By unveiling its sleek new Fire TV streaming video box last week, online retailing giant Amazon has finally entered the streaming media wars. The coaster sized device enables users to play online games and watch movies and TV shows from Amazon Instant Video as well as from Netflix, Hulu Plus and other sites.

Amazon clearly believes that the future of content distribution is in the consolidation of content through a single source and wants to become a streaming "gateway" for consumers. But with Apple and Comcast in talks to set up a proprietary streaming service that would bypass the congestion of the web and Chromecast having made inroads as a gateway already, simply providing ease of access to multiple sites will not be enough of a differentiator for Amazon.

Customers in the digital age are impatient, and the bifurcation of content across so many platforms and so many media is a serious bottleneck to unlocking the full profit potential of streaming video. As a consumer myself, I find it extremely annoying to have to access, pay for and keep up with several different sites to get a comprehensive movie and TV watching experience.

The remedy for this is for major distributors to pool their streaming libraries under one service to make the connection between content producers and viewers as streamlined as possible. That, in turn, requires long-term thinking.

Netflix, for example, could just piggyback on Amazon's efforts to reach a wider streaming audience, but that would be shortsighted. It may be the leader in this space right now but could lose market share to its competitors as binge-watchers max out on its offerings and look for variety. The smarter play would be to fill the gaps in its library with more current content that Amazon, Hulu Plus and HBO Go offer, as well as take advantage of the marketing capabilities and customer knowledge of Amazon. Amazon's e-commerce platform is also ideal for cross-selling movies and TV shows with books, music and other licensed merchandise.

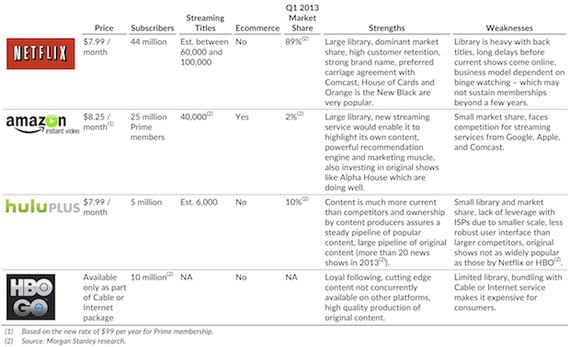

At the same time, even though Amazon has more than 25 million Prime members, its video service is more of a subscriber acquisition tool than a profit center and lags both Netflix and Hulu Plus in market share, according to analysts. That means the online retailing giant could benefit from a partnership, both by gaining new Prime members and generating additional e-commerce activity. There is also little overlap in the libraries: Of the 200 top titles at Netflix, only 68 are shared by Amazon and 36 by Hulu.

Another reason for combining services would be to realize economies of scale in original programming, especially with HBO's well-established setup for film and TV production. Original shows like House of Cards (on Netflix), Alpha House (on Amazon Instant Video), The Awesomes (on Hulu), and Game of Thrones (HBO Go) have become immensely popular and arguably drive subscriber acquisition and retention, but are expensive to produce and market.

Here is how the various services stack up and complement each other:

The CEO of Netflix, Reed Hastings, recently blasted Internet Service Providers for obstructing the user experience by slowing down streamed content, but here too, a partnership between major online players can increase their negotiating power with cable operators and telcos. The future profitability of independent sites like Netflix could even depend on it.

So why hasn't it happened yet?

Mainly because every streaming service wants to become the premier site for online entertainment, but they should keep in mind the airline price wars that have caused major damage to that industry. The ultimate result of runaway competition was forced consolidation amongst major carriers to survive and bolster profitability. That is what could happen here too.

This article also appeared in FORTUNE.com.

--

Sanjay Sanghoee is a banker, author, and commentator.