One of the most serious charges leveled by the Financial Times in its high-profile critique of Capital in the Twenty-First Century is that the author, economist Thomas Piketty, was guilty of "cherry-picking data sources" to support his thesis.

"Sometimes, as in the US, he appears to favour cross-sectional surveys of living households rather than estate tax records. For the UK, he tends to avoid cross sectional surveys of living people," writes Chris Giles, the FT's economics editor.

To support its argument, the FT cited an "independent expert -- who agreed with us, but wants to remain anonymous." But the FT editor and his anonymous expert omitted the context around Piketty's data decisions. And while Giles suggested that Piketty ought to have made different decisions and relied on data put together by other economists, the economists Giles referenced say Piketty's decisions were reasonable.

Whereas Giles says that Piketty "appears to favour cross-sectional surveys" for the US, Piketty himself writes on page 347 of his book that he relied on estate tax records supplemented with survey data.

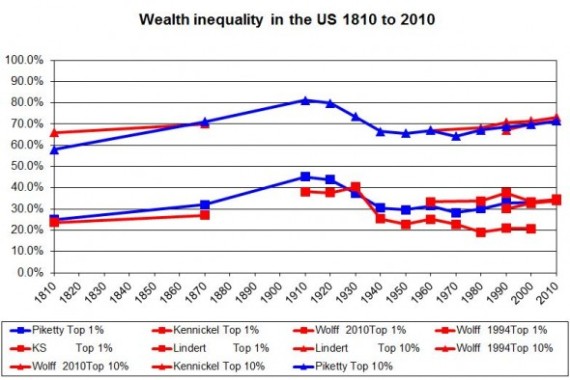

I turn now to the US case. Here, too, we have probate statistics from 1910-1920 on, and these have been heavily exploited by researchers (especially Lampman, Kopczuk, and Saez). To be sure, there are important caveats associated with the use of these data, owing to the small percentage of the population covered by the federal estate tax. Nevertheless, estimates based on the probate data can be supplemented by information from the detailed wealth surveys that the Federal Reserve Board has conducted since the 1960s (used notably by Arthur Kennickell and Edward Wolff), and by less robust estimates for the period 1810-1870 based on estate inventories and wealth census data exploited respectively by Alice Hanson Jones and Lee Soltow.

Giles then goes on to criticize Piketty's use of estate tax data in the UK.

Prof Piketty’s choices are not always the best possible ones. A glaring example is his decision relative to the UK in 2010. The estate tax data Prof. Piketty favours comes with the following health warning.

“[The data] is not a suitable data source for estimating total wealth in the UK, or wealth inequality across the whole of the wealth population; the Wealth and Asset survey is more suitable for those purposes”.

These choices matter: in both the UK and US cases, his decision of which type of data to use has the effect of showing wealth inequality rising, rather than staying constant (US) or falling (UK).

Piketty explains, however, why he relies on the data. "In Britain, we have detailed probate data from 1910-1920 on, and these records have been exhaustively studied by many investigators (most notably Atkinson and Harrison). If we

complete these statistics with estimates from recent years as well as the more robust but less homogeneous estimates that Peter Linder has made for the period 1810-1870 (based on samples of estate inventories), we find that the overall evolution was very similar to the French case, although the level of inequality was always somewhat greater in Britain."

Giles declined to comment on the record. But a source at FT defended the article by pointing to the estate-tax work done by Emmanuel Saez, Wojciech Kopczuk and other researchers. Giles, writing in the FT, said that Piketty's decision not to rely on Saez, Kopszuk and others, and instead to include data from the Survey of Consumer Finance, or SCF, biased his results in favor of his preferred thesis.

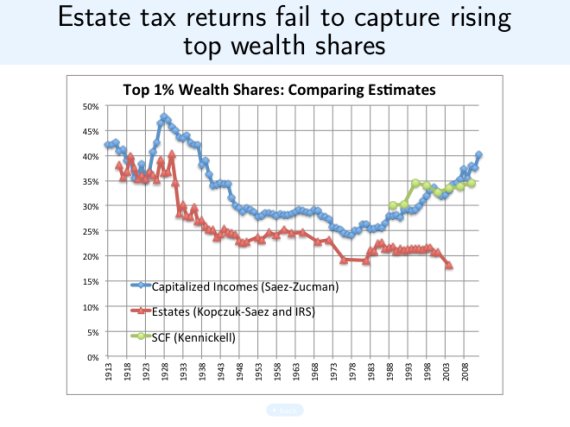

But Saez himself told HuffPost the choice Piketty made was reasonable. "Piketty's choice and judgement were quite good, better than having relied only on estate tax data as Chris Giles would have wanted him to do," Saez said. "In the US, the SCF survey data is quite good (and covers the full pop[ulation]), while the estate tax data covers only the top 1 percent. Hence, to get at the top 10 percent, Piketty had to rely on the SCF and then use the estate tax data to go back earlier in time."

Saez noted that only relying on probate data would have left the picture incomplete. He added that his subsequent research bore out Piketty's thesis rather than Giles', referencing this chart:

Kopczuk said that he personally would not combine estate tax and survey data, but understood why, for a long time series, it would make sense. "There's no perfect way to do it and there's some judgment calls to make," Kopczuk said. "The problem is none of these data sources covers all of the periods when he would like to have estimates for, so that part seems reasonably fine to me."

Kopczuk added that none of the sources -- Piketty's, the SCF, his own or others -- showed a significant rise in wealth inequality in recent decades. Piketty showed a small uptick, while others found a flat trend. Saez' new data, published after the book came out, backs up Piketty's choices, showing wealth inequality on a slight rise.

Giles' general argument also is wildly off. "The central theme of Prof Piketty’s work is that wealth inequalities are heading back up to levels last seen before the first world war," Giles writes.

That, however, is simply untrue, as inequality experts Branko Milanovic and Mike Konczal have pointed out.

Piketty's central theme is that income inequality -- not wealth inequality -- has been rising quickly over the past several decades and is poised to return to pre-World War I levels. The FT's critique did not attempt to challenge Piketty's data on income inequality.