Over the past three years New York has shifted from being a sleepy backwater of tech innovation to a red hot center of startup activity.

There are a number of reasons for this shift -- among them, the completion of the construction of the web 1.0 world... giving innovators the underlying backbone of the web to build on.

But critical to the emergence of startups in NYC has been the growth in the availability of venture capital.

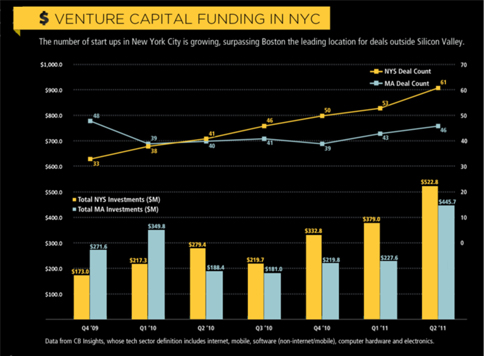

The second quarter of 2011 saw more than 416 million dollars going to 48 internet-based companies in NYC. PriceWaterhouse Coopers and the National Venture Capital Association report that a total of 98 companies landed venture funding in Q2 of 2011, and New York now surpasses Boston as the leading location of venture deals, second only to Silicon Valley. 347 deals were funded in NY, compared with 271 in Boston. That represents a 30 percent increase from 2009, according to Down Jones VentureSource.

What's driving this growth? Brian Cohen, the newly appointed Chairman of the New York Angels Network, told me the primary reason is a more synchronized environment of increased supply and demand.

On the supply side -- Cohen attributes growth to: "Universities' startup academics, clubs, competitions, etc. continue to inspire and more intelligently grow young minds, new types of incubators/accelerators continue to be launched by all sorts of business, a 'go for it' culture driven by Mayor Bloomberg is definitely instigating bright young people from all over the U.S. and world to build their businesses in NYC."

And demand is robust as well. NY Angels was an early leader, investing over 45 million dollars in 70 startups over seven years. Now Cohen says a "mentoring culture" is driving lots of new money. "This new money sees these startup investment opportunities as an exciting opportunistic upside leverage against the doldrums of the ongoing economic calamity." New York Angels has seen deal flow grow 3x in the past year -- as opportunities and membership has grown.

There's more supply, more demand, and a powerful sense of growth and optimism that supports the trend says Cohen. "A strong dose of thoughtful media coverage, it provides a strong forward-looking picture of very positive reinforcement for the supply and demand side to keep its emotional engine running."

It should come as no surprise that this growth is being heralded by a guy who was himself a tech entrepreneur. Speaking recently at the IBM THINK forum, Bloomberg said: "In terms of technology, I'm proud to tell you our city passed Boston to become the second largest recipient of venture capital funding for technology company startups behind only Silicon Valley." Said Bloomberg: "We can't be second at anything; we're New York." You gotta love Bloomberg calling out the competition. "We can't sit here and let Silicon Valley be bigger than us in anything. This is the big pond."

And perhaps most critical to the growth of NY Tech, from ideas to actual companies, is the emerging economic food chain from Angels to deep-pocket venture funds.

Here Cohen points to a critical change: "According to the PWC report a large percentage of the money is Seed investment. The first investment/early "seed" stage has been dominated by Angels for a very long time -- (90 percent of such money according to Kauffman") Cohen explains: "Here is definitely a very cooperative startup and funding environment being created in NYC. The trust factor cannot go unnoticed. The balance of power being funders and startups has reached a wonderful point of equilibrium."