There are a great many people who would love to own a home still hesitating and staying on the sidelines. Some don't have the down payment, or they may have credit problems. However, credit is loosening up; down payment requirements are coming down as well. Many are more able to buy than they think.

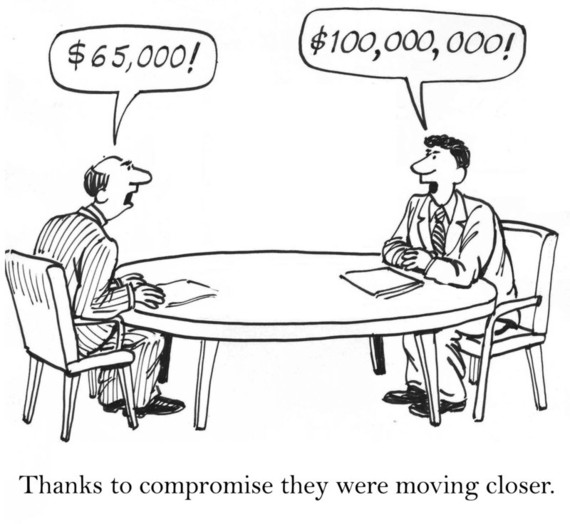

However, a significant percentage of would-be buyers are hesitant because they're afraid of buying a home and immediately finding the value dropping, or buying at too high a price. Of course, paying more than the home is worth in the current market is locking in a deficit unless and until market conditions improve and prices rise. The average consumer home buyer can go into a price negotiation with an advantage, but you need to "love the numbers more than the home."

Have Options Going In

This is crucial. Too many home buyers look around and find the "perfect home," fall in love with it, and they are in trouble before they even enter negotiations. If you only have one home on your final list, you need to go out and look some more if there are other options available. Sure, you don't want to make an offer on a home you hate, but it's usually possible to find two, three or more that meet your needs and you like in varying degrees.

Going into a contract negotiation with fallback options immediately gives you an advantage. You're not in a "must-have" situation, and you should make that clear to your real estate agent if you're using one. It is possible to make too low of an offer and offend the seller(s), but it's less common than you may think.

First time owners and couples who have lived in a home for many years are more likely to let emotions guide their price negotiations. You want to temper your first offer a bit for these people, but having backup options gives you leverage. Also understand that if they have an outstanding mortgage, there is only so much room to negotiate before they have to bring money to the closing table.

It's a Give-and-Take If Repairs are Necessary

When you're negotiating with a seller who has already had an offer, they will probably have seen the home inspection report and will know what repairs are necessary and that another buyer may want them done. Even if they haven't, you can see obvious problems with the property and consider those in your negotiations. Just know that if you push them to their limit and lowest selling price, there will be little or no room to pay for repairs once the inspection comes in.

Until every contingency, such as repair negotiations, is resolved, you're in a continuing negotiation. So, if you've settled on a price and the inspection yields significant repair requirements, you can renegotiate the price instead of having the seller get the repairs. They have a different motivation, saving money rather than getting quality work.

Know Who the Boss Is

Your real estate agent is not the boss; you are. If you have backup options and want to make a low initial offer, it's not their job to try to talk you up to a higher number. They may try to do so, telling you that the seller(s) may get upset and tell you to go away. If they do, go to one of your fallback homes, but you'll probably still get a counter offer, even if it's full price.

Have your buyer agent do a CMA, Comparative Market Analysis for you. You want a realistic valuation of the home in the current market. This is based on recent sales of similar homes in the same area. Then you have a value number and can make an offer below that number; as far below as you want. You're the boss. If the agent is stubborn about submitting it, find another agent.

It's a great feeling to leave the closing table with actual equity over and above your down payment because you paid below market value for the home.