By Kaitlin Butler, CommonBond

The FAFSA, shorthand for the Free Application for Federal Student Aid, is the gateway to financial aid for many graduate students in the U.S. It's available online or by mail -- for free -- through the federal government, and is used to determine your eligibility for all federal loan programs. Many schools require you to complete the FAFSA as part of your financial aid package. If you're going to grad school and new to the world of financial aid, or want a refresher, this guide will walk you through what you need to know to complete your FAFSA.

The Overview. There are five sections to the application: 1) Student Demographics, 2) School Selection, 3) Dependency Status, 4) Parent Demographics and 5) Financial Information. We'll walk you through the highlights of each, though with less attention to the "Parent Demographics" section, which is almost always optional for graduate students.

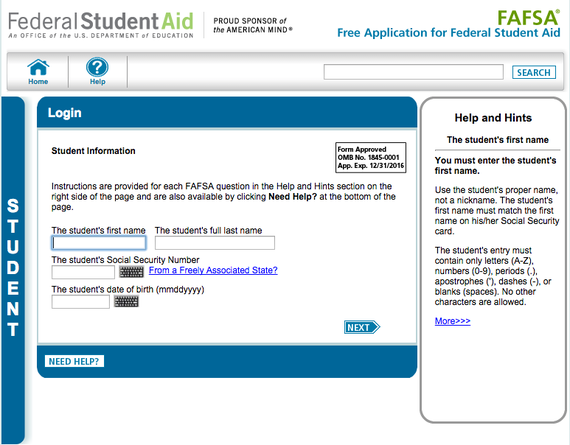

Getting Started. You'll first need to head to https://fafsa.ed.gov/ and click "Start A New FAFSA." Have your Social Security Number at the ready, because you'll find a screen like this.

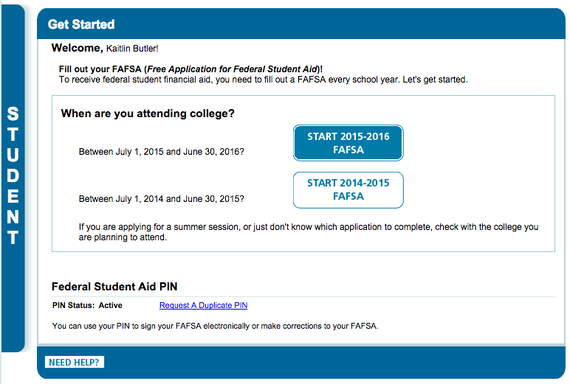

You'll be cautioned to review your information for accuracy before moving to the next screen, where you select the academic year for which you're applying for aid. (If your graduate program is longer than one year, set a calendar reminder now to renew your FAFSA next year.) Note also that the search bar on top does not search your application, but rather provides access to help topics on FAFSA's site.

Easy! You'll be directed to a password screen, and then the introductory page with answers to some FAQs. Now you're ready to begin the first section. Note that in addition to a password, the FAFSA will keep your personal information safe with a PIN. If you lose or forget this number, you'll need to visit the PIN homepage to replace it.

