With the government back open and the hellstorm of a U.S. debt default delayed, you're probably feeling pretty good about things, right? Like maybe we've thwarted the Tea Party's quest to destroy the U.S. economy? Sadly, no.

Although House Republicans seem to have failed miserably to ransom the economy over Obamacare or "spending" or "disrespect" or whatever the last three weeks of idiocy and terror were about, they actually won, Bloomberg Businessweek points out in its latest cover story. The deal Congress struck to get the government back to work and raise the debt ceiling maintains a Tea Party pogrom happening since at least 2010, slashing spending at the fastest rate since the end of World War II, according to Businessweek. Rather than helping the economy, the latest debt deal is another disaster for it in four very specific ways:

1. We Get To Do This All Over Again In January. The deal only pushes the fight down the road for a few months, keeping the government open until mid-January and raising the debt ceiling until early February -- just after Groundhog Day, fittingly -- which means the government might run out of cash to pay its bills by some time in March, the Washington Post notes.

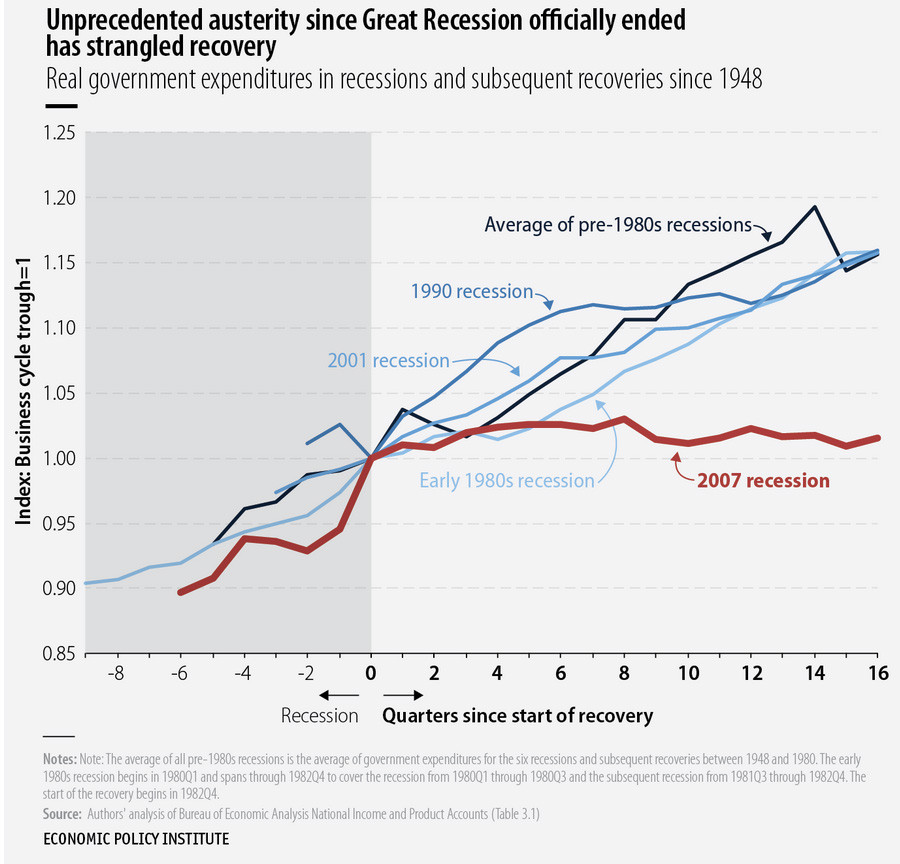

2. The Harsh Spending Cuts Of The Sequester Are Still In Place. The Tea Party's fervor about debt and deficits, which purely out of coincidence blossomed immediately after the election of President Obama, has pushed the government into a series of belt-tightening measures, frustrating the economy's recovery from the worst recession since the Great Depression. In fact, government spending has been the weakest of any recovery since 1948, according to a study by the Economic Policy Institute, a left-leaning think tank. The latest round of brutal cuts, the sequestration that helped "solve" the Tea Party-driven fiscal-cliff crisis earlier this year, are still in place, dragging on the recovery and costing potentially three million jobs.

3. The U.S. Is Perilously Close To Being Downgraded Again. Nobody really cares what rating agencies think, we should point out right off the bat. But if two or three major agencies strip the U.S. of its AAA rating, that could force some investors to re-think their purchases of Treasurys, the Washington Post notes, which could cause issues in global markets. Standard & Poor's stripped the U.S. of its AAA rating in 2011 because of Tea Party shenanigans and was reportedly this close to downgrading it again in the latest round of dumbassery. And Fitch put the U.S. on a negative rating watch, meaning it could launch the deadly Downgrade Trident at any time.

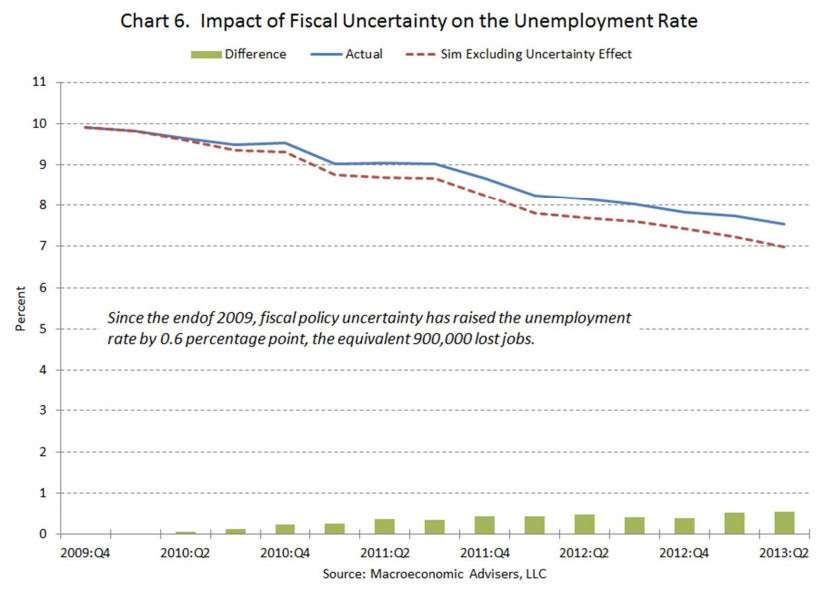

4. The Whole Fiasco Is Still Hurting The Economy. The shutdown alone will likely cut 0.3 percent from economic growth in the fourth quarter, economists estimate. Ordinarily that would be recovered in the first quarter of 2014. But in the first quarter of 2014 we could be dealing with yet another debt crisis. Meanwhile, the uncertainty caused by our perpetual state of crisis is an endless drag on the economy, according to a recent study by Macroeconomic Advisers. That has already cost 900,000 jobs and will likely cost many more in the months ahead.