Part One: Demystifying Credit

Maybe you need to rent an office space to manage your new startup. Or, you need to open a line of credit in order to ensure you can always pay your employee when your income is slow to come in. Even with most of the cash on hand, it is impossible to do these things without credit.

While many of us use credit on a daily basis, very few Americans learn about credit and managing their own credit at school. Chances are that if you didn't have parents talking to you early on about personal finance, then you have been left to figure it out on your own.

Click this source for a larger version

This is a tragic mistake. Building up your credit is one of the most essential strategies in ensuring your future financial health--and it extends beyond your finances.

Put simply, credit is your financial reputation. It determines how much money you can borrow and in many cases other important actions too. It tracks how you have related to and done business with others, and it help potential new creditors or partners decide whether they want to do business with you.

How credit is determined

Your FICO is most commonly used as your credit score. There are five main buckets of information credit assessors--who by the way, nearly always stem from or refer to the scores of the three biggest bureaus: Experian, TransUnion, and Equifax--use to determine it and the report that accompanies it.

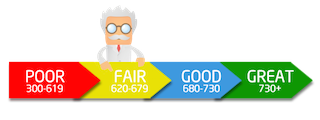

Your FICO score can be up to 850 (source)

The first is payment history and refers to whether you have paid your bills in full, on time, or at all. Most companies report late payments or delinquency to agencies--but they often have a grace period. If you are not sure if your bill payment is late or if you can pay it, just call. Often times the company where you owe is more interested in working with you to actually receive their payment than to report you to another agency.

The second is how much you owe to lenders--from your car payment to your student loan, from your department store credit card to your rent. This also includes exactly how much you owe to various lenders as a percentage of your total credit available. How do you know your total credit available? Just think of how many cards you have open and what their limits are, versus how much you currently owe to them.

The third is the length and life of your credit. How long have you been using credit? When did you first open a credit account? If your "credit life" has been long but troubled by delinquent payments, then your score will be affected. By the same token, if you have only recently begun to use credit but have done so in a timely and responsible way, then it will be positively reflected in your account and score.

The fourth and fifth are simple and slightly less important than one through three--new credit activity on your account and the types of credit you use. If you open several new debts at once, that could hurt your account (as could several inquiries made on behalf of potential creditors as they look into your account).

Coming up next: how to raise your credit score and access critical resources for your business