While compiling this article, I gathered information from a variety of reliable sources, including the St. Louis Federal Reserve website. This data is for guidance and illustration purposes only. With this in mind, I personally do not warrant the accuracy of this data. The data reviewed in this article also include different periods of comparison. While they do not always align perfectly, they are close enough to illustrate the primary point of this article. Together, the information considers the different asset classes in your portfolio. This article is also designed to be informative, but not a direct investment recommendation.

After dealing with the death of a family member, as the estate's executor, I discovered a probate valuation of the deceased's home from nearly 20 years ago. Over the past 20 years, the home has increased in value by approximately 175 percent. This revelation got me thinking about asset classes and how they generally perform over a 20-year period.

In my research, I came upon the Case-Schiller 10-city U.S. residential real estate index. This index showed a growth in asset classes by approximately 141 percent of a similar period, which was still on track with my family's number. With the family member's home being in the UK, and this chart covering U.S. cities, I expected some difference.

Looking at the 20-city index, which has a more nationwide approach, or simply picking an individual city for comparison can also delivered skewed numbers. Due to the importance of location in the real estate market, different homes may experience different growth, just from being in a desirable area. In researching this particular topic, I came across an article that proved real estate outpaced the S&P500 in a given period, which indeed it had in the article. However, it is important to note that the real estate market picked was the San Francisco Bay area, a notoriously competitive real estate market.

If we look at the S&P500 index for approximately the same period, it grew by roughly 330 percent. Lastly, gold provided a return of around 245 percent over a comparable period (London fix in $U.S.)

All nice numbers, but what do they really mean?

First, only two of these asset classes have the ability to produce income. Real estate can earn rent. The S&P500 pays dividends, with an average over the period of about 1.88 percent a year. However, gold generates no income at all.

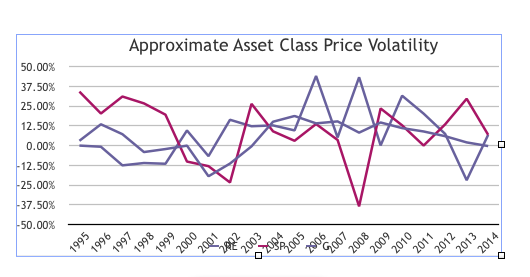

Second, these asset classes demonstrate very different price volatility over the 20-year period. This can be roughly demonstrated on an annual basis as:

This chart shows that, traditionally, real estate had the lowest year to year price volatility, the S&P had the most, and gold was somewhere in-between, sometimes moving in line with the other asset classes, but sometimes materially in the opposite direction. That's important to note for two reasons:

- Some people are way more sensitive to volatility than others, and

- Sometimes an asset class hedges (offsets) losses in another.

Real estate has some other advantages that gold and stocks do not have as well. Primarily, that real estate may be depreciated for tax purposes. I have not accounted for tax in this analysis, but it is an important consideration. Gold and real estate also attribute to volatility in a way stocks cannot -- they likely will never go to zero value. A single stock can plummet this low, and they have in the past, but this is, in fairness not likely of the S&P500, as it is diversified in itself.

In these comparisons, gold should probably be seen less as an investment per-se, than a store of currency-hedged value or, similar to, insurance.

This short article does not presume to tell you which asset class you should place your money in, as different people have different goals and needs with their money whether it is cash flow, capital appreciation, safety, avoidance of volatility or anything in between. These needs can change at different stages in your life and only you can determine what those needs are. Many, likely already own more than one of these asset classes, if not all three, in different proportions which is why looking at their appreciation value, over time, is so important.

Ultimately, what you will need to make that determination for yourself is give yourself the proper financial education. The cost of gaining that education through trial and error can be costly. This is why we proudly offer some of the best practical financial education services in the world, to help people get the financial education they need to find the long term success they deserve.