It is already known that humans are coping with a number of cognitive biases when making a decision or searching for a solution. After going through the list of all known human biases, the recognition of human's illusion of control becomes strong. It is like reading about possible illnesses and thinking being ill as well, one will confirm each bias in oneself. The first question which comes to mind is what is the reason for that.

It is a fact that some of the biases, like overconfidence, prejudgment and ego, are part of human's personality, which is determined genetically or has been formed by one's environment and experience. Biases are reinforced or diminished by one's background, like cultural roots, personal experience and environmental aspects. Understanding the culture from which people come from will help to understand latent biases and to find ways to avoid them.

For instance, successful networking with clients creates strong and lasting relationships. In a time of globalization, the word "cosmopolitan" tends to be used more often, due to the encounter with people that live in different countries and speak different languages and therefore understand proper behaviour in different cultures. In order to build relationships with different types of clients, it is necessary to understand their background. A large part of our culture was inherited from our ancestors. Parents and grandparents have always influenced a nation in its culture of establishing principles and values.

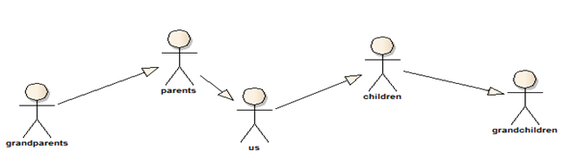

Every person is influenced by four generations during its lifetime, which means that its beliefs and values are shaped by grandparents, parents, itself (thoughts, experience and environment) and its children and grandchildren. If we define each four generations as a cycle and call it closed cycle of influence, we can approximately see the path of influence and become more aware of a culture.

Considering the knowledge about longevity (Buettner, 2010) from people ageing more than 100 years and assuming that people from a nation outside a so called blue zone have an average life expectancy of around 70 years, the number of cycles that shaped a culture can be estimated. Looking at the closed cycle of influence is a surprising discovery if one looks, for instance, at a culture with more than 5,000 years of history which spans only around 21 closed cycles of influence in building its culture.

Respecting different cultures and adapting to it should be called "cultural intelligence" and should be valued among client advisors or relationship managers of a banking institution. Being aware of the concept of closed cycles and knowing about the history of a nation would facilitate the understanding of a client's culture and support the creation of trust.

Given the rapid progress in technology, the wiser approach would be to put more effort in using robots as a controlling arm for all those activities where humans are not able to bring along the endurance as well as the accuracy of a robot. API identification for a new solution, process controlling, approval controlling, etc. are examples which reduce complexity and facilitate controlling processes in a bank. The question is whether technology will ever going to be able to measure culture, biases, emotions and intuitions in the process of information gathering?