Part I: The #1 Retirement Wildcard

Webster's Dictionary defines retirement as a time "to disappear" or "go away." That's definitely not the way people now view the prospects for this relatively new -- and steadily lengthening --stage of life. For previous generations, navigating retirement was very often like rowing across to the other side of a relatively calm lake. The destination was clear to see, and all you had to do was paddle straight ahead to get there. For most retirees, the goal was similar: a time to rest and relax after years of hard work. With shorter life expectancies, retirement was, more often than not, predictably brief. On retirement day, most people felt sufficiently provisioned with supportive benefits from both their employer and the government -- which, when combined with their own life savings, allowed them to have a relatively secure and comfortable final stage of life.

Today, life in adulthood and beyond is far more like rafting down a twisting, turning whitewater river. Its length is uncertain -- you might live 70, 90 or 110 years -- and new challenges, opportunities, discoveries, and potential surprises are around each bend. Today's retirees are living longer than any previous generation. The average 65-year-old can expect to live another two decades or more. And with each new breakthrough in medicine, the average "longevity bonus" will continue to increase.

There is no question that retirees today have unprecedented opportunities to enjoy their leisure, pursue their passions and possibly even reinvent themselves a time or two. But this new and extended period of life also presents a spectrum of real worries about health, healthcare costs, family financial responsibilities, and making sure you have enough money to go the distance.

To better understand how people are now thinking about and approaching retirement, my firm, Age Wave, in partnership with Merrill Lynch, just completed a massive -- and groundbreaking --survey entitled "Americans' Perspectives on New Retirement Realities and the Longevity Bonus." Conducted by research firm Harris Interactive, the survey gathered responses from more than 6,000 people age 45 and older from all walks of life (including pre-retirees as well as retirees), who weighed in with their hopes and fears regarding retirement.

In this three-part Huffington Post series (beginning today), I will present the key findings from this study and explore some of their implications for how you might best prepare and course-correct to optimize your retirement experience. If you like, you can download the entire report at http://www.ml.com/2013retirementstudy.

A Time for New Beginnings

Overall, the study revealed that Americans have a great deal of hopefulness about their retirement prospects. They view the "longevity bonus" as a chance to explore new options, pursue old dreams, and live life to the fullest. Fifty-seven percent of Americans age 45 and older consider retirement "a whole new chapter in life." Seventy percent of baby boomers want to include some continued work in their ideal retirement, and 51% of them say they'd like to take a break to recharge their batteries and then launch into a different line of work altogether.

But, perhaps as a result of the financial wake-up call that has been sounded in recent years, there is a great deal more thoughtfulness--and anxiety--regarding what they may and may not be able to achieve and afford in this stage of their lives.

In our youth, different types of worries may be top of mind. Will I fall in love? Will I keep my job? Will I get a promotion? Will I have kids? And if I do, will they turn out okay? Will I be able to afford their college tuition? Is my relationship with my spouse as good as it can be? Will I need to lend a hand to my parents or in-laws?

But what about in midlife and beyond?