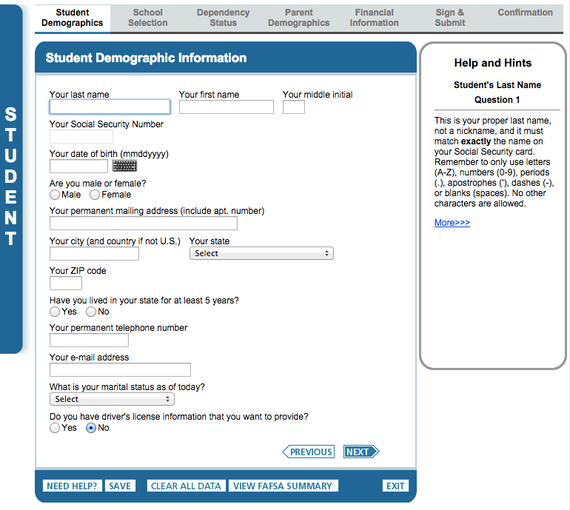

Student Demographics. The Student Demographic Information page, shown below, is the first of several pages that, primarily, determine your eligibility for aid. This is a good time to learn how to use the online FAFSA. You can save your FAFSA and exit at any time, clear all your data or view your summary from each page. When you click into a field in the form, the Help and Hints box on the right will update with relevant information for that field. Because you're a student, you'll always see the dark blue vertical "Student" bar on the left unless you choose to fill out the "Parent Demographics" section, in which case you'll be taken to the Parent application screen.

Beyond the questions on the screen above, you'll be asked questions about your U.S. citizenship, your and your parents' high school educations, your interest in work study and any past federal aid you've received. (You'll also be asked about any convictions for illegal drug charges that you received while on federal aid.) For a handful of questions, such as the conviction question, the FAFSA will confirm whether you're still eligible to apply for federal aid or not after you fill in your answers. You might also receive an alert that your FAFSA information is transferable to your state's student aid application; if this is the case, you'll only be able to make this transfer once your FAFSA is complete. After you fill in your high school, you're ready to move onto the next section.

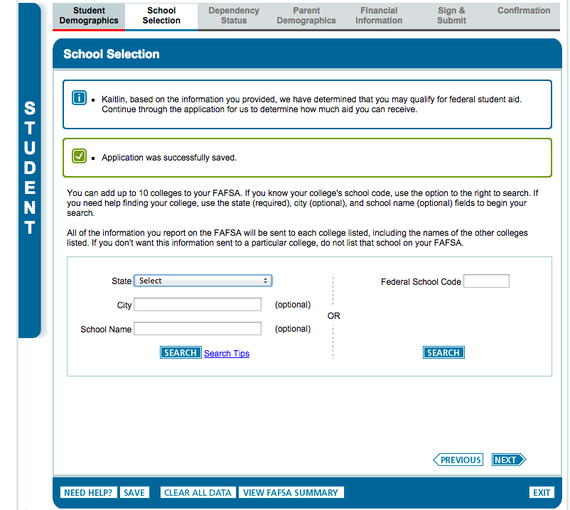

School Selection. This is a two-page section in which you select the school or schools you're attending this fall. These are the institutions that will receive your FAFSA. You can use the FAFSA search on the left or do a quick Google search to find your school's federal code.

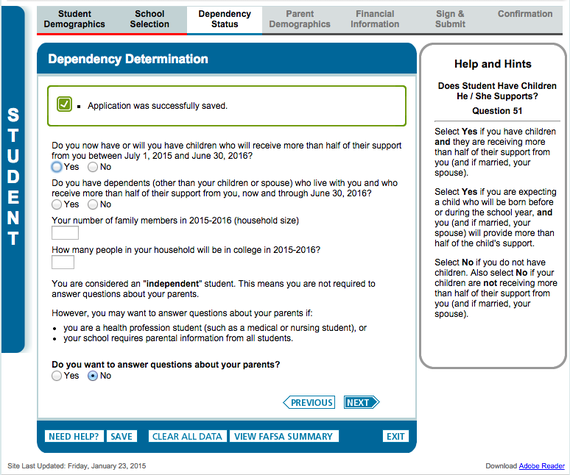

Dependency Status. This short section is primarily geared towards students who are heading to grad school with dependents. After a handful of questions, you'll be able to select whether you share information about your parents - information similar to what you shared in your own "Student Demographics" section - or head straight into the "Financial Information" section. If you're unsure whether or not this section is the right move for you, reach out to your financial aid office. Generally, however, graduate students are not asked to file this. (Graduate students are almost always considered independent students and therefore not required to submit this section.)

