As politicians debate the prospects for successful implementation of the Affordable Care Act, or Obamacare, physicians are reportedly taking a cautious approach toward making business changes related to the law. Recent industry benchmarking data from Sageworks, a financial information company, show that by several metrics, physicians at least have a decent cushion from which to evaluate their options and react to changes.

A recent survey representing medical groups with more than 47,000 physicians found 40 percent weighing their options on participating in the new insurance products offered through state and federal exchanges, according to the Medical Group Management Association.

"While a majority of MGMA survey respondents see potential opportunities to provide care to an underserved patient population and replace current charity care, more than 80 percent cited concerns about the burden of patient collections on practices and low provider reimbursement rates as major barriers to their participation," the MGMA said in a press release. Still, more than half of physician practices responding to the survey didn't plan to make any business changes. The share of respondents anticipating hiring new physicians, extending hours or adding clinical support staff was less than 5 percent, the survey found.

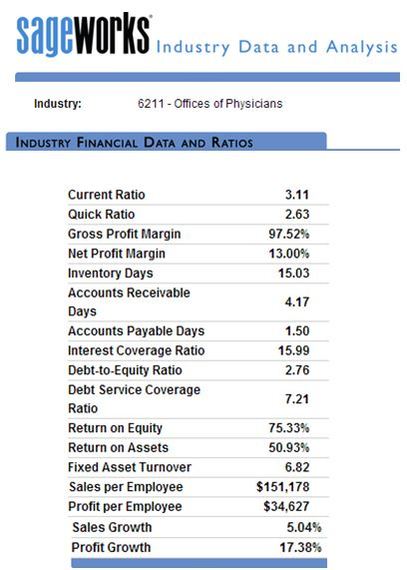

Meanwhile, Sageworks has conducted a financial statement analysis of privately held physician offices to benchmark their recent financial performance. This shows that over the last 12 months, the average net profit margin for private physicians' offices is about 13 percent, bolstered by an average gross margin of 97.5 percent. Those margin levels are among the highest for other white-collar professional firms - topping accountants, veterinarians, engineers and real estate brokers.

"Our industry data shows that privately held doctor's offices have seen steady but moderate sales growth and above-average profitability over the past few years," said Sageworks analyst Libby Bierman. Debt-service coverage and liquidity ratios are also generally healthy.

The average net profit margin for all privately held companies is about 10 percent, Bierman noted.

"When someone is not feeling well or injured, they go to the doctor, without too much thought of 'economic uncertainty,'" which has been blamed for sluggish sales in other industries, she said.

"That is, demand for these healthcare services isn't as elastic as demand in other industries, like auto sales for example. It might be that insensitivity in the market that has allowed NAICS 6211, or doctors' offices, to remain among the more profitable industries we track."

"With that profit cushion, doctors' offices have a few more options in how to respond to regulatory changes or the demand generated by the ACA, whether that's adding more staff to accommodate additional patients or investing in technologies to increase efficiency or quality of service."

There have been reports that doctor's offices may be flooded in January with patients seeking care once ACA coverage kicks in, but some critics of Obamacare say doctors will have to take a pay cut for the new system to work.

Bierman said it's unclear from Sageworks' data how physician revenue trends will be affected, and whether they'll see increased staffing and overhead costs to accommodate health system changes.

"It will be interesting to see the overall impact on their bottom lines," she said. "As every business knows, if revenue gains don't match cost increases, profit margins could get squeezed."