The federal budget is a very big and complex document, but it sets out really important policies and spending priorities. Unfortunately, like the spending bill last December -- called the "CRomnibus" where the swaps push out was repealed -- it is also where Wall Street's too-big-to-fail bank lobbyists sneak in their special interests.

This time, the House Republican budget calls for repealing the "Orderly Liquidation Authority" section of the Dodd-Frank financial reform law and has special "reconciliation" instructions for the House Financial Services Committee to move the repeal super-quickly. While it hasn't generated the same amount of attention as other misguided proposals in the budget, this proposal is a gift to the biggest Wall Street banks and a return to the days that lead to the 2008 financial crisis.

Passing this repeal would lead to another series of disorderly bail-outs of Wall Street's biggest too big to fail firms just like last time. That's because, in the absence of these provisions, whenever the next crisis occurs, these gigantic, dangerous firms would be able to demand a bailout from taxpayers or we would face a collapse of the financial system and a second Great Depression. That's exactly what happened in 2008 and, to avoid that collapse and economic wreckage, Wall Street was bailed out by the government and taxpayers, which is going to cost the U.S. more than $12 trillion. Here's why.

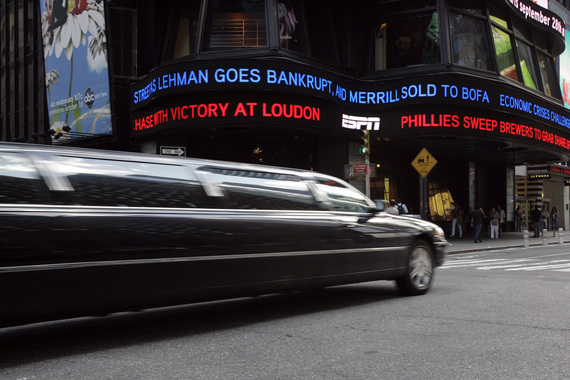

Orderly Liquidation Authority is a direct response to the chaotic failure of Lehman Brothers in 2008, the event that triggered the financial crisis. When Lehman was collapsing into bankruptcy, financial regulators lacked the tools to facilitate an orderly liquidation of the bank. It was bailout or bankruptcy. No middle choice was available to temporarily bail out the bank to reduce the systemic risk and then liquidate the firm over time in a way that prevented the financial crash from spreading, thereby ending the crisis. As a result, Lehman's failure was catastrophically disorderly. It triggered the contagion leading to the financial crisis that resulted in trillions of taxpayer dollars being handed over to the biggest banks on Wall Street and led to the worst economic disaster since the Great Depression.

To stop that from happening again, the financial reform law created a process to facilitate the orderly wind-down of a major financial institution. To do so, the law gives the FDIC the authority to take over a failing institution, temporarily support it with funds from the Deposit Insurance Fund, and if necessary with a temporary loan from the Treasury, so that it can be liquidated over time in an orderly fashion that doesn't cause a panic and collapse of the financial system and economy. Once the crisis and panic have been stopped, the FDIC is required by law to recover any funds expended from the financial industry. While many advocated for the Dodd-Frank Act to charge the financial industry an upfront fee to create a fund before a future crisis hits (so that the government wouldn't have to even provide temporary funding before being paid back), the biggest banks lobbied so hard against that sensible idea that the Orderly Liquidation Authority was the option that that could pass Congress.

While we haven't yet seen this new authority at work during a crisis, there is simply no reason to return to the days of Lehman Brothers, when policymakers were faced with a devil's bargain of either bailing out the banks with taxpayer money or fueling the crisis through inaction. We know from that experience, when policy makers and elected officials are faced with such horrible choices, they will choose to bail out the banks every time. That is exactly what Wall Street wants: remaining too-big-to-fail so that they have to be bailed out by taxpayers when their recklessness causes their firms to collapse, conveniently after they have already pocketed billions in bonuses.

That's why the effort to repeal Orderly Liquidation Authority would be such a gift to the biggest Wall Street banks. Without that authority, Wall Street would be assured that no matter how big the risks they take, the American taxpayer could be forced to bail them out. With the authority, Wall Street firms would be liquidated in an orderly fashion so that they aren't allowed to threaten the financial system, our economy and our standard of living.