Please don't blame Fannie Mae and Freddie Mac, guarantors of most of the housing market's conventional mortgages and reason the housing market continues to function at all, for the housing bust. The bust was caused by the oversupply of housing built during the bubble, and aggravated by many commercial banks and hedge funds cooking up every kind of 'liar' loan they could think of to sell to Wall Street securitizers -- including to themselves.

Sure, Fannie/Freddie had to be taken over by the federal government and are being subsidized with approximately $167 billion to date, but that is because banks and other commercial lenders then withdrew from financing the housing market, leaving government to clean up the mess. So the government subsidy is a very cheap price to pay to keep housing from collapsing completely.

Credit was too cheap in early 2000, as Fed Chairman Alan Greenspan's Federal Reserve kept short term interest rates below the inflation rate to pay for the Bush tax cuts and wars. I.e., when short term interest rates were 1-2 percent and inflation in the 3 percent range at the time, it was borrowers who actually profited since inflation deflated the value of the debt This meant it was interest free money!

Economists have estimated that below inflation interest rates were probably also responsible for the double digit housing price rises during the height of the bubble. Don't take my word for it. Almost everyone, including the nonpartisan Government Accountability Office, the Harvard Joint Center for Housing Studies, the Financial Crisis Inquiry Commission majority, the Federal Housing Finance Agency, and virtually all academics, have rejected the argument of conservative think tanks such as the American Enterprise Institute that it was federal affordable housing policies designed to make housing available to a broader public, that created so many high risk loans.

Fannie and Freddie created and have always maintained the gold standard of mortgage qualification standards, with the highest income, credit, and ability to pay requirements. As a mortgage banker/broker for 30 years, I have never originated or underwritten a conforming mortgage that didn't meet those standards.

So why do conservatives hate Fannie and Freddie so much? Because of their ties to the Democratic Party, mainly. As Gretchen Morgenson and Joshua Rosner detail in their book, Reckless Endangerment, Fannie Mae and Freddie Mac grew hugely under Democratic Administrations eager to encourage more affordable housing. And they did buy subprime mortgages from Countrywide Financial that were not underwritten to their conforming underwriting standards, thus fattening their portfolios in a bid to play catchup to the issuers of so-called 'private label' mortgages. But the subprime purchases were a drop in the bucket; just $60.8 billion for Freddie Mac, according to David Min of the Center for American Progress, with borrowers who had FICO scores under 620, a common definition of subprime mortgages.

In fact, the current delinquency and foreclosure rates of Fannie and Freddie, guarantors of Agency Prime mortgages, are close to the historical norm. Fannie Mae reported that the serious delinquency rate decreased to 4.27 percent in March, close to the long term historical average. This is down from 5.47 percent in March 2010. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59 percent. Freddie Mac reported that the serious delinquency rate decreased to 3.57 percent in April. (Note: Fannie reports a month behind Freddie). This is down from 4.06 percent in March 2010 and Freddie's serious delinquency rate also peaked in February 2010 at 4.20 percent.

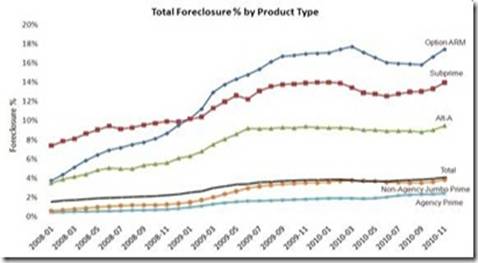

And their foreclosure rates are approaching the 1 percent historical average of all conventional loans. The Calculated Risk graph shows the latest foreclosure rates for all mortgage categories. It may not be surprising that Option ARMs (those with negative amortization that caused the principal loan balance to increased substantially in many cases) have the highest foreclosure rates, even above the Subprimes.

Sadly, Lender Processing Services, Inc. (NYSE: LPS) Mortgage Monitor report shows the number of mortgages 90 or more days delinquent, combined with the foreclosure inventory at the end of June, still totaled 4,073,00 down very slightly from its May 4,084,557 total. so it looks like without additional government help, which doesn't seem likely (see Renae Merle at Washington Post: Obama administration not planning another big housing program), most of those units will be added to the existing home inventory over the next 2 years.

Then why doesn't the Obama Administration spend more of the reportedly $11 billion set aside for the HAMP loan modification program? It may be because Timothy Geithner's Treasury Department isn't requiring banks holding the delinquent loans to get them off their books more quickly. And that means not much upside potential for housing prices until when, maybe 2014?

Harlan Green © 2011