The FOMC is scheduled to commence its two-day meeting on November 1-2, 2016, and it seems like Fed officials are still unsure about its interest rate policy. Some Fed officials have a strong stance that rates should be raised in November, while others are still reluctant. Dovish Federal Open Market Committee (FOMC) members seem to have a strong stance that rates should remain at their current levels. On the other hand, the few hawkish FOMC members are unlikely to budge. However, the market is already pricing in a dovish Fed heading into November.

Low Probability of Rate Hike in November

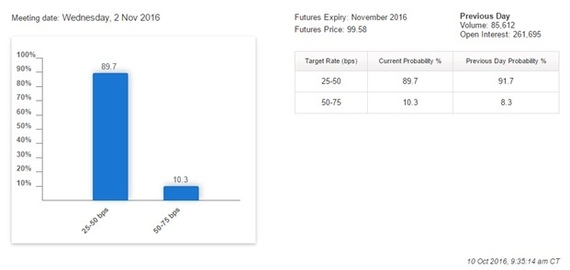

According to the CME Group FedWatch Tool, the 30-day Fed Fund futures prices are indicating a 89.7% probability that the Fed funds target range will be between 25 to 50 bps in November and only a 10.3% probability that the Fed funds target range will rise to a range between 50 and 75 bps.

Although the market is already pricing in that the Fed won't raise interest rates in November, FOMC officials could shock the market by raising rates. The Fed doesn't seem to know what it wants to do at this point, and it appears as if they're just "winging it".

September Employment Situation Report

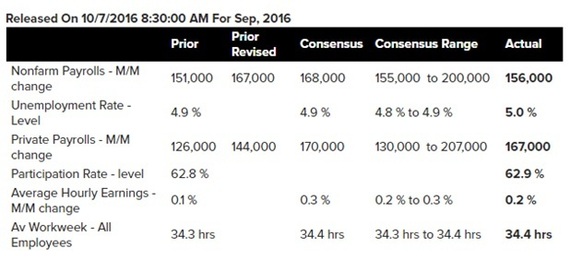

The September jobs report was the main focus in early October 2016, which has been one of the Fed's primary tools to gauge U.S. economic conditions. The September jobs report was mixed, but missed the consensus estimate. Consequently, this may add more uncertainty to the Fed's rate decision, which could shake the currency and equity markets.

The U.S. economy added 156,000 jobs in September, while the consensus estimate was 168,000. The unemployment rose to 5%, while the consensus estimate was 4.9%.

The weaker-than-expected job growth coupled with a moderate degree of wage growth puts the Fed at a standstill. The September jobs growth may signal that the Fed is not ready to raise rates in November. However, the 0.2% month-over-month growth in average hourly earnings could signal high inflation.

The FOMC has been primarily looking at jobs growth, inflation and global macroeconomics for its interest rate policy. Since the wage growth could increase inflation, the Fed could move to increase its target range to combat inflation growth.

Conversely, the addition of just 156,000 jobs could indicated low or stable aggregate consumer demand, which could impact companies' revenues. Consequently, the Fed may not want to raise rates, which could further impact revenues.

How Fed Funds Rates Could Impact the FX Market

Regardless of whether the Fed decides to raise interest rates, the foreign exchange market should be affected in November. Depending on what the FOMC decides, the U.S. dollar could weaken or strengthen against other major currencies.

If the Fed decides to raise its target range, the higher rates will likely boost the U.S. dollar because dollar assets will be more attractive to investors seeking high yield. Consequently, the U.S. dollar should strengthen against currencies, such as the euro, British pound and Japanese yen.

On the other hand, if the Fed decides to leave its target rate unchanged, the U.S. dollar should fall against other currencies. Additionally, if the Fed indicates that it won't raise rates in 2016, the news should heighten volatility in the FX market.

For example, after a weaker-than-expected September U.S. jobs report, the dollar fell against the euro, causing the currency pair, EUR/USD, to hit 1.1206 in the late-hours on October 7, 2016. Market participants were thinking the weak jobs growth should hinder an interest rate hike in November.

That being said, if you're an FX trader or investor, you should set up trading alerts, to capture any potential moves in the foreign exchange currency pairs in early November 2016.