It's only Wednesday and it has already been a dramatic week in Greece. As Tuesday's deadline for an IMF debt repayment and a new bailout deal came and went without agreement, the country moved into uncharted waters.

While Greece and its international creditors continue to wrangle over the terms of a deal, worried Greeks lined up outside closed banks, uncertain about what is next for their money, their currency and their country.

Here are 10 things to know in order to understand what is going on right now:

Greece received the first multibillion-dollar bailout deal in 2010, months after the country had announced that it would no longer be able to pay for years of accumulated debt. Determined to save the eurozone member state from financial collapse, the International Monetary Fund, eurozone governments and the European Central Bank -- often collectively referred to as "the troika" -- provided the cash-strapped country with a total of 240 billion euros in two bailout rounds in exchange for a range of reforms, including spending cuts and tax increases.

While the funds saved Greece from financial collapse and a possible exit from the eurozone, Greeks did not see their economy fully recover and many were hit hard by the imposed public spending cuts.

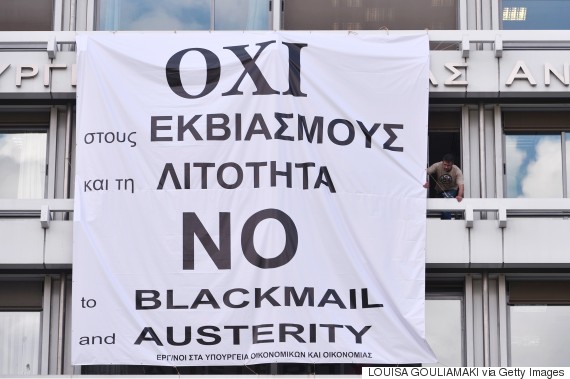

In January, the left-wing party Syriza was voted into power amid promises to renegotiate the bailout program and roll back austerity. In the meantime, the clock to repay the bailout funds was ticking.

In February, Greece and the troika agreed to extend emergency funding for four months and renegotiate the conditions of the bailout deal. Greek negotiators participating in the talks aimed to unlock a crucial 7.2 billion euro tranche that Athens needed in order to pay off 1.6 billion euros it owed the IMF by June 30. The creditors, on the other hand, demanded new budget surplus targets and reforms in exchange for new bailout funds.

Last weekend, the negotiations took a dire turn. Greece's Prime Minister Alexis Tsipras slammed the creditors' final offer, but asked the ECB to extend Athens' emergency credit past the June 30 deadline so he could put the creditors proposed plan up for a popular vote. The ECB refused and Greece announced it wouldn't be able to make its payment to the IMF.

While the first two bailouts have kept Greece from a potential default, most of the money involved ultimately didn't end up with the Greek people. According to Greek news site Macropolis, only 11 percent of the bailout funds have gone toward government services. Instead, a large part of the funds was used to pay off private creditors that held Greek bonds and the same lenders who gave Greece the bailouts.

“The rescue that took place in the banking sector was really more of a rescue of northern European financial institutions that had overexposed themselves to Greece,” Vicky Pryce, chief economic adviser at the analyst firm Centre for Economics and Business Research, told The WorldPost.

On Tuesday night, Greece missed its deadline to repay 1.6 billion euros to the IMF, becoming the first developed nation to miss an IMF payment.

The IMF declared Greece in arrears. While this left the country technically in default to the IMF, the organization avoided officially declaring a default -- which would have sent a stronger warning sign to eurozone countries and lenders about the Greek economy. The IMF also said it would consider Greece's last-minute request to extend its repayment, though that process was expected to take several weeks.

Greece still has a long list of debt obligations to meet in the coming months, and the missed IMF payment has raised fears about how Greece will pay its other creditors.

One of the upcoming deadlines is a 3.5 billion euro payment to the ECB, due in July. Greek banks rely on the ECB's emergency lending assistance program to stay afloat, and the bank may cut off its assistance if Greece doesn't pay up. The risk of default then looms large again.

The troika broke off negotiations over the weekend after Tsipras called a referendum on the proposed bailout terms -- and urged his fellow countrymen to vote "no." But the wrangling goes on.

While Greece no longer has access to bailout funds after the previous program expired Tuesday, the government is still trying to reach a new deal. Tsipras on Wednesday said he'd accept the deal with some supposedly minor changes, but Germany countered the offer was too little, too late.

The much-discussed "Grexit" -- a Greek exit from the eurozone -- is one possible outcome of the crisis. If Greece's coffers run dry, it may make sense for the country to revert to its pre-euro currency, the drachma, and leave the eurozone. Greece could also be forced out of the eurozone by other European leaders concerned about the ripple effect of the economic chaos. This has never been done before, and the eurozone doesn't have any explicit rules on the subject, so its fairly unclear how this might work.

But there are plenty of other possible outcomes. A bailout deal may yet emerge. Greece might persuade other creditors to keep it afloat. Even if Greece runs out of money, it could stay in the eurozone, and issue either a parallel currency or a form of IOU notes, to make its domestic payments.

Greece's economy is in shatters. One million jobs were lost within a period of six years. The country's economy has shrunk by more than a quarter between 2009 and 2013. Greece now has the highest unemployment rate in the European Union, with one in four people out of work and half of young people without a job. Greece is also the only European country where the minimum wage has dropped.

On Monday, Greek banks and the country's stock market remained shut as officials feared a run on the banks ahead of this week's deadlines. Supermarkets and petrol stations ran out of supplies. Pensioners went without their monthly stipend.

Economists warn that leaving the eurozone could send inflation spiraling. Whether there is a Grexit or not, a prolonged economic crisis could cause even more Greeks to lose wages, jobs, pensions and savings, likely shaking long-term confidence in the financial system. Some analysts warn of social unrest and political instability if Greece's economy collapses.

The impact on the rest of the world is harder to predict. While most economists believe the immediate impact of the crisis to be fairly contained inside Greece, heightened uncertainty could disrupt financial markets and shake confidence in the euro currency.