One of the most pressing issues for our society today is income inequality. That is, the rich get richer while the poor struggle to access meaningful opportunities. Janet Yellen, President Obama, and former Secretary of Labor Robert Reich have all cited it as a growing concern for our economic well-being.

Equally troubling is the sense that the primary path to generational advancement - access to quality education - is increasingly a product of privilege. In an age of hypercompetitive college admissions, it's largely households that can afford SAT classes and developmental opportunities that can send their children to top schools. College costs have skyrocketed, with the price of a college education almost doubling since 1998, leading to a record $1.2 trillion in educational debt and a crisis in affordability. Meanwhile, those who are fortunate enough to graduate from a top school often don't pursue activities that benefit society or create additional opportunities for those around them.

Underlying this is the logic of meritocracy. Because admissions to "good" schools are based on supposedly objective qualities, the whole arrangement has a stamp of propriety and inevitability. That is, if you're smart and worked hard enough, you'd be a beneficiary of the system. If you complain, it's because you weren't smart, industrious, or "meritorious" enough.

What started out as "Everyone can get ahead if you work hard" has turned into "get into the best club you can and then try and pass the membership along to your kids." Society is bifurcating into people with resources and social capital and those without. Mobility between the two groups is low and getting worse, and is persistently low among underrepresented minorities - which is going to be hugely problematic when those minorities comprise the majority in about 30 years.

A lot of people agree with the general set of problems listed above. The question is, what can be done about them?

The most commonly discussed remedies to income inequality rely upon government. People who get paid more, particularly on capital gains, could pay more taxes. Big inheritances could be taxed and discouraged. At the low end, the federal minimum wage could go up from its current $7.25 an hour. Universities could control costs better and let in more people of diverse backgrounds to try and equalize opportunities. We could invest more heavily in education at every level to close the achievement gap between rich and poor.

People can agree or disagree with these particular suggestions - many would find at least some of them reasonable. But passions run high on both sides of each issue. The big ones remain largely hostage to our political system and difficult to implement, in part because they require some individuals and institutions to 'vote' against their own interests. They also often put the government in the role of redistributor.

I recently spoke to a member of Congress who said quite openly that the political system is designed to resist any significant policy changes. It's more true now than it ever has been.

Asking the government to fix our economy is like asking an editor to fix a movie, but in this case the editor's not even of one mind.

There is, happily, a non-redistributive approach to address income inequality - one that doesn't rely upon government. It's to grow the pie. That is, create more decent jobs that pay more.

I ran an education company in New York that was founded in 2001 - as it grew we hired over one hundred teachers and employees. One of them was Beretzi, a Dominican-American woman from the Bronx. She was hired as Assistant to the Office Manager, an entry-level position, right after she'd graduated from SUNY Albany. She excelled, got promoted numerous times over the next 7 years, and climbed all the way to Director of Operations, eventually taking a similar management role at another company. Her family life was transformed; she helped several of her relatives out as her career developed.

If a new company is formed, it hires people and creates jobs in its community. As it grows, people's opportunities multiply and wages rise. Inequality diminishes as more people get pulled into good jobs.

Two-thirds of new net jobs in the U.S. are created by new firms that are less than five years old. If you want to ease income inequality, what you really want are more new firms being founded and employing people. Even a company that only hired, say, engineers, would support additional unskilled service jobs in the community for nannies, cleaners, hairdressers, bartenders and the like - between 2 and 5 additional jobs per engineer. New companies create opportunities at every level, which in turn increases the tax base and leads to better access to education.

This 'grow the pie' approach has the advantage of being universally appealing - who doesn't want more jobs? Let's make this happen!

Unfortunately, economic dynamism and small business formation are at multi-decade lows. All the hype around startups overshadows the fact that fewer people work on starting new businesses today than at any point since 1978. The number of people under the age of 30 who own shares of a private business is at a 24-year-low, and the proportion of new companies to all businesses has been nearly cut in half between 1978 and 2011. Over the same period, the proportion of American workers employed by companies less than five years old dropped from over 20 percent to less than 11 percent, and in 2008, for the first time, the majority of U.S. workers worked at companies with 500 or more employees.

People who understand these numbers understand that lower rates of business formation are an economic disaster that will have repercussions for decades to come. Reversing these trends is the central economic challenge of our time.

What can be done? Broadly speaking, new companies need three things to take form and grow: Financial capital, team and talent, and product-market fit. Policy discussions often center around the money - provide tax incentives and streamline investment and thousands of new businesses will bloom.

However, if you talk to any entrepreneur, he or she will tell you that team and access to human capital is the most important factor in his or her company's success. If you have the right team and talent, you can get the money you need and devise your product or service. Intellectual capital drives financial capital and growth.

