Millennials -- the so-called "spoiled" generation, born with silver spoons rather than pacifiers -- aren't as foolish with tax refund money as you probably suspect. While it's tempting to picture Gen-Y-ers jumping on the next flight to Vegas and partying with that extra few thousand returned from the government, shockingly, they're not. Millennials don't cave to impulse spending as easily as you may think, naturally hindering splurging with an inherent desire for more, and this year are actually investing tax refund money. But, of course, this investing is in an "alternative" fashion.

From an insider perspective, I'll admit, initially it's hard to not splurge the money. You're young, you're likely single without dependents, so carefree is your middle name. And you basically get this free (although, yes, I realize it's technically already my money) lump sum of cash deposited into your checking account, amounts of which averaged around $3,000 this year.

With an extra few thousand sitting in my account, of course I wanted take an expensive stroll down Broadway in Soho. Or take a trip. Or buy every other health and beauty loot deal on Lifebooker. Or simply go a month without checking my bank account every Tuesday morning with a knot in my stomach. But, low and behold, I restrained myself, and so do most Millennials.

The Millennial Shopper is the Mass Maximizer

The consumer characteristic outsiders overlook about Millennials, is that when it comes to spending, we are a generation of maximizers, and it's both a blessing and a curse. Sure, we can identify what we like, online, on our phones and in store, but liking a product simply isn't enough to make us buy it.

First of all, we want the very best deal on it. And some type of gamification incentive that makes the purchase feel rewarding. And the fastest delivery option. And free shipping -- of course. And, while we're at it (and since we're alpha-influencers), the option to customize it. And eventually we think, "But, wait, now that an hour has passed, do I really want this in the first place? Maybe there's something better out there... "

It takes so long to find all the aspects of an item we want, that by the time we do, we'll often just forfeit the need to buy it at all -- yes, the epitome of counterproductive.

Millennial Entitlement is a Splurge-Deterrent

The dreaded entitlement Millennials feel, which usually manifests as arrogance, or superiority without merit, is actually an inherent splurge-deterrent. Like the dieter with a sweet tooth who spends 20 minutes picking a flavor before indulging in a chocolate at which time, right before, the urge suddenly passes, often by the time Millennials finally find an item and place to buy that meets all the purchase aspects that we feel we deserve, either the craving for the item has passed or our attention spans are just spent.

The never-satisfied, non-spending trend has even spanned to online commerce, where many Millennials treat online shopping the same way showroomers typically treat in-store shopping: continually on the hunt for the "better" product, price, incentive, what have you. This extensive, somewhat dysfunctional cycle of a typical Millennial consumer has paved the way for unprecedented, visibly soaring rates of digital native advertising and explains why lucrative brands are becoming products in and of themselves.

Here's How Millennials Really "Invest" Tax Refunds

Nowadays, instead of splurging, most Millennials, 67 percent in fact, are saving or investing tax refund money. Saving is one thing, but "investing" in a loose term. Again acting as mass maximizers, Millennials strive to find somewhat unconventional outlets and methods to "invest" tax money and most are investments in themselves:

Goodbye life insurance; Millennials invest in health.

Is there such a thing as being too proactive? Millennials may put off the future, but we're opting for a health-conscious lifestyle right now. Instead of contributing to a "death" fund, Millennials are opting to invest in tech to live longer, healthier lives.

Goodbye IRA; Millennials invest in retiring at the end of each day.

Rather than wait until 65 to sit back and spend, Millennials are investing in the things that help them relax each day. As a generation who grew up with robots before computers, automation is hip right now in the millennial world, and so are automated products that do the work for you, such as iRobot Vacuums.

Goodbye financial advisor; Millennials invest in personal accountability.

It's not all instant gratification, we also think about our future. Millennials are investing in a new type of money management with online, cloud-based personal finance software.

Goodbye insurance policy; Millennials cover themselves in different ways.

Different and digital ways, that is. Wearable tech is the hot new commodity hardworking Millennials can't get enough of. It's not just FitBits; it's straight-from-the-trade-show-debuted wearable technologies that actually provide some useful benefits.

Why spend more money than need be? As opposed to saving money for an unpredictable future, Millennials are going green and choosing to invest in gadgets that help them save more money now. Plus, energy-saving is trendy, so we're willing to pay more for "smart" lightbulbs and nest thermostats.

Goodbye home improvements; Millennials invest in heart improvements.

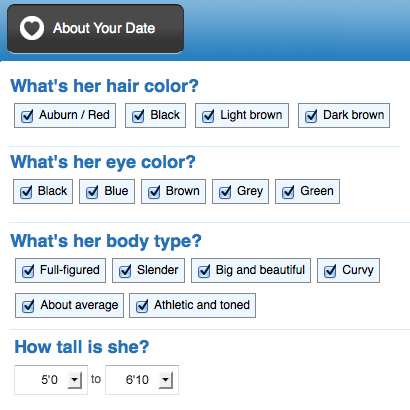

(Image source: AskMen)

After all, we've all heard growing up that home is where the heart is. Millennials may be unfamiliar with courtship and phone dates, but we still think love is worth investing in. (And unlike other generations, it's perfectly acceptable to go the online dating route to find it.)

Goodbye charitable donations; Millennials invest in giving a better version of themselves to the world.

We were taught we must help ourselves before helping others, so this shouldn't come as any surprise. Millennials invest in improving who they are first and foremost before taking on external challenges, and there's plenty of tech out there, such as the Lumo Lift, to help us do just that.