The Brookings Institution recently published a report that finds little evidence that a student loan bubble exists. This has caused a dust up with those who believe a bubble is already here. Before we run for our blogs to attack each other, can we at least agree if a student loan is even a loan?

If we just look at its skeleton, then a student loan is clearly a loan. It has an amount, a lender, a borrower, an interest rate, repayments and penalties. But strangely, the body of the loan and the blood that makes it work, that gets it repaid, is missing.

Start with the financial aid letter that notifies a student about a loan. No loan terms or document are sent. Loans and grants are listed together in mishmash. No mention is made of the fact that unlike other loans you can't get out of a student loan in bankruptcy. How about a loan officer with whom a family might consult? They don't exist.

Unfortunately, the aid letter sacrifices transparency to make things as nonthreatening as possible which hides the true burden of the loan. This is no way to begin a productive relationship between a lender and a borrower.

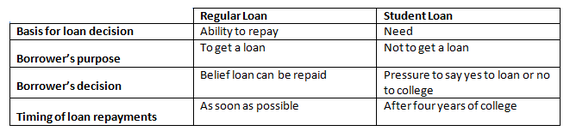

Creditworthiness is the heartbeat of a loan. All loans must have it to thrive. Student loans replace creditworthiness with a measure of income: the lower the income, the bigger the loan. Poverty may be a fine criterion on which to base grants, but it provides no gauge for repaying loans.

Another key difference is that a borrower sets out to get a loan whereas a student borrower does not want a loan. Instead, the student wants financial aid with as little loans as possible. A borrower's voluntary decision to take a loan reflects a belief that he/she can repay it, while a student borrower is forced to either take the loan or forego college. Good loan discipline has the borrower making payments as soon as possible so as to get into a routine. By comparison, students forget that they even have a loan as four college years go by before they must make a payment. And for most loans, interest accrues during those 4 years, silently adding to the burden that prompter payment would have avoided.

All of these differences between regular loans and student loans are really violations of good loan practice. They prevent the student from ever taking ownership of their loans. As a consequence, many students feel their loans are unjust. This is reflected in the poor repayment performance. Only 39 percent of 37 million student borrowers are current on their loans, a terrible record compared to credit card debt, mortgages, or car loans.

The administration has declared many student loans dead by forgiving them. Senator Warren condemns the government-paid debt collectors for being ambulance chasers, trying to earn a fee off of every lifeless student loan they find. Loans that are forgiven are really grants. If we want to base financial aid on grants we can simply do so rather than issue loans to later forgive them. Issuing loans instead as grants may or may not be wise but issuing them as loans then later forgiving the loans is just dumb.

So what is it: Is a student loan a loan? For those students who understand their obligation through all the fog and repay them, sure it is. But for most students, a loan is something they try to forget. One thing is certain, however, the lender of all these loans is you and me. If we can't breathe life back into student loans, we'd best take them out back and bury them.