Take Kickboard, a promising education software company in New Orleans with 20 employees. What does it need to grow? Its CEO, Jen Medbery, is looking for talented engineers to improve its product, passionate salespeople to market and sell it, content developers to devise curricula, account managers to troubleshoot for teachers, and operations people to design better processes. What Jen needs is brainpower.

Imagine if Kickboard and every other promising startup and growth company in the country had a battery of our top prospects lined up to work there. The odds of success would go up for each of them - we'd see a lot more job growth and innovation as a result.

Where is our talent currently heading? Let's assume for a moment that we use educational achievement as a rough proxy for intellectual capital.

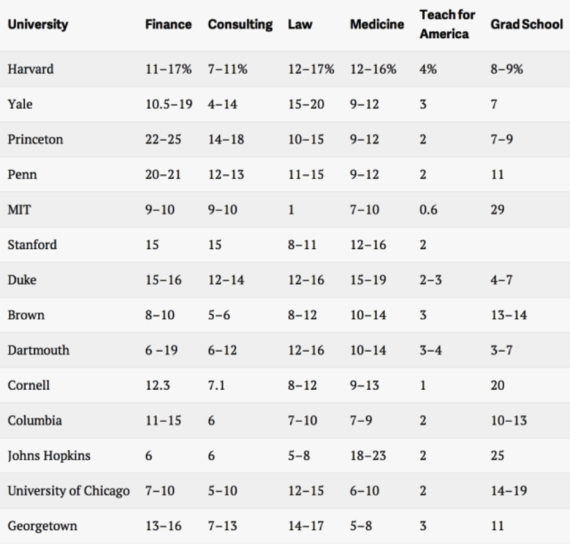

There are six predominant paths. 3 are easy to identify and apply to and are subsidized by the federal government: law school, medical school, and graduate school. The other 3 paths benefit from tens of millions of dollars in annual recruitment resources: financial services, consulting and Teach for America. The primary destinations, particularly for banking, consulting, and law, are New York City, San Francisco, Boston, Washington D.C., Chicago and Los Angeles. A Kauffman Foundation study found that graduate level technical students were less likely to start a business today because they are now more likely to be recruited to professional services. Our talent is doing six things in six places, little of which directly leads to new business formation or is likely to alleviate income inequality.

If our problems could be solved by having brilliant bankers/consultants/lawyers in our coastal cities, we'd be in great shape. But these professions generally provide a services layer to more mature businesses without forming new ones. We're investing in a ton of icing on top of a shrinking cake.

What if we were to challenge our top graduates with this: How would you like to ease income inequality and learn how to build a business? What we need you to do is help create some jobs. There are hundreds of newly formed companies around the country that need your talents to grow and succeed. With your help and the help of your classmates, some of these companies could grow to employ hundreds of people and create thousands of new jobs. We'll give you the training, network, prestige and community you seek as a young person. And then, if you want to start a company we'll support you. Let's revitalize the country and economy by having you help build companies - it will help lead to both the career and society you want.

It turns out, they LOVE this challenge. We've been posing it to young people for the past few years with Venture for America and we already have ten times more applicants than we have spots.

Brian Bosche's an example. After graduating from Dartmouth with an Anthropology and Environmental Studies degree in 2012, Brian joined VFA. He moved to Detroit to work at Bizdom, a small business incubator funded by Dan Gilbert. He noticed that small companies often struggled to both create and manage video content. Two years later he co-founded a company, TernPro, that provides video content management services to small businesses. After just six months, his company already has six employees in Detroit and is poised to grow and create more jobs.

There is an army of young people like Brian waiting to build things. Imagine if we were to meaningfully redirect the flow of intellectual capital to early-stage growth firms in Detroit, Baltimore, New Orleans, St. Louis, Providence, San Antonio, Cincinnati, Cleveland, Nashville, Philadelphia, Pittsburgh, Columbus, Indianapolis, Charlotte, Miami, Denver and other cities around the country. The rate of job growth and innovation would measurably increase. Companies in healthcare, energy, education, transportation, retail, technology, agriculture and every other sector would have direct access to the talent they need to grow.

We'd also be training our graduates to become operators and the kind of people that would be more likely to solve problems and start businesses themselves. Entrepreneurs beget other entrepreneurs. Spending two years working at a growth company in Detroit produces a different sort of person than two years as a lawyer in New York.

Let's get our talent working on the challenges of this era. The message is to build something.

If we want to address income inequality, we need to spur new business formation and dynamism. To do this, we don't need the government - we just need to get our smart people building things again.

A version of this post originally ran on http://www.entrepreneur.com/.