Health Problems: Triple Whammy

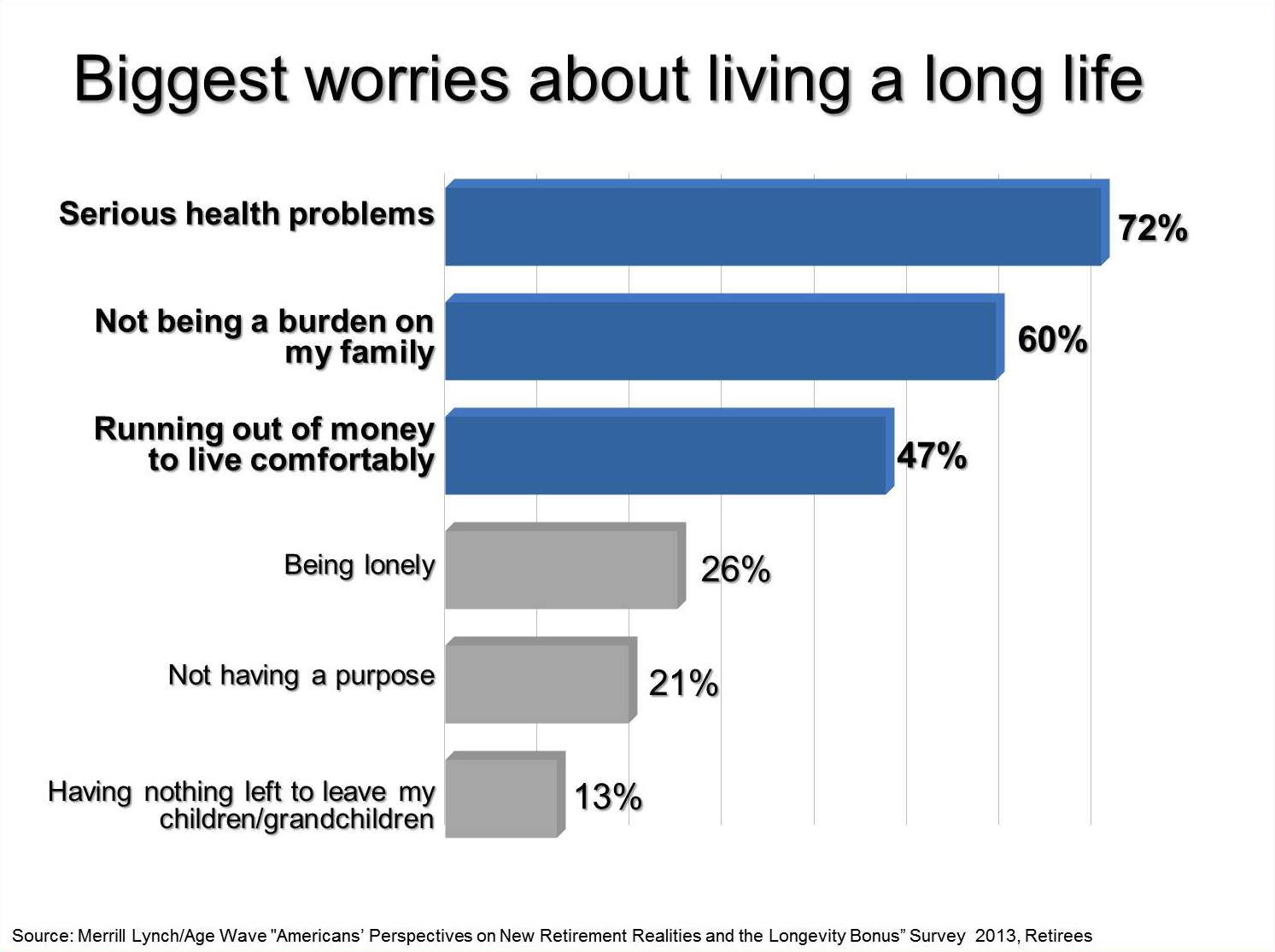

What's keeping people up at night? When we asked Americans who are 45 and older, "What are your biggest worries about living a long life?" pre-retirees and retirees responded in no uncertain terms that (1) the prospect of serious health problems tops the list, followed by (2) not being a burden on one's family and (3) running out of money.

As it turns out, a health disruption is a triple whammy. First, it's unpredictable. No one knows exactly when he or she might fall ill, how bad the problem will be, or how long it might last. We've all had a friend or loved one who seems perfectly healthy one day, then receives a bad diagnosis or is sidelined with an illness the next.

Second, health disruptions can be very expensive. You might be forced to miss work, or you might need long-term care or be challenged by other health-related costs. Now is a good time to find out what healthcare costs your insurance, or Medicare, covers and what you would have to pay out-of-pocket. Waiting until a crisis hits to research contingency solutions is never a good idea. Unanticipated medical expenses can derail years of retirement preparation. Sixty percent of bankruptcies in the U.S. today are related to medical bills, and retirees who are struggling with health issues are twice as likely to say they are in a financial crisis.

