have never had it better. For the very highest earners, federal taxes are half of what they were in 1975:

The highest earners have seen their tax rate cut in half, from 70 percent to 35 percent.

5. Income inequality is rising, and the rich are richer than ever.

We've always prided ourselves on having a "level playing field." But we have more income inequality than other developed countries, and we're one of the few such countries where inequality has gone up over the last three decades.

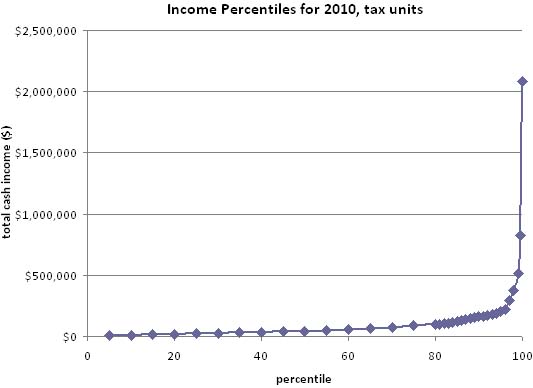

What's more, income for the very, very rich is much higher than it is for the merely rich. The New York Times' Catherine Rampell has the lowdown, but the picture tells the story:

The ultrarich on the very right of this slide have made out spectacularly. Capping their income tax at 35 percent saves them a lot more than it saves the merely rich. (And we haven't even mentioned the 15 percent tax rate for billionaire hedge fund managers.)

6. Corporations have never had it so good.

It's party time for American corporations, too. They had their best quarter ever in the third quarter of 2010 (the most recent quarter we know about). That's stunning, given the economy's near-collapse and massive ongoing unemployment.

As Harold Meyerson noted, 47 percent of all revenue for the Fortune 500 corporations came from outside the United States. We can differ about the solution to this problem, but it's clear that American corporations aren't as invested in the American dream as they once were. These days they don't need an America that's working in order to turn a nice profit.

The Republicans like to say that corporate taxes are higher here than abroad, but there are so many loopholes in this country that corporations wind up paying much less in taxes. And as Derek Thompson noted, revenue from corporate income fell from more than 30 percent in 1950 to about 7 percent in 2010.

Conservatives used to love comparing us to a certain other country where, we were told, the corporate tax rate was much lower and the economy was booming as a result. What was that country again? Oh, yeah -- Ireland.

7. We're in a jobs depression.

For working Americans, the state of the union is grim. An unemployment rate of 9.4 percent sounds high, and it is. But that number gets even higher when you include people who have stopped looking for work and those who can only find part-time work. The total figure, known as U-6, was was 16.7 percent as of last month, nearly double its 2005 level. 14.5 million people are jobless, and nine million people are unemployed. Altogether, one in every six Americans is either unemployed or isn't working as many hours as they want and need.

We haven't seen unemployment at these levels since the Great Depression.

8. People with jobs are hurting too.

People who are lucky enough to have jobs are hurting too. As the Federal Reserve Bank of San Francisco reports, wage growth has been stalled since the recession. Average wage increases were just over 4 percent a year before the bankers wrecked the economy, and in 2010 they were down to less than 2 percent.

People are cannibalizing their own savings just to stay afloat. For the first time in nearly six decades, Americans withdrew more from their savings accounts than they put in. As the Wall Street Journal noted, "That's a sharp divergence from the previous 57 years, during which they never made a net quarterly withdrawal. Rather, they added an average of 12% of disposable income to their holdings of financial assets."

In an unprecedented reversal, Americans are breaking open the piggy bank just to survive -- while the banks are acting like piggies.

9. Young people are being lost to unemployment

Unemployment has hit the young especially hard. Employment for young people last summer was the lowest ever recorded since the Bureau of Labor and Statistics began tracking it in 1948. Teenage unemployment stands at 25.4 percent, The economy hasn't been creating enough jobs to keep up with new entrants into the job market, and that hits young people especially hard. Studies show that the first few years of a career shape an entire lifetime's earnings. We're losing a generation to this unemployment crisis.

Remember when we wanted our kids to have a better life than we did?

The youth jobs crisis also means that "household formation," where people split off from an existing household to start their own, is way down. In fact, housing formation is at a 60-year low. Fewer new households means less demand for housing. Less demand for housing means an even more depressed housing market -- which, in turn, leads to less spendable income for everybody.

10. The housing situation? Don't even ask.

There are more than 10 million "underwater" mortgages in the United States, where the homeowner owes more than the home is worth. That's down from a peak of 11.3 million, but only because there have been so many foreclosures. More than one home in five -- 22.5 percent -- is underwater. Even if housing prices stop declining -- and that's a big "if" -- roughly half of these homes are expected to still be underwater in five years.

That's a lot of money being taken out of circulation. U.S. are stuck with about $700 billion more in debt than their homes are actually worth. ($700 billion, coincidentally, happens to be the size of the TARP bailout for the big banks that sold them these mortgages.) There's no sign of any bailout for homeowners, and the government has resisted all attempts to have the banks share in the "underwater" losses along with homeowners.

Will we hear anything tonight about doing more for struggling homeowners? Don't count on it. Their payments are a kind of "backdoor bailout" for the banks, providing them with more income that their assets deserve and allowing them to avoid acknowledging the lost value of those assets. American families are paying the bill so that banks can pretend they're in better financial shape than they really are.

We have seen their future, and it doesn't work.

You'll hear the Republicans tell us that tax cuts and deregulations create jobs. Well, we had 10 years of both. How's that working out for you?

Texas was supposed to be the model for Republican free-market ideas, a kind of Anti-Socialist Bosses' Utopia, where growth would be built around tax cuts and spending reductions. Gov. Rick Perry was going to show the country how deficit reduction can be done right. Instead, Texas is facing a 30 percent shortfall.

Texas had a shortfall last year, too, but it was able to cover up 97 percent of it -- with federal stimulus money.

And are our memories really that short? Deregulation led to the financial collapse of 2008, and that little oil problem in the Gulf of Mexico too. Two years later we're hearing the same old deregulation talk. We've seen their promised land. It's broke, impoverished, and covered in crude. Their utopia is where the American dream goes to die.

What to listen for

The president says he'll talk about jobs and growth. That's what he should be doing -- and he should be offering bold investment initiatives to make it happen. The more he speaks about investment, and the more he defends this country's social programs, the better news it will be for the economy.

Another good way to promote jobs and growth is by putting the government's dollars where they're going to be recirculated back into the economy. That means fewer tax breaks for the wealthy and the corporations who are sitting on $2 trillion in cash. And it means more financial support for people who will spend the money as soon as they get it: more benefits for retirees, unemployment insurance extensions for the long-term unemployed jobless, and work for people who need to pay their bills.

Rep. Ryan's budget-cutting plan is the real "jobs killer." Tonight he'll offer the age-old promise that spending and tax cuts will lead us to salvation. Our answer: Been there, done that.

The economy needs stimulus, so let's hope the president doesn't shy away from that word. But when "stimulus" is used to mean tax cuts, that's a sign that less effective "tax expenditures" will crowd out our ability to invest in jobs and growth. And whenever the word "deregulation" is mentioned -- unless it's used as an epithet -- be afraid. That's how we got into this mess in the first place.

Richard (RJ) Eskow, a consultant and writer (and former insurance/finance executive), is a Senior Fellow with the Campaign for America's Future. This post was produced as part of the Curbing Wall Street project. Richard also blogs at A Night Light.

He can be reached at "rjeskow@ourfuture.org."

Website: Eskow and Associates