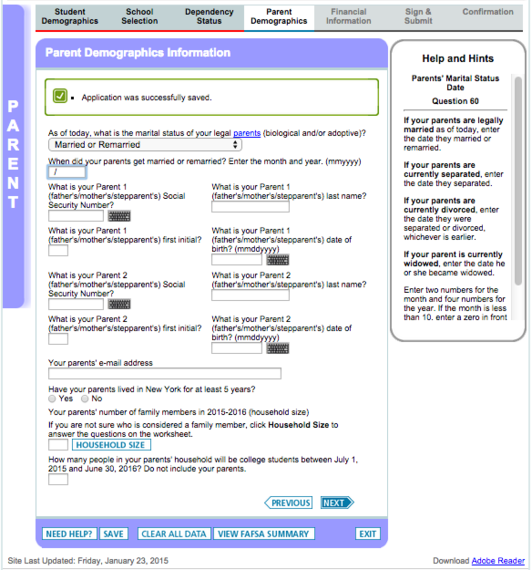

Parent Demographics. As you can see from the screenshot below, you'll need to provide fairly detailed personal information for your parents if you fill out this section. If you think you might benefit from filling this in, check with your financial aid office first to see whether they'll accept this section or not.

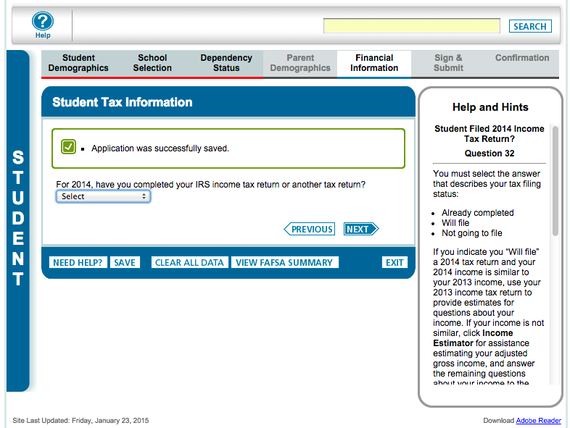

Financial Information. The final section of the FAFSA goes much more quickly for students who have already filed their tax returns, as the following screen makes clear. If you've filed your taxes, you'll be able to use the IRS Data Retrieval Tool to pull in all the financial information the government requires to assess your financial need.

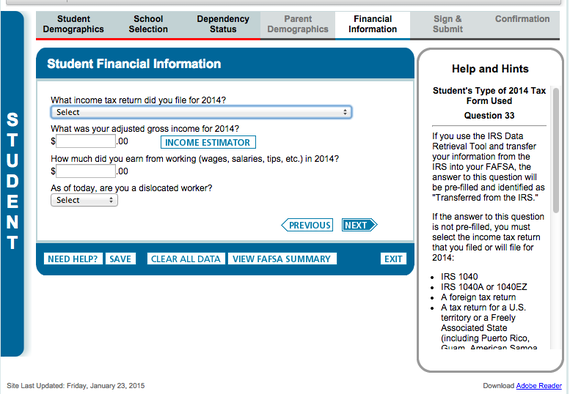

If you haven't filed your taxes, or you've filed them recently, this tool may not work. (The FAFSA specifically states that your tax data might not be available if you've filed within the last 3 weeks electronically or within the last 11 days by mail.) In that case, you'll face a series of questions that read similarly to a tax form, starting with the following.

What information will helpful to make this section a breeze? As the Help bar notes, gather tax materials like your 1040 in order to provide the government with a consistent financial picture.

Once you've finished disclosing your financial information, congratulations! You're done, and you'll be able find out if you're eligible to receive federal loans. If you're interested in exploring your private loan options as well, or just have more questions about how loan financing works, contact our Care Team at care@commonbond.co or call us at (800) 975-7812. We know the student loan process can feel overwhelming at times, and we're here to help.

Kaitlin Butler is Content Manager at CommonBond, a student lending platform that provides a better student loan experience through lower rates, superior service, a simple application process and a strong commitment to community. CommonBond is also the first company to bring the 1-for-1 model to education and finance.