It's interesting that most of the money advice we get warned about actually makes very little difference.

For example, have you heard money experts shaking their fingers and nagging you about these?

- "Stop buying lattes!"

- "Keep a budget!"

- "Owning is better than renting. Why throw away money on rent?"

Saving $3 on lattes actually doesn't add up to that much. Almost nobody keeps a budget. And you're not throwing away money on rent -- buying a house is usually a poor investment.

It turns out that most people parrot these tips because they're easy to share and most people nod, saying, "Yeah, I really should do that..."

But we already know these things -- yet we still don't do them!

There's a better way. Instead of worrying about 50 things we "should" do -- and doing none of them -- let's focus on 3 money mistakes that cost of hundreds of thousands of dollars over our lifetimes. If we can avoid these, we're well on way to living a rich life.

Mistake #1: Worrying about minutiae

It's easy to worry about keeping a budget or cutting back on lattes. After all, that's all the media tells us to do!

I prefer to focus on Big Wins. Big Wins are the 5 or 10 things that, if you get right, you'll never have to worry about small details.

For example, if you negotiate your salary (even in this economy), you can earn thousands of dollars for a few hours of work. Here are the exact words to use in a salary negotiation.

If you stop worrying about cutting back on everything, and instead start a side business, there's no limit to how much you can earn.

When I published my book back in 2009, I included word-for-word scripts on how to eliminate hundreds of dollars of fees from your credit card, bank account, and even cable company. The result? Thousands of readers are paying exactly $0 in monthly and late fees. The credit card companies hate me for this! Here are the actual word-for-word scripts to negotiate hundreds of dollars with one phone call.

Mistake #2: Trusting investing "experts"

Everywhere we turn, we're told the things we should do: Invest in a Roth IRA! Get an annuity! Invest in equities!

And yet, 80 percent of money managers fail to beat the market. That's remarkable, since you can actually get better performance, for a lower cost, than these so-called "investing experts."

Why do we continue to pay larded-up fees to these under performing managers? Because we don't know how to invest ourselves. We're so overwhelmed with investing "must-dos" and "no-nos" that instead of picking up a good book and learning how to invest over a weekend, we believe investing is about picking stocks (it's not), and that we need to become numerical wizards to understand how investing works.

This isn't true. When it comes to investing, it's simpler than you think. Today, there are terrific, low-cost investments called target-date retirement funds. You simply tell them when you plan to retire (assume age 65), and they'll automatically allocate your investments, making them more conservative as you get older. All you have to do is automatically transfer money there each month.

Remember, most of us don't need to delegate our finances to a financial advisor. With just a few hours of work, we can save hundreds of thousands of dollars over our lifetimes.

Mistake #3: Not automating your money

Which brings me to mistake #3 -- using "willpower" to try to save money.

It's interesting that most of us say things like, "This month I'm going to buckle down" and "Yeah, I really need to try to save more..."

If you're depending on willpower, you've already lost. Instead, use systems to automatically save money -- and leave yourself money to spend, guilt-free.

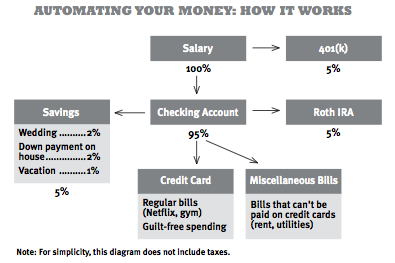

Here's a simple system you can use to automatically make your money flow to the right places:

Notice how money is automatically going where it needs to go -- to investment accounts, to savings (and even sub-savings goals), and then guilt-free money you can spend on anything you want.

Compare this to people who don't know where their money goes, and simply pay bills as they come in.

You can use this exact system to spend less than 1 hour/month on your finances -- and still automatically pay bills (never missing a payment), build credit, and be in total control of your money. Here's a quick 12-minute video I put together to automate your finances.

And that's it! If you master these 3 Big Wins, you don't have to worry about minutiae like cutting back on lattes. You'll know your money is automatically going where it needs to go, and you can get on with your life.

Ramit Sethi is a New York Times bestselling author who writes about personal finance, psychology, and careers. Learn the word-for-word scripts to negotiate your salary, lower your cable fees, and earn more money at http://www.iwillteachyoutoberich.com.