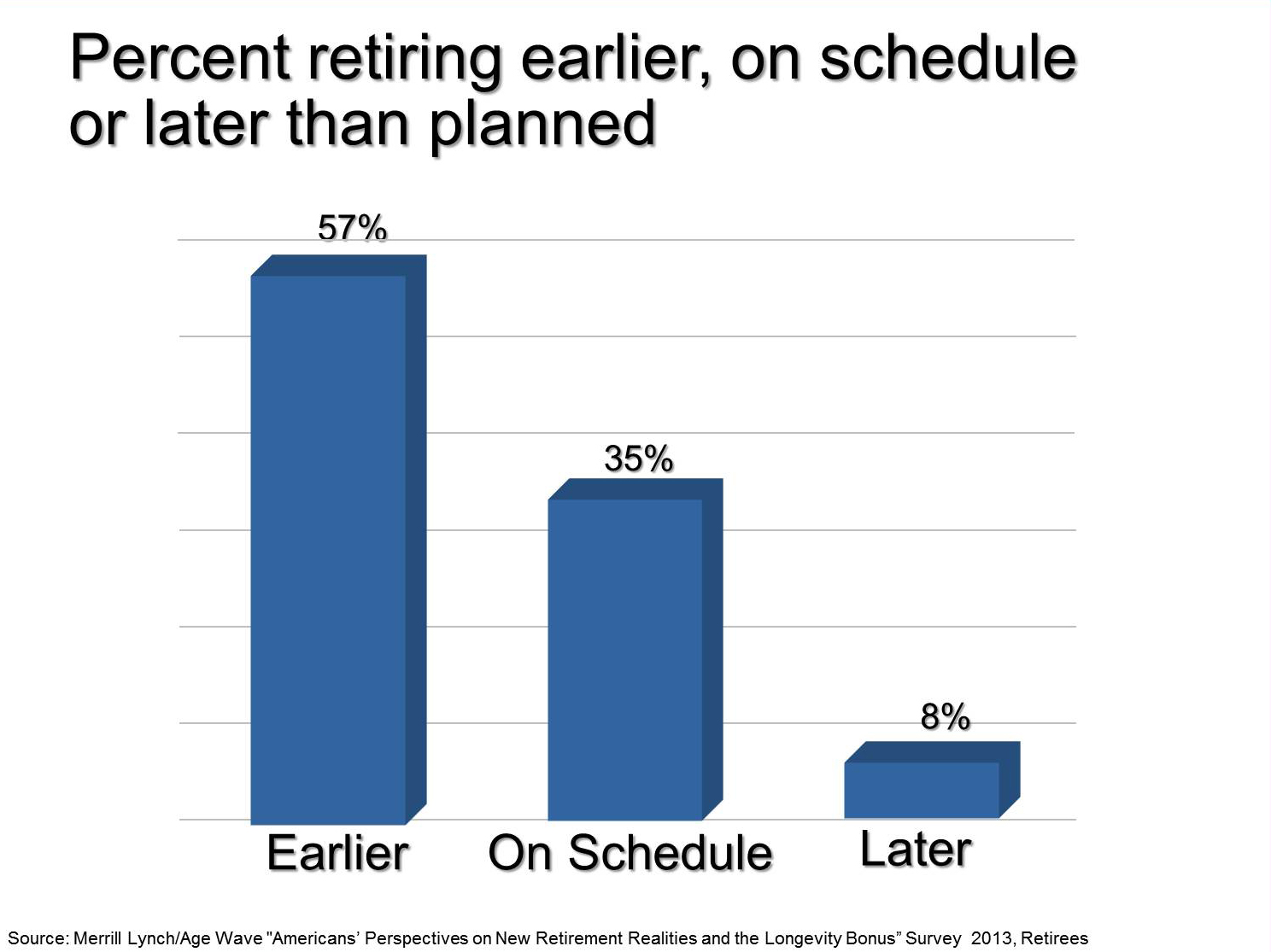

And third, illness turns out to be the number one reason that people retire earlier than they planned. In our survey, we asked retirees whether they had retired on schedule, later than they had planned, or earlier than they had planned. Notwithstanding a growing desire to work a few extra years to shore up retirement savings, 57% of today's retirees say they retired earlier than they expected--while 35% retired on schedule and 8% retired later than planned.

The tragedy of these circumstances is that too many of us spend more time planning for our summer vacation than our retirement. And avoiding these issues won't make them disappear. Yet most people haven't thought through these potential challenges or ways to plan for or around them, and they haven't discussed and shared priorities with family members. I guess I shouldn't be surprised that 90% of our survey respondents said they don't feel extremely confident that they've got the right solutions in place.

Protecting Against Retirement Health Risks

Twenty-five years ago, many people would have simply counted on their employer to cover their healthcare costs in retirement. Two-thirds of large companies offered health benefits to retirees. Now, just one-third of these companies offer retirement health benefits. And of course, many pre-retirees have no health insurance at all. Moreover, there's growing worry that, under increasing fiscal pressure, government healthcare programs, such as Medicare, may be forced to reduce benefits in the years ahead.

Today, preparing for healthcare costs is becoming an essential part of retirement planning. Unexpected challenges, such as health problems, can be very tough both emotionally and financially. But, according to David Tyrie, head of Personal Wealth & Retirement for Bank of America Merrill Lynch, "If you can anticipate and prepare for some of these challenges -- and course-correct your plans when they arise -- it can help you get through them and stay on the path to a secure retirement."

Whether it's programs that supplement traditional Medicare (such as Medigap and Medicare Advantage), long-term care insurance, or putting some extra money aside to cover healthcare expenses in case you can't work as long as you anticipate, there are steps you can take that can help reduce the financial impact of a health problem in maturity. And just as important, taking better care of your health now -- by eating better, keeping the proper body weight, exercising regularly, and being sure to take sufficient time to rest and recharge -- can help you stay as healthy as possible in the years ahead.

Parts II and III to come. Stay tuned -- over the next several days, I will be covering more of the insights from this study, including the new role of work in retirement and how today's family interdependencies are impacting retirement.

In case you'd like to watch me giving a presentation on the transformation of retirement (or you've got a family member or friend who's sorting their way through the challenges and opportunities of this stage of life), here's a link: http://www.huffingtonpost.com/ken-dychtwald/the-transformation-of-ret_b_3048327.html

Earlier on Huff/Post50: