Aren't your kids the absolute most important thing in the world to you?

Is there anything you wouldn't do to make sure they grow up happy and healthy? And aren't you completely dedicated to getting them educated, imparting solid values, and helping them pursue their passions?

Of course you are.

What about their financial security? Many parents assume that will be determined later, when they're grown, and out in the working world.

But the fact is, there's a powerful, time-tested technique you can use right now to help secure your child's financial future:

Buy that child a life insurance policy.

To be clear, this has nothing to do with a death benefit. Rather, it's about using the power of compound interest and time, within the tax-advantaged environment of a life insurance contract, to build real wealth over your child's lifetime.

For the best results, you need to purchase a whole life, cash value policy from one of the handful of elite carriers in the marketplace. These companies are financially solid, consistently out-perform the also-rans, and have long track records that prove their mettle through good times and bad -- a few were in business before Abraham Lincoln was president.

But before we go further, let's take a moment to explain how whole life policies work. It's just over 100 words. I know you can do it without your eyes glazing over. Ready... GO!

- A whole life policy has two components, the Death Benefit and the Cash Surrender Value.

Did that make sense? Don't just nod along so you won't seem dense. Whole life insurance can be confusing, and these are new concepts to most people; make sure you understand the basics.

Now, let's look at ten reasons to consider purchasing a whole life insurance policy for your child:

- He or she gets life insurance at the youngest age and best health possible, meaning premiums are the lowest they can possibly be.

So what does it cost, and how much does it produce?

Let's look at an actual policy projection from one of the top companies, based on the interest and dividend it's currently paying (the dividend is not guaranteed, but has been paid consistently since the 1860s). The policy is on a newborn boy, with monthly premiums of $500 ($6000 per year). The premiums are payable for 20 years, meaning a grand total of $120,000 will be paid into the policy.

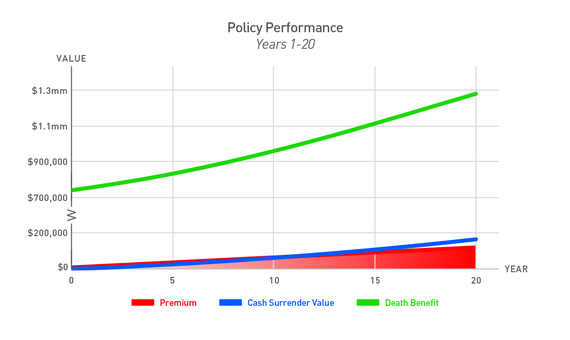

Here's a graph covering the first twenty years:

The Death Benefit, in green, starts a bit above $700,000, and by year twenty has grown to just under $1.3 million. Cash Surrender Value, in blue, has grown to about $165,000 after twenty years. And the total premium paid in is $120,000 (in red).

So after twenty years, $120K has gone in, producing a CSV of $165K. It's a positive return, but minimal. Remember, though, this is a long term play. And no more premiums are due -- not another penny goes into this policy. Guaranteed.

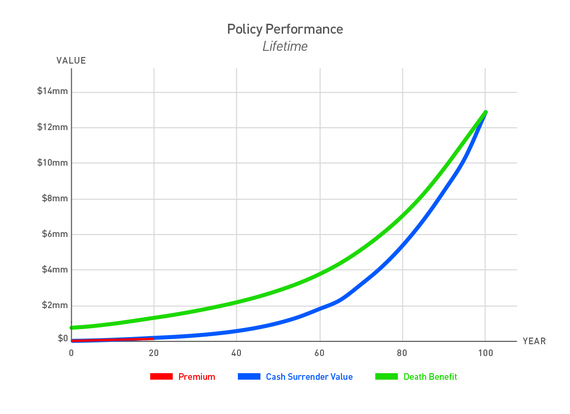

Now let's look at the policy over what may be the child's lifespan, 100 years.

See that little bit of red in the bottom left? That's the total amount of premium paid in. Ever. See the blue Cash Surrender Value and green Death Benefit? Do you like the direction they take later in your child's life?

Check out the green Death Benefit at age 30, when that boy may be starting a family and wants to be sure his wife and kids are protected, just in case.

Look at the blue Cash Surrender Value at age 50, when he may need some help sending those kids to college.

Take in the CSV that will be available at age 80, when a health expense like long term care may crop up.

And if that boy dies at age 95, he will leave his loved ones over $11,000,000. That's more than 90 times the amount paid into the policy.

To be sure, $500 per month is significant, perhaps beyond the means of many young couples. But no matter what premium level you can afford, the performance is proportional.

And if mom and dad can't handle the premiums, maybe grandma and grandpa can. Many grandparents are looking for a chance to help out -- this approach allows them to transfer their wealth simply, safely, and tax-free. And if there's a concern about Nana and Pop-Pop committing to twenty years of premiums, some policies can be fully paid in ten.

Please note, this article is not intended to suggest that life insurance be the only financial vehicle parents employ for their children. Diversification is a fundamental part of good financial planning.

But because of its tax-advantaged nature, and the tremendous leverage a policy generates, whole life insurance is certainly worth considering. It's a powerful way to help ensure the financial future of your child, as well as future generations of your family.

This article is a very basic look at how a juvenile life insurance policy could benefit a child, and is offered for illustrative purposes only. To determine the advisability of actually purchasing a policy, individuals need to consult a qualified, licensed financial advisor. If you have questions, please leave them in the Comments Section below. You can also email me at barry@barrygold.com.